US Dollar Pulls Back vs. Yield-Sensitive FX as FOMC Minutes Loom

DailyFX.com -

Talking Points:

US Dollar corrects lower versus yield-geared currencies

Euro and British Pound drop alongside local bond yields

Canadian Dollar falls as crude oil prices turn downward

Currency markets have put in a mixed performance heading into Wednesday morning in European trade. The US Dollar is trading lower against particularly rates-sensitive alternatives at both ends of the policy spectrum, with the perennially low-yielding Yen as well as the high-beta Australian and New Zealand Dollars scoring outsized gains.

This is perhaps reflective of pre-positioning ahead of the upcoming release of minutes from February’s FOMC meeting. Steady hawkish comments from central bank officials including Chair Yellen seems to have primed investors for more of the same. Still, cautious profit-taking on near-term USD exposure appears to have taken hold after the greenback managed the highest close in a month yesterday.

Meanwhile, European currencies looked decidedly downbeat. The Euro and the British Pound plunged alongside benchmark German Bund and UK Gilt yields, respectively. This points to eroding ECB and BOE policy supportexpectations, although a discrete catalyst for the pickup in momentum is not readily apparent. The moves began long before the day’s offering of regional economic data began to cross the wires.

The Canadian Dollar likewise declined, tracking crude oil prices. The latter’s turn downward may be corrective after yesterday’s gains on the back of supportive comments from OPEC Secretary General Mohammad Barkindo. Markets may have turned leery ahead of API inventory data that may show swing supply continued to swell last week and may undermine the cartel’s production cut scheme.

Where is the US Dollar going this week? Join a Q&A webinar and ask a DailyFX analyst!

Asia Session

European Session

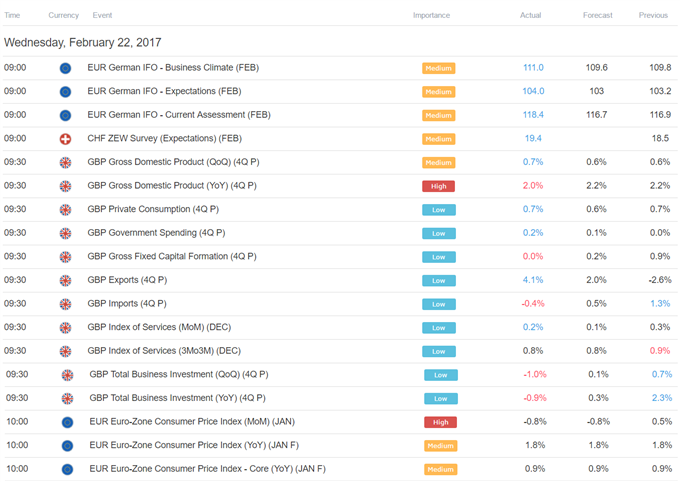

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance