Union Pacific (UNP) Beats on Earnings, Revenues in Q3

Union Pacific Corporation’s UNP third-quarter 2017 earnings of $1.50 beat the Zacks Consensus Estimate of $1.49 per share. The bottom line expanded 10.3% on a year-over-year basis. Results were aided by higher revenues.

Operating revenues of $5,408 million also surpassed the Zacks Consensus Estimate of $5,306.5 million. Revenues increased 4.5% on a year-over-year basis. The bulk of revenues (93.4%) at Union Pacific was derived from freight in the reported quarter.

Freight revenues grew 4%, boosting the top line. The uptick was owing to volume growth and increased fuel surcharge revenues among other factors.

Operating income in the third quarter rose 3% year over year to $2 billion. Operating ratio (defined as operating expenses as a percentage of revenues) came in at 62.8% in the third quarter compared with 62.1% in the year-ago quarter. The deterioration was due to higher fuel prices.

During the quarter, the company bought back 11.8 million shares for $1.3 billion.

Segment Details

Agricultural Products freight revenues were $914 million, down 2% year over year. Business volumes decreased 10%year over year. Average revenue per car however increased 9%.

Automotive accounted for $469 million of freight revenues, down 3% year over year. Business volumes were also down 5% and average revenue per car inched up 1% year over year.

Chemicals contributed $896 million to freight revenues, up 2% year over year. Business volumes were down 5%, while average revenue per car improved 8%.

Coal revenues (freight) fell 2% year over year to $711 million. Business volumes decreased 3% and average revenue per car was flat on a year-over-year basis.

Industrial Products generated freight revenues of $1,079 million, up 26% year over year on 15% growth in business volumes. Average revenue per car was up 10%.

Intermodal segment freight revenues came in at $981 million, up 3% year over year. Business volumes were flat, while average revenue per car improved 2%.

Other revenues improved 6% to $358 million in the third quarter of 2017.

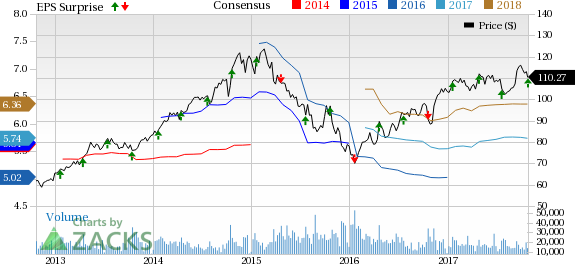

Union Pacific Corporation Price, Consensus and EPS Surprise

Union Pacific Corporation Price, Consensus and EPS Surprise | Union Pacific Corporation Quote

Liquidity

Union Pacific exited the quarter with cash and cash equivalents of $1,847 million compared with $1,277 million at the end of 2016. Debt (due after one year) came in at $15,930 million at the end of the quarter compared with $14,249 million at the end of 2016. Adjusted debt-to-capitalization ratio increased to 50.4% from 47.3% at 2016-end.

Zacks Rank & Key Picks

Union Pacific currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Transportation sector are Deutsche Lufthansa AG DLAKY, International Consolidated Airlines Group SA ICAGY and Bristow Group Inc BRS. While Deutsche Lufthansa and International Consolidated Airlines sport a Zacks Rank #1 (Strong Buy), Bristow Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Deutsche Lufthansa, International Consolidated Airlines and Bristow Group have gained more than 46%, 14% and 22%, respectively in the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristow Group Inc (BRS) : Free Stock Analysis Report

Deutsche Lufthansa AG (DLAKY) : Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance