US Dividend Stocks To Consider In September 2024

As of September 2024, the U.S. stock market is experiencing a notable upswing, with the S&P 500 and Dow Jones Industrial Average closing at record highs. This positive momentum has been driven by gains in major tech stocks and a recent interest rate cut by the Federal Reserve. In this favorable market environment, dividend stocks can offer stability and income potential for investors seeking to capitalize on current economic conditions. Here are three U.S. dividend stocks to consider this month.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

WesBanco (NasdaqGS:WSBC) | 4.76% | ★★★★★★ |

Columbia Banking System (NasdaqGS:COLB) | 5.59% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.59% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.20% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.79% | ★★★★★★ |

OTC Markets Group (OTCPK:OTCM) | 4.70% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 4.41% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.36% | ★★★★★★ |

Chevron (NYSE:CVX) | 4.42% | ★★★★★★ |

Virtus Investment Partners (NYSE:VRTS) | 4.32% | ★★★★★★ |

Click here to see the full list of 171 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

First Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc. (NasdaqCM:FCAP) is the bank holding company for First Harrison Bank, offering a range of banking services to individuals and business customers, with a market cap of $127.38 million.

Operations: First Capital, Inc. generates its revenue primarily from its banking segment, which amounts to $40.80 million.

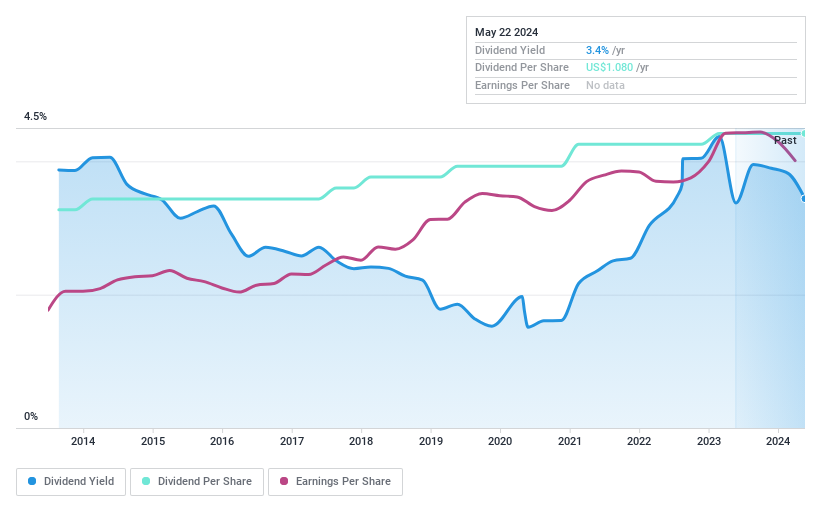

Dividend Yield: 3.2%

First Capital pays a reliable dividend of 3.16%, which, while lower than the top 25% of US dividend payers, has been stable and growing over the past decade with a low payout ratio of 30%. Recently, the company increased its quarterly dividend by $0.02 to $0.29 per share, reflecting a 7.4% rise. Despite trading at 57.1% below estimated fair value and recent buybacks totaling $11.72 million, earnings growth remains modest but steady.

Dillard's

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States and has a market cap of $5.96 billion.

Operations: Dillard's, Inc. generates revenue primarily from its Retail Operations segment, which accounts for $6.50 billion, and additionally from its Construction segment with $299.37 million.

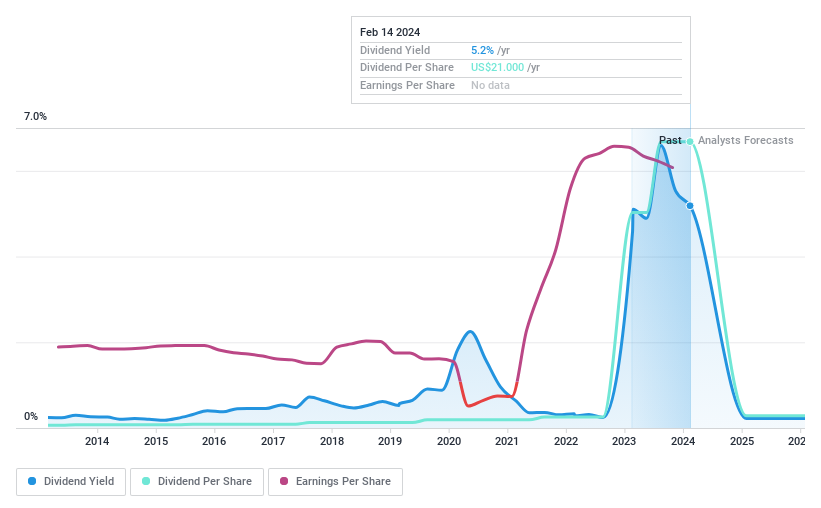

Dividend Yield: 5.6%

Dillard's pays a reliable and attractive dividend of 5.59%, consistently growing over the past decade with minimal volatility. The dividends are well-covered by earnings (payout ratio: 2.5%) and cash flows (cash payout ratio: 63.9%). Despite recent declines in revenue and net income, Dillard's trades at a significant discount to its estimated fair value, offering potential value for dividend investors. Recent news includes the affirmation of a $0.25 per share dividend payable on November 4, 2024.

Navigate through the intricacies of Dillard's with our comprehensive dividend report here.

The valuation report we've compiled suggests that Dillard's current price could be quite moderate.

Robert Half

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Robert Half Inc. offers talent solutions and business consulting services across multiple continents, with a market cap of $6.83 billion.

Operations: Robert Half Inc.'s revenue segments include Protiviti ($1.90 billion), Contract Talent Solutions ($4.01 billion), and Permanent Placement Talent Solutions ($517.33 million).

Dividend Yield: 3.1%

Robert Half pays a reliable dividend of $0.53 per share, covered by earnings (payout ratio: 66.8%) and cash flows (cash payout ratio: 59.4%). The company has consistently increased dividends over the past decade, although recent net income declined to US$68.16 million in Q2 2024 from US$106.29 million a year ago. Despite being dropped from the FTSE All-World Index, Robert Half trades at a significant discount to its estimated fair value, offering potential value for dividend investors.

Summing It All Up

Explore the 171 names from our Top US Dividend Stocks screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FCAP NYSE:DDS and NYSE:RHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com