United Community Banks Inc (UCBI) Q1 Earnings: Slight Beat on Analysts' EPS Estimates

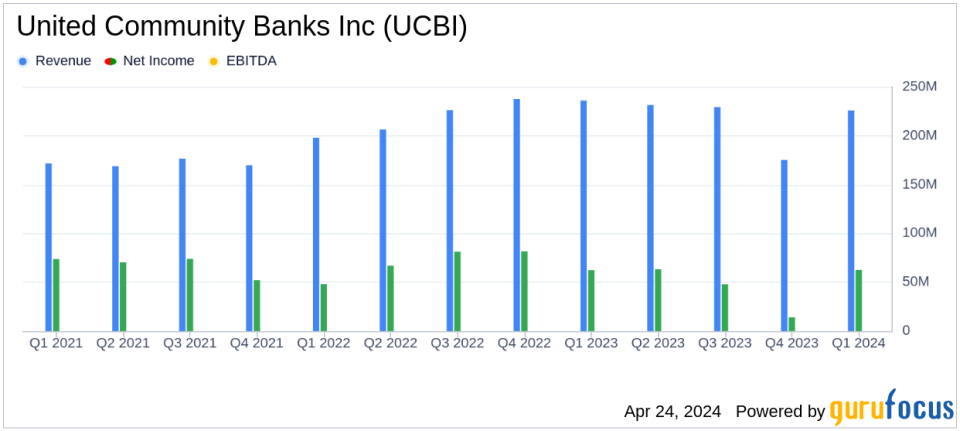

Net Income: Reported at $62.6 million, slightly above the estimated $59.47 million.

Earnings Per Share (EPS): Achieved $0.51, surpassing the estimated $0.49.

Revenue: Total revenue reached $225.84 million, falling short of the estimated $232.02 million.

Net Interest Margin: Increased by 1 basis point to 3.20% from the previous quarter.

Loan Growth: Loans grew at a 1.2% annualized rate, with total loans amounting to $18.375 billion at quarter-end.

Core Deposit Growth: Excluding brokered deposits and public funds, core deposits grew by 5% annualized.

Return on Assets and Equity: Return on assets was 0.90%, and return on equity stood at 7.14%.

United Community Banks Inc (NASDAQ:UCBI) announced its first-quarter results on April 24, 2024, revealing a net income of $62.6 million and diluted earnings per share (EPS) of $0.51, marginally surpassing the analyst consensus estimate of $0.49 per share. The detailed financial performance can be explored in their recent 8-K filing. Despite a challenging economic landscape marked by inflation and global tensions, UCBI demonstrated resilience with a pre-tax, pre-provision income of $93.7 million.

About United Community Banks Inc

United Community Banks Inc, a prominent bank holding company, operates through its subsidiary, Union Community Bank, across Georgia, Tennessee, and the Carolinas. The bank focuses on a community-centric model, offering comprehensive retail and corporate banking services. With a strong emphasis on commercial loans, UCBI has consistently expanded through both organic growth and strategic acquisitions.

Quarterly Financial Performance

The first quarter saw UCBI achieving a net interest margin of 3.20%, slightly up from the previous quarter, driven by an 8 basis point increase in the average yield on interest-earning assets to 5.39%. However, net interest revenue declined by 2% due to lower average interest-earning assets and fewer days in the quarter. The bank also reported a 5% annualized growth in core deposits and a 1.2% growth in loans.

Operating challenges included higher effective tax rates and seasonal increases in operating expenses, which were partially offset by favorable asset write-ups and lower provision expenses. Notably, UCBI's return on assets stood at 0.90% on a GAAP basis and 0.93% on an operating basis, with a return on equity of 7.14%.

Strategic Insights and Market Conditions

Lynn Harton, Chairman and CEO of UCBI, commented on the quarter's performance, highlighting solid pre-tax, pre-provision earnings and stable margins amidst slowing loan growth and stronger-than-anticipated core deposit growth. Harton also noted the positive economic conditions in UCBI's markets but remained cautious about ongoing inflation and global economic tensions.

"We reported solid results in the first quarter, with strong pre-tax, pre-provision earnings, a stable margin, and good credit performance. Loan growth slowed as expected while core deposit growth was stronger than we anticipated," said Lynn Harton.

Amid these conditions, UCBI continues to adopt a conservative management approach to maintain its strength as a reliable community banking partner.

Awards and Recognitions

UCBI's commitment to service excellence was underscored by its receipt of the JD Power Award for Best Retail Banking Satisfaction in the Southeast for the tenth time, along with 15 Greenwich Excellence Awards for Small Business Banking. These accolades reflect the bank's dedication to superior customer service and operational excellence.

Looking Forward

As UCBI navigates through 2024, the bank remains optimistic about leveraging its robust operational framework and community-focused banking model to sustain growth and profitability. The strategic focus will continue to be on enhancing asset quality, expanding core deposits, and prudent capital management to support sustainable long-term growth.

Conclusion

United Community Banks Inc's first-quarter performance illustrates a stable financial position and an ability to adapt to evolving market dynamics. With a clear strategic direction and a strong focus on community banking, UCBI is well-positioned to continue its trajectory of growth and customer satisfaction in the challenging banking landscape.

Explore the complete 8-K earnings release (here) from United Community Banks Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance