Unity (NYSE:U) Delivers Impressive Q1, Gross Margin Improves

Game engine maker Unity (NYSE:U) announced better-than-expected results in Q1 CY2024, with revenue down 8% year on year to $460.4 million. It made a GAAP loss of $0.75 per share, down from its loss of $0.53 per share in the same quarter last year.

Is now the time to buy Unity? Find out in our full research report.

Unity (U) Q1 CY2024 Highlights:

Revenue: $460.4 million vs analyst estimates of $433.5 million (6.2% beat)

EPS: -$0.75 vs analyst expectations of -$0.67 (11.5% miss)

Q2 2024 revenue guidance of $423 million at the midpoint vs. vs analyst estimates of $443.2 million (4.6% miss) (full year revenue guidance also below)

Gross Margin (GAAP): 68.6%, up from 67.6% in the same quarter last year

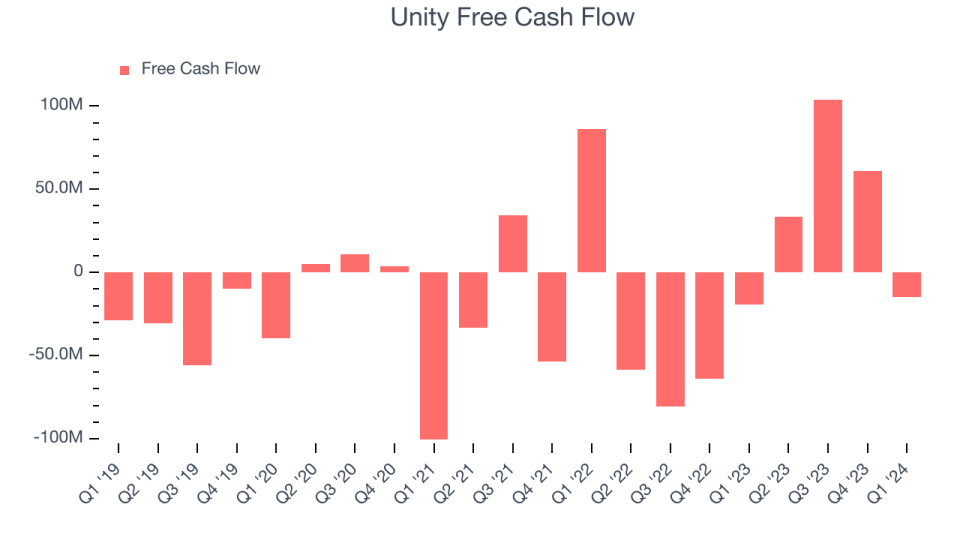

Free Cash Flow was -$14.56 million, down from $60.74 million in the previous quarter

Market Capitalization: $9.42 billion

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

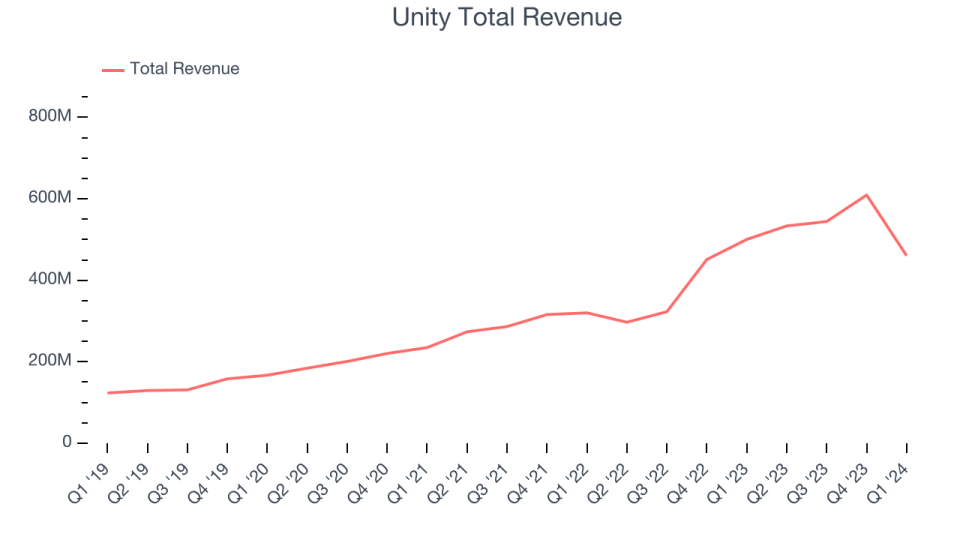

As you can see below, Unity's revenue growth has been very strong over the last three years, growing from $234.8 million in Q1 2021 to $460.4 million this quarter.

This quarter, Unity's revenue was down 8% year on year, which might disappointment some shareholders.

Looking ahead, Wall Street was expecting revenue to decline 13.6% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Unity burned through $14.56 million of cash in Q1 , increasing its cash burn by 25.1% year on year.

Unity has generated $183.7 million in free cash flow over the last 12 months, or 8.6% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Unity's Q1 Results

We were impressed by Unity's strong gross margin improvement this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, revenue guidance for next quarter and the full year are below expectations. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is down 3.2% after reporting, trading at $23.4 per share.

So should you invest in Unity right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance