Unilever tanks, RBS surges: Here's what you need to know in European markets on Monday

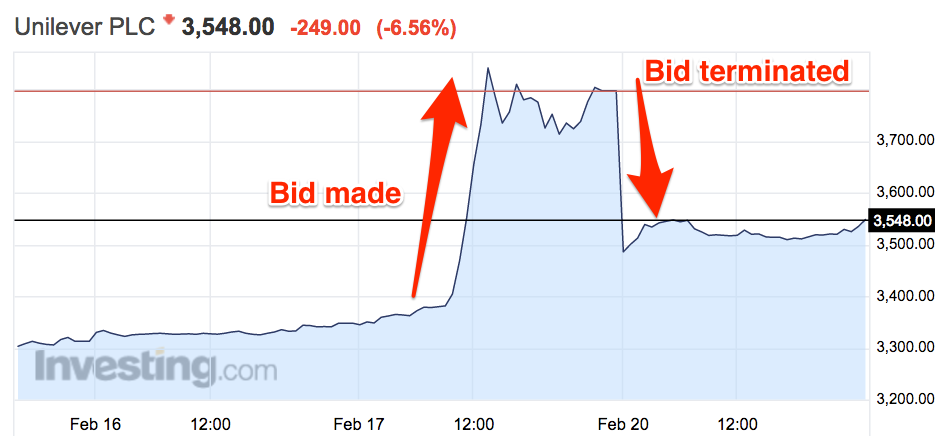

Shares in Unilever tanked on Monday after fellow consumer goods giant Kraft Heinz terminated a takeover bid for the firm on Sunday.

Kraft, which is backed by the legendary investor Warren Buffett, confirmed that it had made an approach to take over Unilever after the Financial Times Alphaville blog had reported it earlier in the day. Unilever rejected the bid the same day.

"Unilever and Kraft Heinz hereby announce that Kraft Heinz has amicably agreed to withdraw its proposal for a combination of the two companies," the companies said in a statement on Sunday.

"Unilever and Kraft Heinz hold each other in high regard. Kraft Heinz has the utmost respect for the culture, strategy and leadership of Unilever."

Unilever's stock had rocketed on the news of the merger bid, gaining around 13% in UK trade on Friday, but with any chance of a deal now dead in the water, shares have reversed course, and the close of play in Europe were lower by roughly 6.5%, having dropped as much as 8% in the first half hour of trade.

Here's how shares looked at the close:

Investing.com

In the broader equity markets, the FTSE 100 closed in exactly the same position it started the day, moving 0.00%. While it was pulled lower by Unilever, the index was bolstered by Royal Bank of Scotland and Rolls-Royce. RBS shares climbed 6.8% after the bank confirmed that it probably won't have to spin out its Williams & Glyn bank after all. Rolls-Royce investors took comfort in Goldman Sachs upgrading the company's stock from a neutral rating to a buy rating.

On the rest of the continent, stocks were something of a mixed bag, with Germany's DAX and Spain's IBEX climbing, while France's CAC and Italy's FTSE MIB fell. Markets lacked a little direction on a day when US markets remained closed for Presidents' Day.

Here is the scoreboard:

Investing.com

See Also:

The FTSE 100 broke its record closing high for the 13th time in 2017

The FTSE 100 'struggled for direction' on another quiet day for the index

SEE ALSO: CALLED OFF: Kraft Heinz is killing its plan to merge with Unilever — just 2 days after announcing it

Yahoo Finance

Yahoo Finance