Union Pacific Corp (UNP) Q1 2024 Earnings: Marginal Gains Amid Market Challenges

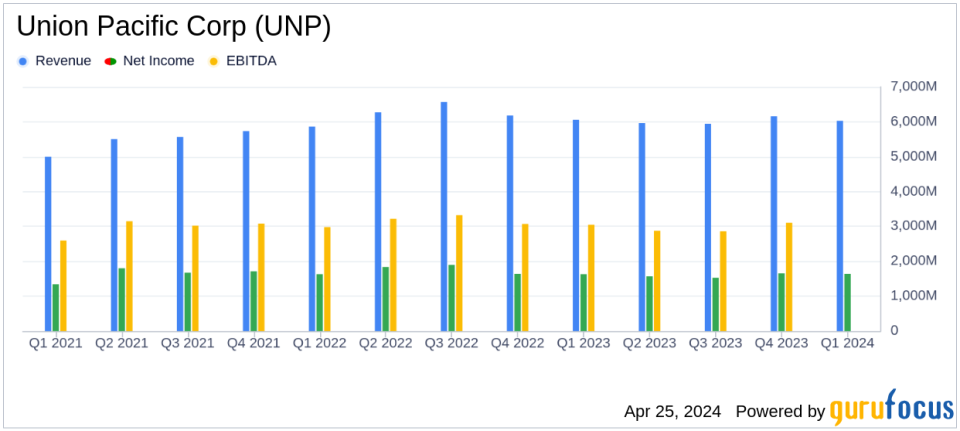

Earnings Per Share: Reported at $2.69, up 1% year-over-year, exceeding estimates of $2.52.

Net Income: Reached $1.641 billion, a slight increase of 1% from the previous year, surpassing estimates of $1.54688 billion.

Revenue: Total operating revenue was $6.031 billion, slightly below last year's $6.056 billion, falling short of estimates of $5.98427 billion.

Operating Income: Grew by 3% to $2.372 billion, indicating improved operational efficiency.

Operating Ratio: Improved by 140 basis points to 60.7%, reflecting higher operational efficiency.

Freight Revenue: Excluding fuel surcharge, grew by 4%, despite a 1% decline in revenue carloads.

Dividends: Maintained at $1.30 per share, consistent with the previous year.

On April 25, 2024, Union Pacific Corp (NYSE:UNP) disclosed its financial results for the first quarter of 2024. The company reported a slight increase in earnings per share (EPS) to $2.69, surpassing the analyst estimate of $2.52. Net income also saw a modest rise to $1.641 billion, slightly above the forecast of $1.546 billion. These results were detailed in their latest 8-K filing. Despite facing a challenging freight market and typical winter conditions, the Omaha, Nebraska-based railroad giant managed to improve its operational efficiency and core pricing, which contributed to these gains.

Union Pacific, the largest public railroad in North America, operates over 30,000 miles of track primarily in the western two-thirds of the United States. The company specializes in transporting a diverse array of goods including coal, industrial products, and automotive goods, and plays a crucial role in the North American supply chain.

Financial and Operational Highlights

The first quarter of 2024 saw Union Pacific achieving records in both operating income and net income, with operating income increasing by 3% to $2.372 billion. Total operating revenues were slightly down, totaling $6.031 billion, impacted by reduced fuel surcharge revenue and lower volume, despite a 4% growth in freight revenue excluding fuel surcharges. The operating ratio improved significantly by 1.4 percentage points to 60.7%, indicating enhanced profitability.

Operational performance also saw notable improvements. The company reported advancements in safety and service metrics, with a decrease in both personal injury and derailment rates. Locomotive productivity and train length saw increases, contributing to a more efficient operation overall. The fuel consumption rate improved by 1%, reflecting better fuel efficiency across operations.

Strategic Outlook and Challenges

Looking ahead, Union Pacific's CEO, Jim Vena, emphasized the importance of continuing to enhance service quality and operational efficiency to sustain profitability. The company plans to restart share repurchases in the second quarter, signaling confidence in its financial stability. However, challenges such as a muted volume outlook due to factors like lower coal demand and soft economic conditions could pose hurdles to growth.

Despite these challenges, Union Pacific remains committed to its long-term capital allocation strategy, with a planned capital expenditure of $3.4 billion. This investment is aimed at further improving infrastructure and operational capabilities, ensuring the company remains competitive in a fluctuating market.

Conclusion

Union Pacific's first-quarter results reflect a resilient performance amid market adversities, with slight improvements in key financial metrics. As the company continues to navigate through economic uncertainties and operational challenges, its focus on strategic investments and efficiency improvements is expected to support its long-term growth and shareholder value.

For more detailed financial information and future updates on Union Pacific, stakeholders and interested investors are encouraged to view the full earnings presentation on their website and join their upcoming webcast.

Explore the complete 8-K earnings release (here) from Union Pacific Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance