Unpacking Q2 Earnings: Starbucks (NASDAQ:SBUX) In The Context Of Other Traditional Fast Food Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at traditional fast food stocks, starting with Starbucks (NASDAQ:SBUX).

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Luckily, traditional fast food stocks have performed well with share prices up 12.1% on average since the latest earnings results.

Starbucks (NASDAQ:SBUX)

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

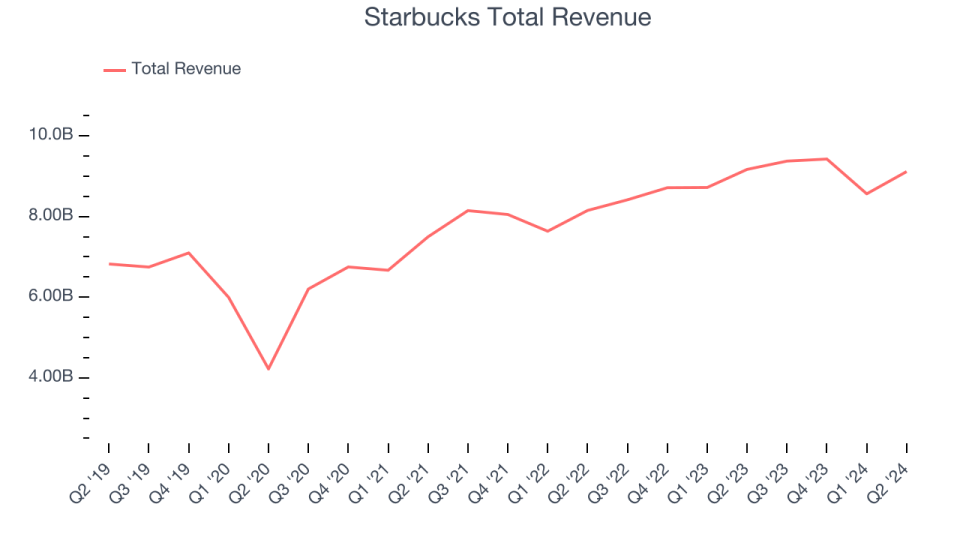

Starbucks reported revenues of $9.11 billion, flat year on year. This print fell short of analysts’ expectations by 1.5%. Overall, it was a slower quarter for the company with a miss of analysts’ earnings estimates.

“Our three-part action plan is beginning to work and driving operational improvements that we expect to improve financial performance,” commented Laxman Narasimhan, chief executive officer.

Interestingly, the stock is up 28.5% since reporting and currently trades at $97.56.

Is now the time to buy Starbucks? Access our full analysis of the earnings results here, it’s free.

Best Q2: Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

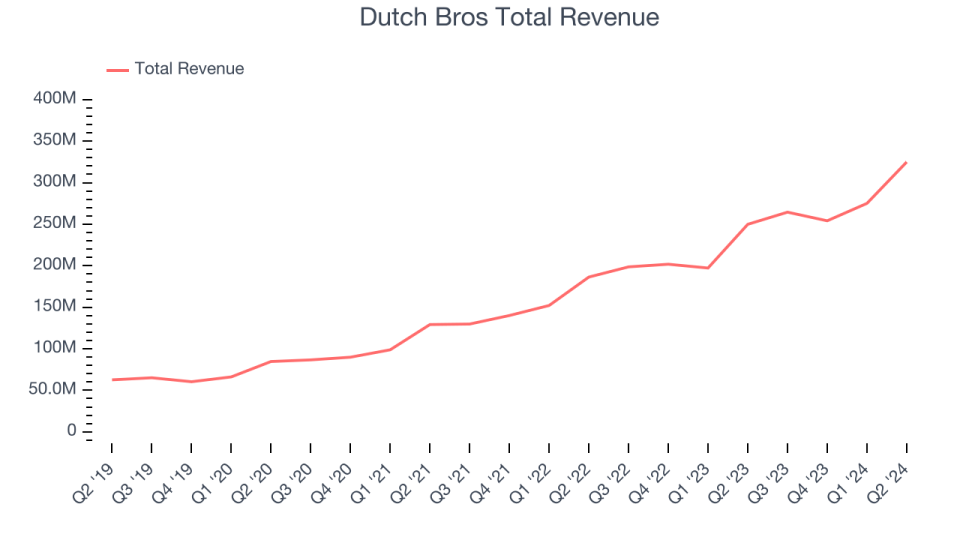

Dutch Bros reported revenues of $324.9 million, up 30% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with an impressive beat of analysts’ earnings estimates.

Dutch Bros delivered the fastest revenue growth and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.1% since reporting. It currently trades at $32.03.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Portillo's (NASDAQ:PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ:PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $181.9 million, up 7.5% year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted a miss of analysts’ earnings estimates.

Interestingly, the stock is up 52.4% since the results and currently trades at $13.55.

Read our full analysis of Portillo’s results here.

Domino's (NYSE:DPZ)

Founded by two brothers in Michigan, Domino’s (NYSE:DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

Domino's reported revenues of $1.10 billion, up 7.1% year on year. This number met analysts’ expectations. Zooming out, it was a slower quarter as it failed to impress in other areas of the business.

The stock is down 9.6% since reporting and currently trades at $427.51.

Read our full, actionable report on Domino's here, it’s free.

El Pollo Loco (NASDAQ:LOCO)

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

El Pollo Loco reported revenues of $122.2 million, flat year on year. This print surpassed analysts’ expectations by 1.5%. It was a very strong quarter as it also put up a decent beat of analysts’ earnings estimates.

The stock is up 15.5% since reporting and currently trades at $13.70.

Read our full, actionable report on El Pollo Loco here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.