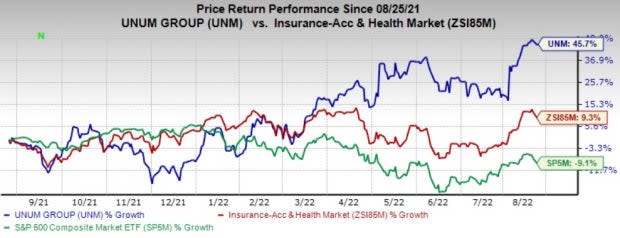

Unum Group (UNM) Up 45.7% in a Year: More Room for Growth?

Shares of Unum Group UNM have gained 45.7% in a year against the industry's decline of 9.3%. The Zacks S&P 500 composite decreased 9.1% in the said time frame. With a market capitalization of $7.8 billion, the average volume of shares traded in the last three months was 1.8 million.

Image Source: Zacks Investment Research

The rally was largely driven by strong persistency in group lines, higher premium income, growth in the in-force block and higher sales.

This Zacks Rank #1 (Strong Buy) insurer has a solid track record of beating earnings estimates in five of the last seven quarters.

UNM has a favorable VGM Score of B. VGM Score helps to identify stocks with the most attractive value, the best growth and the most promising momentum.

Can UNM Stock Retain the Momentum?

The Zacks Consensus Estimate for Unum Group’s 2022 earnings is pegged at $5.94, indicating a 36.5% increase from the year-ago reported figure on 1% higher revenues of $12.1 billion. The consensus estimate for 2023 earnings is pegged at $6.06, indicating a 2% increase from the year-ago reported figure on 2.6% higher revenues of $12.4 billion.

The expected long-term earnings growth rate is 12.5%, which is higher than the industry average of 8.7%.

The Unum U.S. segment of the insurer stands to gain from strong persistency in group lines, favorable benefits experience, primarily in group product lines, higher premium income, lower operating expenses and higher net investment income.

Improving premium income, favorable risk results, higher sales and higher level of persistency should continue to drive the Colonial Life segment. Management remains focused on moving to a mix of businesses with higher growth and stable margins.

The Unum International segment remains well poised for growth on higher net investment income, premium income, favorable benefits experience and improved benefit ratio.

The primary driver of the international segment’s results is the Unum UK business, which continued to improve with strong persistency, good sales and the successful placement of rate increases on the in-force block. Sales in Unum UK and Unum Poland continued to remain strong.

Unum Group boasts a solid capital position. Sustained solid operating results have been fueling a solid level of statutory earnings and capital, cushioning financial flexibility. The risk-based capital ratio for Unum’s traditional U.S. insurance companies was 415% as of Jun 30, 2022, and holding company cash and marketable securities was $1.2 billion, both above targeted levels.

Banking on operational excellence, the board approved a quarterly dividend hike of 10% in May 2022, marking the 13th dividend hike in the last 12 years. The dividend yield is currently 3.4%, better than the industry average of 2.5%. This makes the stock an attractive pick for yield-seeking investors. Unum expects $200 million worth of shares buyback annually through 2024.

The Zacks Consensus Estimate for 2022 and 2023 has moved 1.5% and 0.7% north, respectively, in the past seven days, reflecting analysts’ optimism.

Unum Group has an impressive Value Score of A. Back-tested results show that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy) offer the best opportunities in the value investing space.

Other Stocks to Consider

Some other top-ranked stocks from the property and casualty insurance industry are Arch Capital Group Ltd. ACGL, American Financial Group, Inc. AFG and ProAssurance Corporation PRA, each sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Arch Capital surpassed earnings estimates in three of the last four quarters and missed in one, the average being 33.64%. Year to date, the insurer has rallied 6.3%.

The Zacks Consensus Estimate for Arch Capital’s 2022 and 2023 earnings has moved 5.7% and 4.9% north, respectively, in the past 30 days.

American Financial’s earnings surpassed estimates in each of the last four quarters, the average beat being 37.09%. Year to date, American Financial has lost 1.6%.

The Zacks Consensus Estimate for AFG’s 2022 and 2023 earnings has moved 3.1% and 3.3% north, respectively, in the past 30 days.

The bottom line of ProAssurance surpassed earnings estimates in three of the last four quarters and missed in one, the average being 150.9%. Year to date, the insurer has lost 8.6%.

The Zacks Consensus Estimate for ProAssurance’s 2022 and 2023 earnings has moved 25.9% and 13.9% north, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Unum Group (UNM) : Free Stock Analysis Report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance