Unveiling 3 Leading Growth Companies In Canada With Insider Ownership Reaching 20%

Amidst a backdrop of resilient economic growth and robust corporate earnings, the Canadian market continues to demonstrate its strength. The recent performance, particularly in tech sectors, underscores the potential for investors looking at growth companies with high insider ownership—a factor that can align interests and potentially enhance shareholder value in these evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Growth Rating |

goeasy (TSX:GSY) | 21.7% | ★★★★★☆ |

Aritzia (TSX:ATZ) | 19% | ★★★★★☆ |

Allied Gold (TSX:AAUC) | 22.4% | ★★★★★☆ |

Payfare (TSX:PAY) | 15% | ★★★★★☆ |

Aya Gold & Silver (TSX:AYA) | 10.2% | ★★★★★☆ |

Amerigo Resources (TSX:ARG) | 11.8% | ★★★★★☆ |

ROK Resources (TSXV:ROK) | 16.6% | ★★★★★☆ |

Lion Electric (TSX:LEV) | 12% | ★★★★★☆ |

UGE International (TSXV:UGE) | 35.4% | ★★★★★☆ |

Ivanhoe Mines (TSX:IVN) | 13.3% | ★★★★★☆ |

We'll examine a selection from our screener results.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. is a company that designs and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$3.73 billion.

Operations: The company generates CA$2.29 billion from its apparel sales in the United States and Canada.

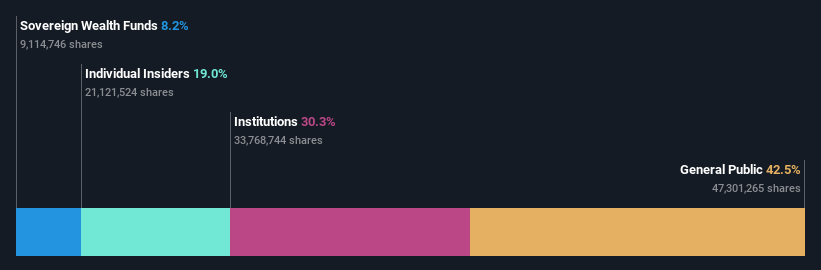

Insider Ownership: 19%

Aritzia, a Canadian retailer, shows promising growth with expected annual revenue and earnings growth outpacing the broader market at 11.3% and 51.5% respectively. Despite no significant insider buying recently, analysts predict a potential stock price increase of 20%. However, Aritzia trades significantly below its estimated fair value and has seen a decline in profit margins from last year. The forecasted Return on Equity is high at 28.8%, underscoring strong future profitability potential despite some current financial weaknesses.

Dive into the specifics of Aritzia here with our thorough growth forecast report.

The valuation report we've compiled suggests that Aritzia's current price could be quite moderate.

Curaleaf Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. is a cannabis operator in the United States with a market capitalization of approximately CA$5.01 billion.

Operations: The company generates its revenue primarily through the cultivation, production, distribution, and sale of cannabis, totaling $1.35 billion.

Insider Ownership: 20.5%

Curaleaf Holdings, a growth-oriented company in Canada, is expected to become profitable within three years, with earnings forecasted to grow significantly at 59.82% annually. Despite trading at 76.5% below its estimated fair value and facing shareholder dilution last year, Curaleaf's revenue growth of 10.1% per year outpaces the Canadian market average of 6.7%. Recent strategic moves include relocating its Phoenix Airport dispensary to enhance customer access and launching new products, indicating proactive management in expanding market presence.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a mining company focused on the exploration, development, and extraction of minerals and precious metals mainly in Africa, with a market capitalization of approximately CA$25.52 billion.

Operations: The company primarily generates revenue through the exploration, development, and extraction of minerals and precious metals in Africa.

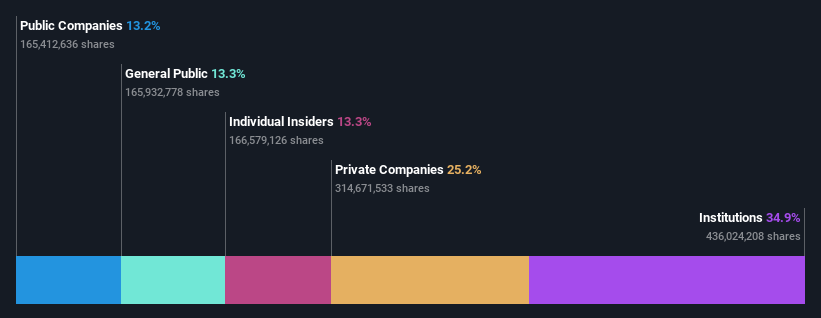

Insider Ownership: 13.3%

Ivanhoe Mines, a Canadian growth company with high insider ownership, is poised for robust expansion. Despite experiencing shareholder dilution in the past year, Ivanhoe's revenue and earnings are forecasted to surge by 73.8% and 34.4% annually, respectively—significantly outpacing the Canadian market averages. Recent developments include maintaining its 2024 production guidance for the Kamoa-Kakula project and initiating a cost-effective transportation agreement via the Lobito Corridor, which will likely enhance export efficiencies and reduce logistics costs.

Where To Now?

Navigate through the entire inventory of 42 Fast Growing Companies With High Insider Ownership here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include TSX:ATZ TSX:CURATSX:IVN and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance