US election: European stocks closed up as US vote goes down to the wire

European stocks closed higher on Wednesday as vote counting continued in the US election, with investors closely following results in key states.

Stocks tumbled at the open before leaping in a volatile day’s trading amid heightened uncertainty and tension over the tight presidential race.

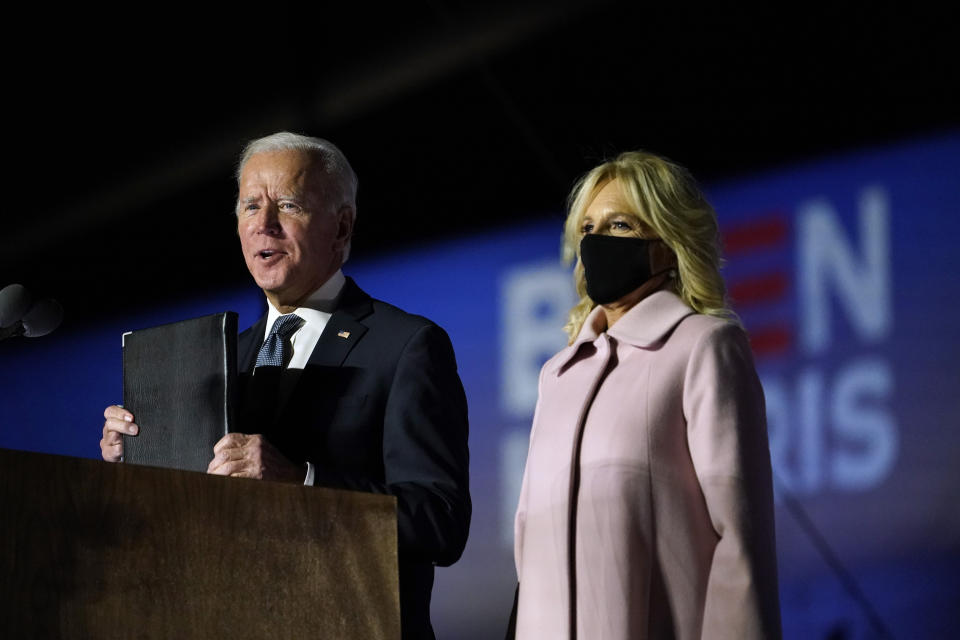

Neither candidate had secured the 270 electoral college votes needed to win by the end of the session in Europe. Associated Press had Joe Biden on 238 votes and a higher share of the popular vote, with Donald Trump on 213 votes at around midday Wednesday on the east coast in the US (5pm in London).

US and European stocks saw a rally on Wednesday despite the race looking far tighter than the ‘Blue Wave’ suggested by polls in recent weeks, which had boosted investor hopes of large fiscal stimulus.

The S&P 500 (^GSPC), Dow (^DJI) and Nasdaq (^IXIC) all leapt more than 2% as trading began on Wall Street, with the tech-heavy Nasdaq soaring 4% higher. Some analysts said fading chances of a Democrat win in the Senate lowered the threat to big tech firms from antitrust action and higher taxes, while others said such firms were seen as a safe haven.

READ MORE: US tech stocks leap as investors watch election results

The FTSE (^FTSE) in London closed 1.7% higher. Germany’s Dax (^GDAXI) finished the day up 2%, while France’s CAC 40 (^FCHI) rose 2.4%.

It marked a significant turnaround for European stocks. The FTSE had tumbled 1.1% at the open, and the Dax was down 1.9% as the trading day began.

Financial markets had been rattled as markets opened in Europe, with a sudden sharp sell-off after the president made unsubstantiated claims of fraud and of victory while the results remained too close to call. Trump also vowed to fight a legal battle and called for states to stop counting votes.

Biden had already told supporters he was “on track to win this election,” though he urged patience while votes were counted. His team called Trump’s claims “outrageous.”

But the sell-off swiftly reversed and European stocks followed Wall Street higher, confounding some analysts’ expectations of steep declines.

WATCH: Trump falsely claims he won 2020 election

“The US election results are still to be fully determined, but the expected selloff has not arrived,” said Chris Beauchamp, chief market analyst at IG.

It came as the dollar strengthened against both the euro (USDEUR=X) and the pound (USDGBP=X) as demand grew for the safe-haven asset. Investors also had one eye on new purchasing managers’ index (PMI) data on Wednesday, showing eurozone firms performing better than expected by analysts in October.

READ MORE: US election: Trump now favourite to win after complete turnaround in betting

But analysts said market volatility was likely until greater certainty emerges over the US election result. Giles Goghlan, chief currency analyst at HYCM, said the outcome was “on a knife edge.”

“Donald Trump just declared war by declaring victory in the election before all the counting is over,” said Neil Wilson, chief analyst at Markets.com shortly after Trump’s inflammatory claims.

WATCH: Trump versus Biden – the election night in tweets

The results have been much tighter than expected by pollsters, with Trump closing the gap after Biden’s strong lead in the polls for months ahead of the vote.

READ MORE: 2020 US election – live coverage and results

"Not a great night for the pollsters and arguably the worst possible outcome for both the markets and the prospect of a peaceful outcome," said Craig Erlam, senior market analyst at OANDA Europe.

Erlam warned of a potential wait of days or even weeks for conclusive results. But he added: "The market reaction has been fairly subdued under the circumstances."

Stock markets were mixed in Asia overnight. The Hang Seng Index in Hong Kong (^HSI) lost 0.2%, but China’s SSE Composite Index (000001.SS) gained 0.2% and Japan’s Nikkei 225 (^N225) leapt 1.7%.

WATCH: Former UBS chairman says markets will do ‘well’ whoever wins the election

Yahoo Finance

Yahoo Finance