Unilever suffers 'Marmitegate' - is this karma? asks analyst Zak Mir

“Lies, lies and damn statistics” is the saying which appears to be appropriate in the wake of the (so far) failed marriage between Kraft Heinz (KHC) and Anglo-Dutch consumer giant Unilever (ULVR).

On the face of it, this should have been a “slam dunk deal”, if only on the basis that since the Brexit vote the fall of Sterling makes UK Plc around 15% cheaper to any would be deal maker. This is a hefty discount, especially when there is the added bonus with Unilever that it is an true multi-national.

[graphiq id=”1ra6l38nGbH” title=”Unilever Sp Adr (UL) vs. S&P 500 Percent Change Over Time – 1 Year” width=”600″ height=”489″ url=”https://sw.graphiq.com/w/1ra6l38nGbH” link=”https://www.graphiq.com” link_text=”FindTheCompany | Graphiq” frozen=”true”]

But just as interesting as the “Karma payback” the Marmite maker has received after trying to pass on the alleged costs of Sterling weakness to Tesco customers in the autumn, is the way that the abortive Kraft affair puts the spotlight on the management of Unilever, and whether the company is being led in the right direction?

According to Rowen Squibb, Managing Director of Why Media: “There is an irony for brands focused Unilever that in the wake of Marmitegate its own company brand has been tarnished, and Kraft Heinz attempted to strike at this point of weakness.”

The temptation is to suggest that the fact that Unilever even became the subject of an M&A deal ties in with the historic rule on the stock market of underperforming companies receiving offers. At the very least this implies there are challenges at the group and a shake up is indicated.

For instance, selling off underperforming brands, and perhaps focusing on the core consumer staples, whether they are consumables or not. Of course, it could also be that if there is an air of stagnation here, Unilever itself should get on the front foot and revitalise its portfolio with an acquisition or two?

However, you view the aftermath of this affair, what is worth noting with regard to information provided by Reuters is the way the value of withdrawn M&A is nearing the levels last seen in 2007, hitting $209bn.

Rather tellingly, it would appear that as was the case in the 2000 withdrawn M&A peak, market peaks can be associated with imminent corrections – sometimes just months later. In fact, it would probably have been the case that even if the story of a possible takeover of Unilever had not appeared in the Financial Times last week – scaring off Kraft, the competition authorities in association with meddling politicians would have scuppered the deal anyway. Indeed, the rumour mill has suggested that the deal was deliberately leaked to the press.

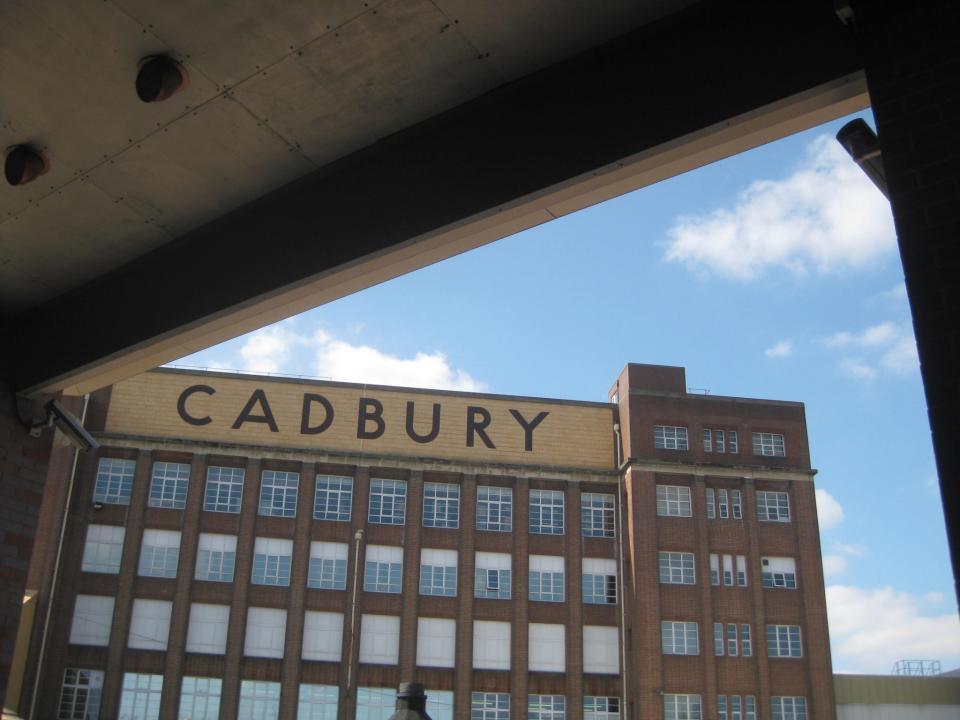

In the wake of the bad blood created by the Kraft purchase of Cadbury some years ago these deals have now become very much a breed of political hot potato. Patriotism, protecting jobs and M&A do not tend to be a good mix.

Of course, this week has not all been about the failure of what would have been one of the biggest deals in history. Here in the UK, the financial press has been doing its best to build enthusiasm regarding the latest trading updates from leading High Street banks.

For some reason, just because we are all familiar with the likes of Lloyds (LLOY) and RBS (RBS), journalists believe we look forward to hearing how much money these companies are making or losing from us. Unfortunately, all signs point to the sector being in a structural decline, something which even bailouts and not having to pay interest on deposits cannot hide.

True, there is money in mortgages and credit cards. But it is usually the case that whatever is earned here in the good times tends to be lost with market crashes and calamities.

Given the way that what could have been regarded as one of the sector’s better plays, HSBC (HSBA) has just reported a 62% fall in profits and continues to be hit by the operational tax known as historic practices fines, one would have to consider that unless these institutions can think of some kind of new fintech based magic fundamental bullet, the long wave goodbye is set to continue.

Related columns:

How are US-Russian relations shaping the global stock markets?

Will the Snap-Chat IPO self-delete?

Zak Mir is is the author of chart topping books, including 101 Charts For Trading Success and 49 Golden Rules of Technical Analysis, and is generally acknowledged as being one of the most experienced independent technical analysts in the UK.

Disclaimer: The content on this page does not constitute financial advice and is provided for general information purposes only. Nothing on this page should be regarded as an offer to conduct investment business or to buy/sell any investment.

Yahoo Finance

Yahoo Finance