Unveiling Three UK Dividend Stocks With Yields Up To 3.6%

As the FTSE 100 experiences fluctuations influenced by global economic cues and sector-specific developments, investors remain attentive to shifts in market dynamics and potential opportunities. Amidst this landscape, dividend stocks continue to attract attention for their potential to offer steady income streams, particularly appealing in times of market uncertainty.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.60% | ★★★★★★ |

Keller Group (LSE:KLR) | 4.32% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.23% | ★★★★★☆ |

DCC (LSE:DCC) | 3.49% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.85% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.27% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.12% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.27% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.41% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.55% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

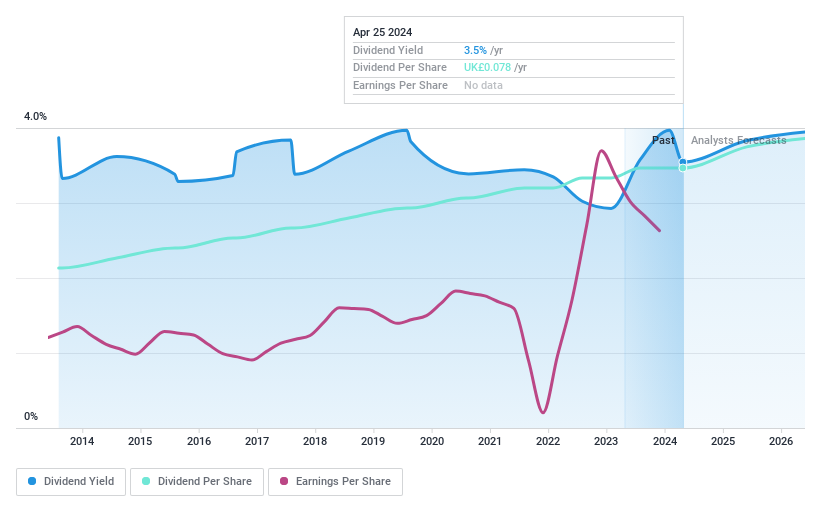

NWF Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc operates primarily in the sale and distribution of fuel oils across the United Kingdom, with a market capitalization of approximately £108.77 million.

Operations: NWF Group plc generates revenue through three main segments: Food (£74.3 million), Feeds (£210.4 million), and Fuels (£707.2 million).

Dividend Yield: 3.5%

NWF Group plc maintains a steady dividend, reaffirmed at 1.0 pence per share, reflecting consistent shareholder returns despite a leadership transition with Chris Belsham stepping in as CEO. The company's recent financials show a dip in sales to £472.9 million and net income to £2.7 million. While its dividend yield of 3.55% is below the UK market's top quartile, the dividends are well-supported by earnings and cash flows, with payout ratios of 29.6% and 10.3%, respectively, indicating sustainability amidst modest declines in performance expectations.

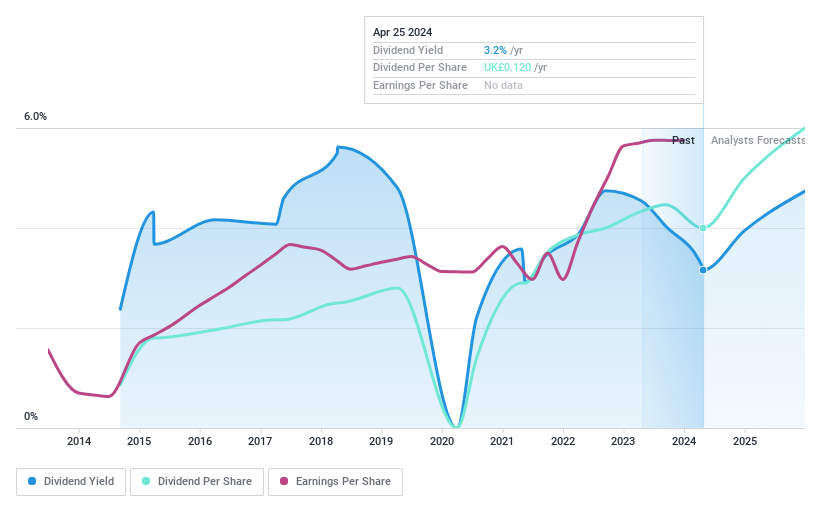

Property Franchise Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Property Franchise Group PLC, with a market capitalization of £236.85 million, operates in managing residential real estate properties across the United Kingdom.

Operations: The Property Franchise Group PLC generates revenue primarily through financial services and property franchising, amounting to £1.50 million and £25.78 million respectively.

Dividend Yield: 3.2%

Property Franchise Group's dividend yield of 3.16% is modest compared to the UK market's leading payers. Despite this, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 52.2% and 85.4%, respectively. However, the company has experienced volatility in dividend payments over the past decade and shareholder dilution within the last year. Recent financials show slight growth with sales reaching £27.28 million and net income at £7.4 million for FY 2023.

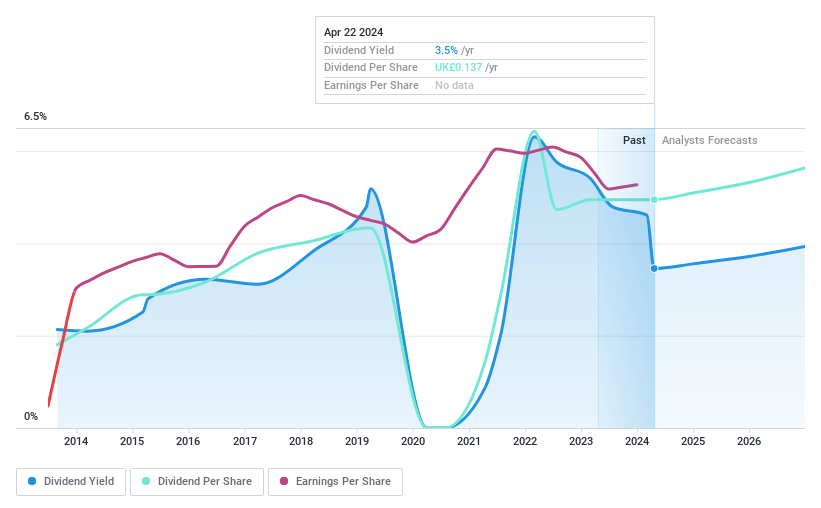

Tyman

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tyman plc is a company that designs, manufactures, and supplies engineered fenestration components and access solutions to the construction industry, with a market capitalization of approximately £728.38 million.

Operations: Tyman plc generates its revenue primarily from three geographic segments: UK & Ireland (£97.5 million), International (£129.8 million), and North America (£434.5 million).

Dividend Yield: 3.7%

Tyman plc, amidst a takeover by Quanex, offers a final dividend of £0.095 per share, maintaining the previous year's level with a total payout of £18.5 million. Despite stable recent dividends, Tyman's historical dividend track record shows variability. The dividends are well-covered by earnings and cash flows with payout ratios at 69.9% and 28.6%, respectively. However, its dividend yield at 3.66% falls below the top UK payers' average of 5.87%. The acquisition could influence future dividend policies as Tyman transitions to private status post-merger.

Unlock comprehensive insights into our analysis of Tyman stock in this dividend report.

Upon reviewing our latest valuation report, Tyman's share price might be too optimistic.

Summing It All Up

Embark on your investment journey to our 53 Top Dividend Stocks selection here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NWFAIM:TPFG LSE:TYMN

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance