Unveiling 3 Premier Dividend Stocks Yielding Over 5.1%

As global markets show signs of vitality, with the US tech giants rallying and positive expectations for the ASX200, investors are keenly awaiting domestic economic cues from upcoming inflation data that could influence future interest rate decisions. Amidst these broader market movements, understanding the attributes of strong dividend stocks becomes crucial, especially in a landscape where economic indicators and corporate actions might sway investor sentiment.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Nick Scali (ASX:NCK) | 4.98% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.74% | ★★★★★☆ |

Auswide Bank (ASX:ABA) | 9.86% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.71% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.65% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.49% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.40% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 8.11% | ★★★★☆☆ |

Australian United Investment (ASX:AUI) | 3.63% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

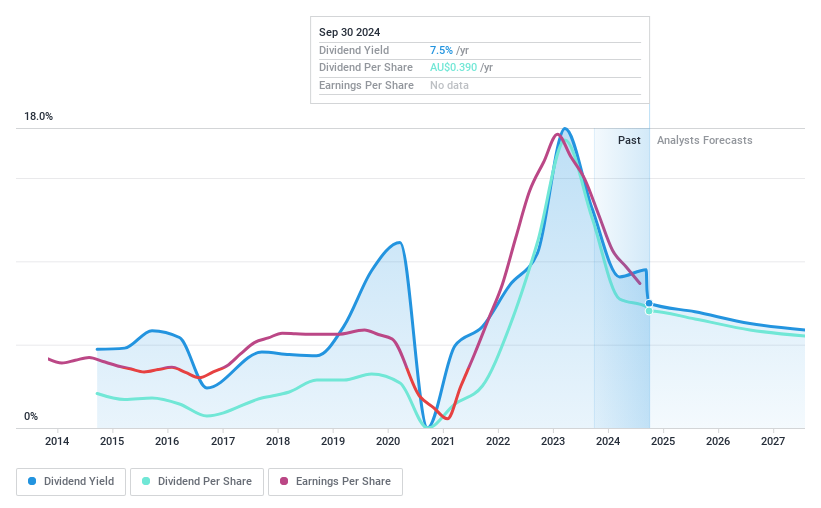

New Hope

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited, operating in the energy sector, focuses on the exploration, development, production, and processing of coal and oil and gas properties with a market capitalization of approximately A$3.82 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its coal mining activities in New South Wales and Queensland, totaling approximately A$1.88 billion and A$0.05 billion respectively.

Dividend Yield: 9.5%

New Hope Corporation Limited, with a dividend yield of 9.51%, offers an attractive rate in the top 25% for Australian dividend stocks. Despite this, its dividends raise sustainability concerns; they are not well-covered by cash flows, evidenced by a high cash payout ratio of 90.2%. Financially, the company saw a significant drop in net income and revenue in the half-year report ending January 2024, with earnings per share also declining from A$0.775 to A$0.298. While trading at 45.2% below estimated fair value suggests potential upside, inconsistent dividends over the past decade and forecasted earnings decline could concern investors looking for stable returns.

Click to explore a detailed breakdown of our findings in New Hope's dividend report.

Our expertly prepared valuation report New Hope implies its share price may be lower than expected.

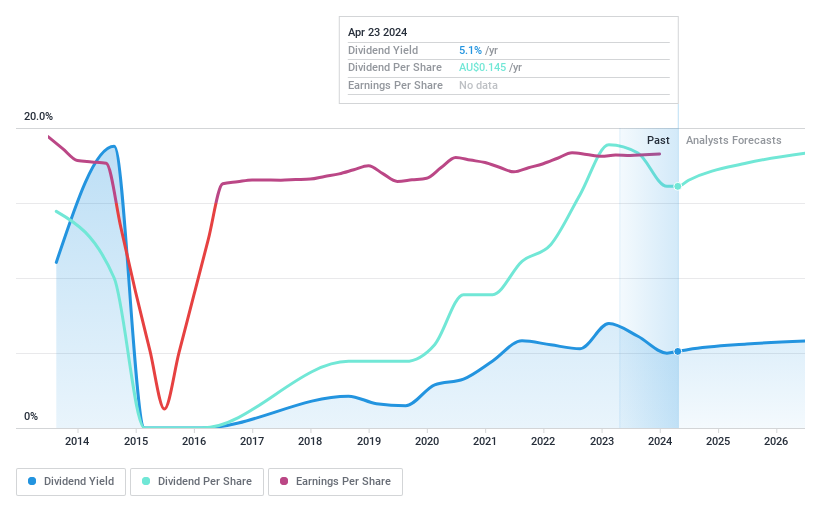

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited is an Australian company offering diversified contract services to the resources and infrastructure sectors, with a market capitalization of approximately A$1.29 billion.

Operations: NRW Holdings Limited generates its revenue primarily from three segments: Mining (A$1.49 billion), MET (A$739.07 million), and Civil (A$593.62 million).

Dividend Yield: 5.1%

NRW Holdings Limited, with a recent dividend of A$0.065, shows an unstable dividend history but has seen a 10-year increase in payouts. The company's dividends are reasonably covered by both earnings and cash flows, with payout ratios of 74% and 68.6% respectively. Despite a low yield of 5.11% compared to the market's top quartile at 6.24%, NRW trades at good value relative to peers and is forecasted to grow earnings by approximately 14.05% annually. Recent financials indicate a year-on-year growth in sales and net income as of December 2023.

Delve into the full analysis dividend report here for a deeper understanding of NRW Holdings.

Upon reviewing our latest valuation report, NRW Holdings' share price might be too pessimistic.

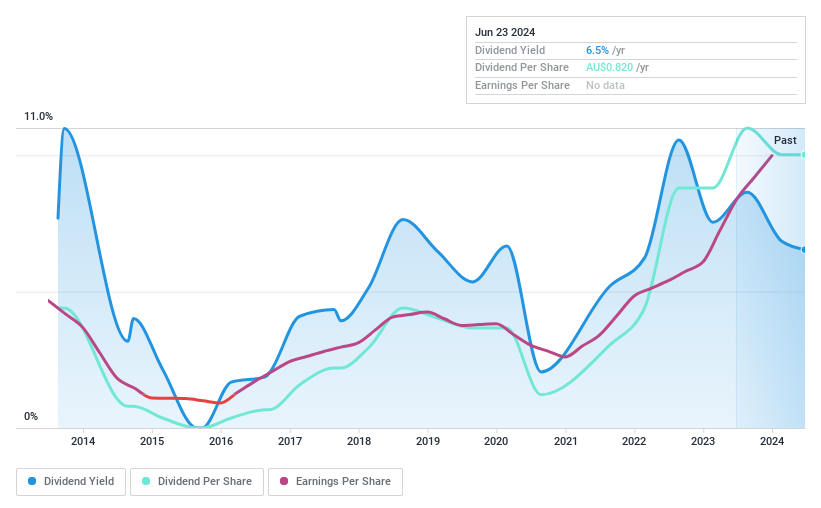

Lycopodium

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited, with a market cap of A$464.56 million, offers engineering and project delivery services across the resources, infrastructure, and industrial processes sectors.

Operations: Lycopodium Limited generates revenue primarily from its involvement in the process industries sector, totaling A$11.85 million.

Dividend Yield: 7.0%

Lycopodium Limited offers a dividend yield of 7.01%, ranking it in the top 25% for dividends within the Australian market. Despite this, its dividend sustainability is questionable, with a high cash payout ratio of 244.7% and earnings not sufficiently covering dividend payments. Recent financials show robust year-over-year earnings growth of 79.9%, with reaffirmed revenue guidance around A$345 million and NPAT between A$46 million to A$50 million for FY2024, signaling continued strong performance. However, significant insider selling over the past three months could raise concerns about its future prospects.

Next Steps

Embark on your investment journey to our 31 Top Dividend Stocks selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NHC ASX:NWH and ASX:LYL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance