Universal Electronics Inc. Reports Q1 2024 Results: A Detailed Comparison with Analyst Estimates

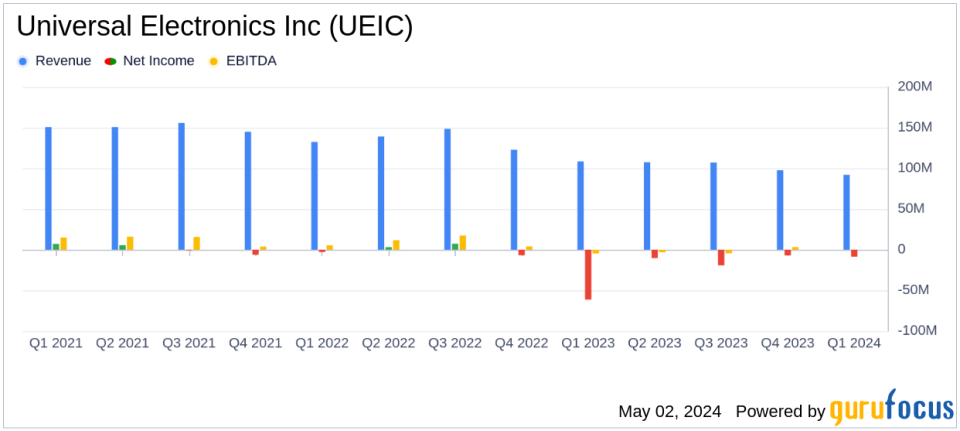

Revenue: Reported $91.9 million, exceeding estimates of $90.74 million.

Net Loss: Reported $8.6 million, significantly higher than the estimated net loss of $3.12 million.

Earnings Per Share (EPS): Reported a loss of $0.67 per share, underperforming against the estimated loss of $0.24 per share.

Gross Margin: Improved to 28.3% from 22.8% year-over-year, reflecting effective cost management and operational improvements.

Operating Loss: Reduced to $6.9 million from a much larger loss of $59.5 million in the previous year, demonstrating significant operational recovery.

Share Repurchase: Bought back approximately 95,000 shares for $0.8 million, indicating confidence in the company's intrinsic value.

Cash Position: Ended the quarter with $26.9 million in cash and cash equivalents, down from previous periods, reflecting ongoing investments and share repurchases.

On May 2, 2024, Universal Electronics Inc. (NASDAQ:UEIC) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, a leader in universal control solutions for home entertainment and smart home devices, reported a net loss of $8.6 million, or $0.67 per share, which was significantly wider than the estimated loss of $0.24 per share and net income of -$3.12 million projected by analysts. Revenue for the quarter stood at $91.9 million, slightly above the expected $90.74 million.

About Universal Electronics Inc.

Based in the United States, Universal Electronics Inc. specializes in designing, developing, manufacturing, and supporting innovative control and sensor technology solutions. These products range from universal control systems to smart home devices, catering to major brands across various sectors including video services, consumer electronics, and home automation. The company primarily operates in the United States, leveraging its expertise to maintain a strong market presence.

Q1 Performance and Strategic Initiatives

Despite the challenging economic environment, UEIC has made significant strides in its strategic initiatives, particularly in the climate control and home automation sectors. According to UEIC Chairman and CEO Paul Arling, the company has secured projects with six of the top ten HVAC equipment manufacturers globally. This expansion is part of UEIC's broader strategy to diversify its product offerings and enhance its market reach.

"We are very encouraged by numerous customer wins and are confident that there are many more to come," stated Paul Arling.

The company also emphasized its ongoing efforts to optimize manufacturing operations and implement cost-saving measures, which are expected to bolster profitability in the long term.

Financial Highlights and Challenges

UEIC's financial results for Q1 2024 reflected a decrease in net sales from $108.4 million in Q1 2023 to $91.9 million. This decline was primarily due to a strategic shift in sales channels and product development resources. However, gross margins improved from 22.8% to 28.3% year-over-year, indicating enhanced operational efficiency.

The company faced a GAAP operating loss of $6.9 million, which was a substantial improvement from the $59.5 million operating loss in the previous year, which included a significant non-cash charge for goodwill impairment. The adjusted Non-GAAP operating loss was $2.2 million, compared to $3.6 million in Q1 2023.

Outlook and Forward Guidance

Looking ahead to the second quarter of 2024, UEIC anticipates GAAP net sales to range between $90.0 million and $100.0 million. The expected GAAP loss per share ranges from $0.53 to $0.43, reflecting ongoing investments and operational adjustments. The Adjusted Non-GAAP loss per share is projected to be between $0.10 and $0.00, excluding specific one-time costs and adjustments.

The company remains committed to its strategic initiatives and is optimistic about returning to profitability by the end of the year, driven by continued cost optimizations and an expanding portfolio in high-growth markets.

Conclusion

While Universal Electronics Inc. faces short-term challenges, its strategic realignments and focus on high-growth areas suggest potential for long-term gains. Investors and stakeholders will likely watch closely as the company continues to navigate the competitive landscape and strives for sustainable profitability.

Explore the complete 8-K earnings release (here) from Universal Electronics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance