Unlucky buyers rue missing stamp duty tax windfall

People who bought a home in recent weeks have called the stamp duty relief introduced on Wednesday an “injustice” after they missed out on a tax saving worth thousands of pounds.

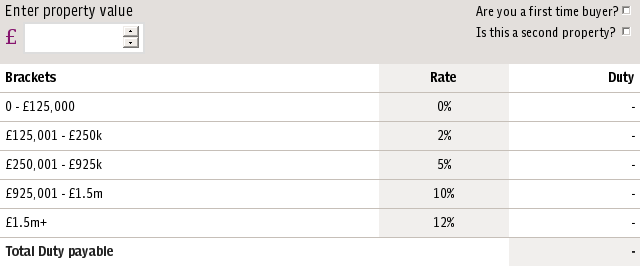

Rishi Sunak, the Chancellor, announced in the summer statement that home purchases up to £500,000 would be exempt from stamp duty until March 31.

The move is intended to boost the country’s struggling housing market, but those who purchased just before the rule change will miss the tax bonus, worth up to £15,000.

Figures published by HM Revenue and Customs show there are 50,000 transactions completed each month, meaning thousands of buyers will have missed out on a tax break by a matter of days.

Nick Hyde, 29, is among them. The business development manager bought a £475,000 property in Basildon, Essex, on July 3. He and his wife, Ashley Brown, paid £13,750 in stamp duty. Had they delayed the purchase by a week, they would have avoided the tax bill.

Mr Hyde said the decision not to backdate the tax break was an “injustice”. He said he felt those who supported the property market and economy in recent months had been unfairly punished.

“If we had bought months before the pandemic I wouldn’t have had a problem, but they’ve changed the goalposts a few days after we’ve bought,” he said.

Mr Hyde said it was especially frustrating as he had been gifted money by his parents to help fund his new home. He added: “It’s completely taken the shine off the new house.”

James Forrester of Barrows and Forrester, an estate agent, said Mr Sunak should backdate the tax break.

“Many home buyers who will have completed over the past few weeks will be forgiven for feeling a little let down,” he said. “This will leave a very sour taste indeed.”

A spokesman for HM Treasury said there were no plans to backdate the tax giveaway. He said nine in 10 buyers would no longer pay stamp duty.

The changes to stamp duty only affect purchases in England and Northern Ireland. In Scotland, buyers must pay land and buildings transaction tax and in Wales they are subject to a land transaction tax.

The Scottish Government has confirmed that it will raise the starting threshold for the tax from £145,000 to £250,000, potentially saving buyers £2,100. However, no date has been set for the launch of the new regime, owing to administrative difficulties.

Estate agents in Scotland have warned that the delay will have repercussions for the market, as potential buyers hold off on purchases until the new rules takes effect.

No changes to Welsh property taxes have been announced. The Conveyancing Association, an industry trade body, has urged the Welsh Government to match the tax cuts elsewhere and boost the country’s property market.

Transactions in Wales worth over £180,000 are currently subject to the tax.

Yahoo Finance

Yahoo Finance