United Parks & Resorts (NYSE:PRKS) Q1 Earnings: Leading The Leisure Facilities Pack

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at leisure facilities stocks, starting with United Parks & Resorts (NYSE:PRKS).

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 13 leisure facilities stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter's revenue guidance was 5.2% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but leisure facilities stocks have performed well, with the share prices up 11.3% on average since the previous earnings results.

Best Q1: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

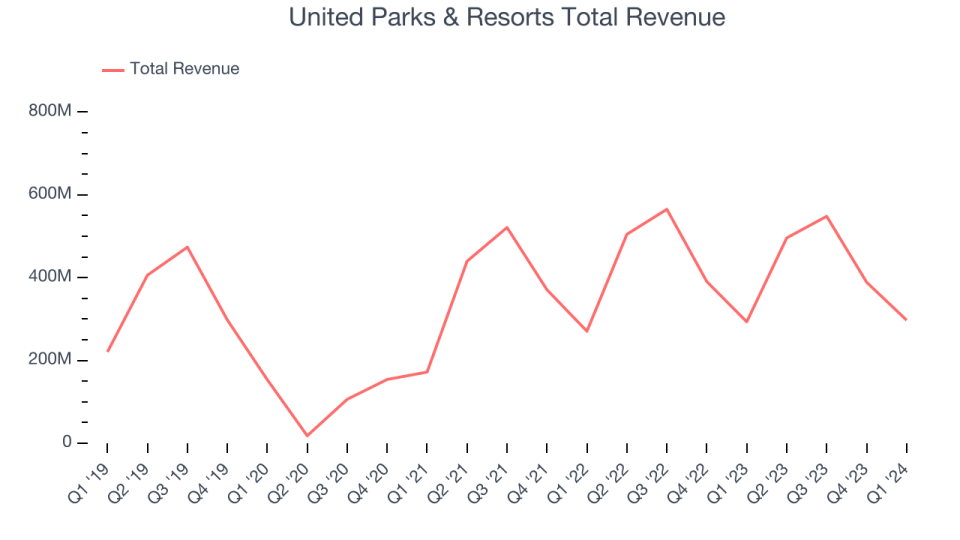

United Parks & Resorts reported revenues of $297.4 million, up 1.4% year on year, exceeding analysts' expectations by 4.5%. Overall, it was a strong quarter for the company with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' visitors estimates.

"We are pleased to report record financial results this quarter including record revenue and Adjusted EBITDA," said Marc Swanson, Chief Executive Officer of United Parks &

The stock is up 15.5% since reporting and currently trades at $56.72.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it's free.

Cedar Fair (NYSE:FUN)

Originally a lakeside resort, Cedar Fair (NYSE:FUN) operates amusement parks and resorts, delivering thrilling experiences and family entertainment across North America.

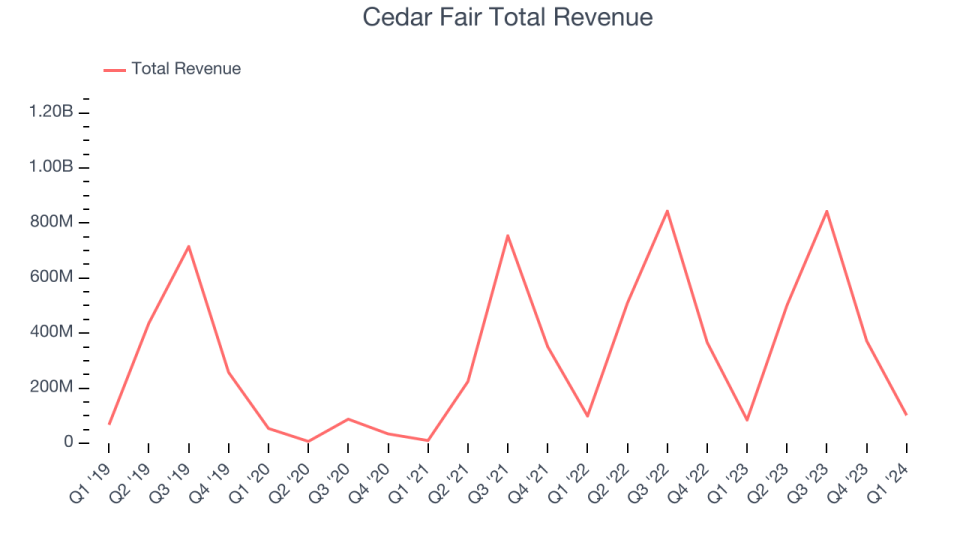

Cedar Fair reported revenues of $101.6 million, up 20.2% year on year, outperforming analysts' expectations by 9%. It was a strong quarter for the company with an impressive beat of analysts' visitors estimates.

The market seems happy with the results as the stock is up 28.3% since reporting. It currently trades at $52.71.

Is now the time to buy Cedar Fair? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $588.1 million, down 1.5% year on year, falling short of analysts' expectations by 4.5%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Dave & Buster's had the weakest performance against analyst estimates in the group. As expected, the stock is down 19.6% since the results and currently trades at $40.53.

Read our full analysis of Dave & Buster's results here.

Life Time (NYSE:LTH)

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Life Time reported revenues of $596.7 million, up 16.8% year on year, surpassing analysts' expectations by 1.4%. Overall, it was a mixed quarter for the company with a miss of analysts' earnings estimates.

Life Time achieved the highest full-year guidance raise among its peers. The stock is up 42.1% since reporting and currently trades at $19.42.

Read our full, actionable report on Life Time here, it's free.

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $51.87 million, up 4% year on year, in line with analysts' expectations. Overall, it was a weaker quarter for the company with and full-year revenue guidance missing analysts' expectations.

The stock is down 6.9% since reporting and currently trades at $10.14.

Read our full, actionable report on European Wax Center here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.