United States Fertilizers Market Poised for Growth, Expected to Reach USD 38 Billion by 2030

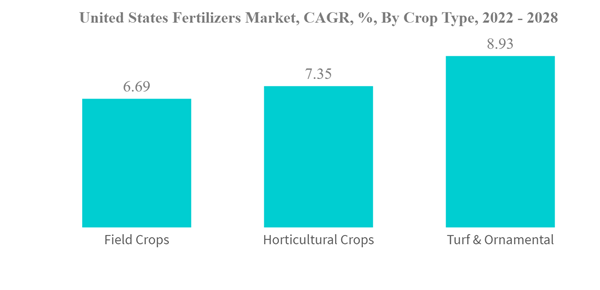

United States Fertilizers Market United States Fertilizers Market C A G R By Crop Type 2022 2028

Dublin, April 01, 2024 (GLOBE NEWSWIRE) -- The "United States Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2016 - 2030" report has been added to ResearchAndMarkets.com's offering.

The United States continues to solidify its status as a leader within the fertilizers market, according to the latest industry analysis. Projections indicate a growth trajectory with the market size blossoming from USD 28.69 billion in 2024 to an anticipated USD 38.08 billion by 2030. This represents a respectable Compound Annual Growth Rate (CAGR) of 4.83% during the forecast period.

Segment Highlights

A discernible surge in demand for Diammonium Phosphate (DAP) underscores the segment's ascension as the fastest-growing product in the U.S. fertilizers space. DAP's growth is primarily fueled by consumption rooted in corn, cotton, and soybean cultivation—key agricultural staples. In conjunction, field crops have emerged as the largest segment by crop type, commandeering significant market share owing to sprawling cultivation areas.

In terms of application method preferences, soil remains the preferred medium, allowing agronomists to effortlessly deliver critical nutrients that underpin both plant health and soil vitality.

Specialty Slow-Release Fertilizers (SRF), recognized for their environmental reckonings and efficacy in nutrient delivery through cropping seasons, represent the fastest-growing specialty type. This aligns with a directional shift in farming practices toward more sustainable and efficient agricultural methodologies.

United States Fertilizers Market Trends

The agricultural dynamics in the United States are reflecting an increased predilection for nitrogen fertilizers, correlated with substantial cereal yields from corn and wheat production. This demand curve is backed by the aggressive expansion of farmable land and the resultant spike in nitrogenous fertilizer consumption.

Concurrently, the population's robust growth trajectory—charted at 330 million in 2020—has compounded the need for escalated food production, further fueling the fertilizers market.

Amidst the broad horticultural landscape, conventional fertilizers continue to dominate; however, an incremental shift towards specialty fertilizers is evident, suggesting a transformative phase in farmer preferences and agricultural sustainability.

Industry Overview

The market landscape is relatively consolidated—the formidable top five entities command a staggering 99.31% market share. These industry pacemakers embody innovation and growth, enhancing the agricultural output necessary to nourish the nation's expanding populace.

As the United States Fertilizers Market progresses, it reflects a confluence of shifting agricultural practices, sustainability, and the imperative to meet the escalating demands of a burgeoning population through augmented productivity.

A selection of companies mentioned in this report includes, but is not limited to:

CF Industries Holdings, Inc.

Haifa Group Ltd

ICL Fertilizers

Koch Industries Inc.

Nutrien Ltd.

Sociedad Quimica y Minera de Chile SA

The Andersons Inc.,

The Mosaic Co.

Wilbur-Ellis Company LLC

Yara International ASA

For more information about this report visit https://www.researchandmarkets.com/r/qoa6tf

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance