Univar (UNVR) Beats Earnings and Revenue Estimates in Q1

Univar Solutions Inc. UNVR recorded a profit (on a reported basis) of $55.9 million or 33 cents per share in first-quarter 2020 against a loss of $63.9 million or 43 cents per share a year ago.

The results were driven mainly due to lower acquisition and integration-related expenses, reduced employee severance costs, the absence of the saccharin legal settlement, and the fair value adjustment on warrants.

Barring one-time items, earnings were 31 cents a share in the quarter, down from 33 cents a year ago. However, the metric surpassed the Zacks Consensus Estimate of 26 cents.

The chemical maker’s revenues were $2,211.2 million in the quarter, up 2.4% year over year. Moreover, it surpassed the Zacks Consensus Estimate of $2,076 million.

On a constant currency basis, revenues rose 3.6% year over year. Contribution from the Nexeo buyout and higher demand for products in essential end markets were partly offset by reduced demand in the global industrial markets, lower sales on account of Environmental Sciences divestiture and price deflation.

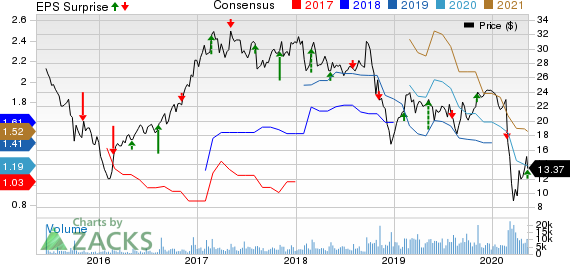

Univar Solutions Inc Price, Consensus and EPS Surprise

Univar Solutions Inc price-consensus-eps-surprise-chart | Univar Solutions Inc Quote

Segment Review

Revenues at the USA division rose 3.8% year over year on a reported basis to $1,357.5 million in the quarter, driven by the contributions from the Nexeo acquisition and higher demand for products in essential end markets. Gross profit rose 7.8% year over year, aided by favorable product mix.

The EMEA segment raked in revenues of $460.3 million, down 4.8% year over year, hurt by reduced demand in certain end markets. Gross profit was down 0.2% year over year.

Revenues at the Canada segment rose 4.4% year over year to $285.8 million, driven by the contributions of the Nexeo acquisition, higher demand for products in essential end markets and a more normal start to the agriculture season. Gross profit rose 15.1% year over year.

Revenues from the LATAM unit rose 12.9% to $107.6 million. Gross profit grew 21.6% year over year. The segment gained from the Nexeo acquisition and higher demand for products in essential end markets and Brazil’s agriculture sector.

Financials

Univar ended the quarter with cash and cash equivalents of $379.7 million, down 51.8% year over year. Long-term debt was $2,860.8 million, down 22.5% year over year.

Outlook

The company withdrew its 2020 adjusted EBITDA guidance due to the impacts of the coronavirus outbreak.

For 2020, it reduced its expected capital expenditure to $95-$115 million from $120-$130 million.

Price Performance

Univar’s shares have lost 40.5% over a year compared with the 26.2% decline recorded by its industry.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Equinox Gold Corp. EQX, Newmont Corporation NEM and Barrick Gold Corporation GOLD.

Equinox Gold currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 231% for 2020. The company’s shares have gained 44.2% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Newmont has a projected earnings growth rate of 85.6% for the current year. The company’s shares have rallied around 103% in a year. It currently has a Zacks Rank #2 (Buy).

Barrick has a projected earnings growth rate of 64.7% for 2020. It currently carries a Zacks Rank #2. The company’s shares have rallied 109% in a year.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Univar Inc (UNVR) : Free Stock Analysis Report

Equinox Gold Corp (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance