Unpacking Q1 Earnings: Titan Machinery (NASDAQ:TITN) In The Context Of Other Specialty Equipment Distributors Stocks

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at specialty equipment distributors stocks, starting with Titan Machinery (NASDAQ:TITN).

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 11 specialty equipment distributors stocks we track reported a mixed Q1; on average, revenues were in line with analyst consensus estimates. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and specialty equipment distributors stocks have had a rough stretch, with share prices down 9.3% on average since the previous earnings results.

Titan Machinery (NASDAQ:TITN)

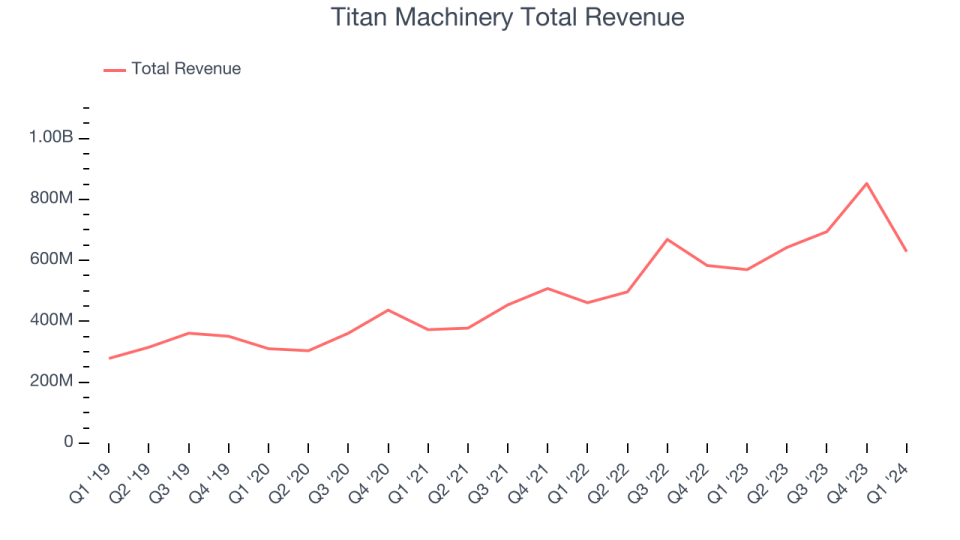

Founded in 1980, Titan Machinery (NASDAQ:TITN) is a distributor of agricultural and construction equipment across the United States and Europe.

Titan Machinery reported revenues of $628.7 million, up 10.4% year on year, falling short of analysts' expectations by 5%. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates.

"Our first quarter results reflected an industry-wide transition to a more challenging market environment, characterized by softening demand and excess supply of inventory in many product categories as OEM delivery timelines returned to normal and as new sales converted to used trade-ins," stated Bryan Knutson, Titan Machinery’s President and Chief Executive Officer.

The stock is down 29% since reporting and currently trades at $16.45.

Is now the time to buy Titan Machinery? Access our full analysis of the earnings results here, it's free.

Best Q1: Hudson Technologies (NASDAQ:HDSN)

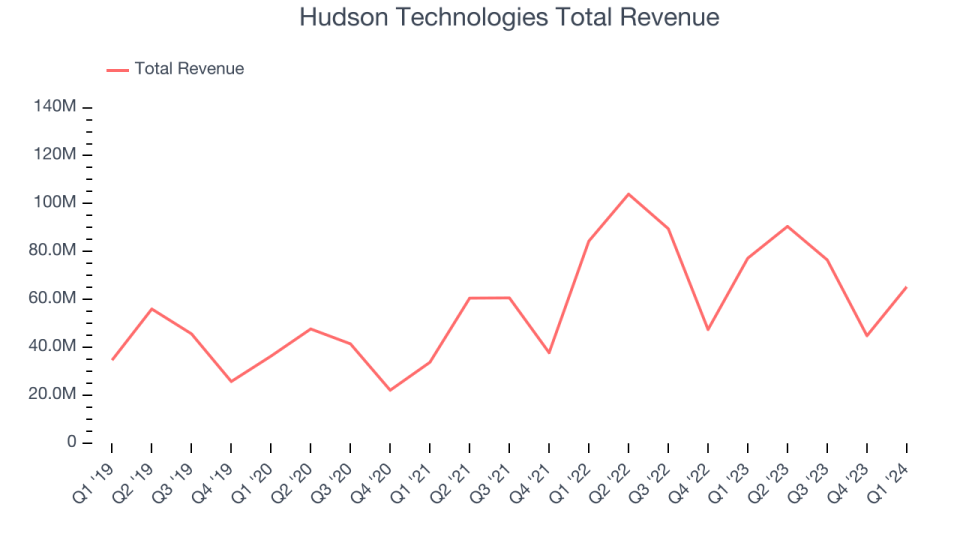

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $65.25 million, down 15.5% year on year, outperforming analysts' expectations by 7.5%. It was an exceptional quarter for the company with a solid beat of analysts' earnings estimates.

Hudson Technologies scored the biggest analyst estimates beat among its peers. Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 14.6% since reporting. It currently trades at $8.35.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it's free.

Karat Packaging (NASDAQ:KRT)

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $95.61 million, flat year on year, falling short of analysts' expectations by 4.2%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

As expected, the stock is down 6.3% since the results and currently trades at $27.08.

Read our full analysis of Karat Packaging's results here.

H&E Equipment Services (NASDAQ:HEES)

Founded in 1961, H&E Equipment Services (NASDAQ:HEES) provides equipment rental, sales, and maintenance services to construction and industrial sectors.

H&E Equipment Services reported revenues of $371.4 million, up 15.2% year on year, surpassing analysts' expectations by 5.3%. Overall, it was a mixed quarter for the company.

The stock is down 26% since reporting and currently trades at $43.81.

Read our full, actionable report on H&E Equipment Services here, it's free.

Herc (NYSE:HRI)

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $804 million, up 8.6% year on year, surpassing analysts' expectations by 2.4%. Zooming out, it was an exceptional quarter for the company with an impressive beat of analysts' Equipment rentals revenue estimates and a decent beat of analysts' earnings estimates.

The stock is down 14.1% since reporting and currently trades at $127.39.

Read our full, actionable report on Herc here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.