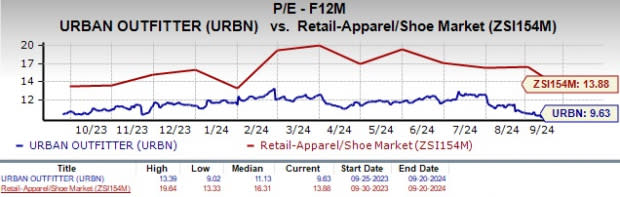

Urban Outfitters Stock Seems Attractive With P/E Multiple of 9.63X

Urban Outfitters Inc. URBN is currently trading at a notably low price-to-earnings (P/E) multiple, which is below the Zacks Retail-Apparel and Shoes industry and broader Retail-Wholesale averages. URBN's forward 12-month P/E ratio is 9.63, lower than the industry average of 13.88 and the sector average of 23.63.

This stock is undervalued compared with its industry peers, thereby offering compelling value to investors looking for exposure to the retail apparel sector. Furthermore, URBN's Value Score of A underscores its appeal as a potential investment.

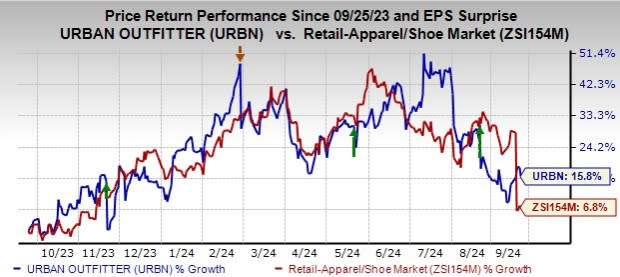

The stock has gained 15.8% compared with the industry’s 6.8% growth in the past year. Closing at $36.77 on Monday, Urban Outfitters’ stock is currently trading 24.8% below its 52-week high of $48.90, attained on July 12, 2024.

Image Source: Zacks Investment Research

URBN is Sustaining Growth Through Strategic Diversification

Urban Outfitters continues to show impressive growth by leveraging its multi-brand portfolio to diversify revenue streams. In the second quarter of fiscal 2025, URBN reported a 6.3% year-over-year increase in total sales, which reached $1.35 billion. This upside stands out in a challenging retail environment, reflecting the company’s acumen.

The Retail segment saw a 2% comparable sales increase, primarily driven by strong performances from Anthropologie and Free People. The Wholesale segment also contributed significantly, with a 15.1% revenue increase, highlighting the emphasis on full-price sales to preserve brand equity.

The FP Movement initiative showcased Free People’s innovative approach, with a 10.2% year-over-year global sales increase. Retail comps rose 7.1% while Wholesale revenues increased 17.5%. Meanwhile, URBN’s subscription rental service, Nuuly, reported a remarkable 62.6% revenue increase, bolstered by a 55% surge in subscribers, which exceeded 250,000. This upside led to a record operating profit of $5.3 million.

The Anthropologie Group achieved its 14th consecutive quarter of growth, with a 7.4% increase in net sales. Retail comps grew 6.7%, driven by strong demand for women’s apparel. Urban Outfitters plans to open 57 new stores while closing around 25, focusing on key brands like Free People and Anthropologie, thereby demonstrating a commitment to sustainable growth.

Effective inventory and expense management were crucial in the second quarter. By aligning inventory levels with sales trends, URBN entered the second half of the year with a streamlined inventory, thereby enhancing margins and reducing markdowns. It maintains a strong financial position, with $209.1 million in cash and $352.4 million in marketable securities as of July 31, 2024. As Urban Outfitters continues to leverage its diverse brand portfolio, it is well-positioned for sustained growth and ready to capitalize on future opportunities.

Image Source: Zacks Investment Research

Challenges in Urban Outfitters’ Flagship Brand

Despite the positive factors, Urban Outfitters has been grappling with ongoing difficulties related to its flagship brand. The flagship brand has been experiencing a prolonged period of underperformance. In the second quarter of fiscal 2025, the brand reported a notable 9.3% year-over-year decline in retail segment comparable sales, particularly affecting the North American and European markets. This downturn was mainly due to disappointing results across both digital and physical sales channels. This consistent negative trend raises significant concerns, emphasizing the brand's ongoing battle to reconnect with its customer base in a highly competitive retail landscape.

Estimate Favoring URBN Stock

The Zacks Consensus Estimate for earnings per share has been revised upward, reflecting the positive sentiment around Urban Outfitters. Over the past 30 days, analysts have increased their estimates for the current year by 6 cents to $3.63 per share and the next year by 1 penny to $3.92. These estimates indicate year-over-year growth of 11.7% and 8%, respectively.

Conclusion

Investors may consider URBN stock due to its appealing valuation and robust growth potential. The stock is considered undervalued compared with industry peers, thus making it an attractive option in the retail apparel sector. URBN has shown resilience through a diverse brand portfolio, particularly strong performances from Anthropologie and Free People.

Although the flagship brand is facing challenges, analysts remain optimistic about the company’s future, with positive revisions in earnings estimates. Furthermore, URBN's strategic focus on sustainable growth, including new store openings and effective inventory management, enhances its prospects for capitalizing on upcoming opportunities. The company currently carries a Zacks Rank #3 (Hold).

Key Picks

Better-ranked stocks are Nordstrom Inc. JWN, Abercrombie & Fitch Co. ANF and Steven Madden, Ltd. SHOO.

Nordstrom is a leading fashion specialty retailer in the United States. The company offers an extensive selection of both branded and private-label merchandise. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2024 sales indicates growth of 0.6% from the fiscal 2023 reported figure. JWN has a negative trailing four-quarter average earnings surprise of 17.8%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It sports a Zacks Rank of 1 at present. ANF delivered a 16.8% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2025 earnings and sales indicates growth of 63.4% and 13.1%, respectively, from the fiscal 2024 reported levels. ANF has a trailing four-quarter average earnings surprise of 28%.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 6.9% and 12.6%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report