US Edged Out by Brazil Beef Fat Destined for Biofuels

(Bloomberg) -- Brazil is reaping the benefits from a US biofuels boom, undercutting American farmers by flooding the market with a little-known commodity that can be used to make renewable fuels.

Most Read from Bloomberg

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

Ukraine Bid for Global South Support Falters at Swiss Summit

Danes Asked to Keep Supplies, Iodine Pills to Prepare for Crises

Southwest Plane Plunged Within 400 Feet of Ocean Near Hawaii

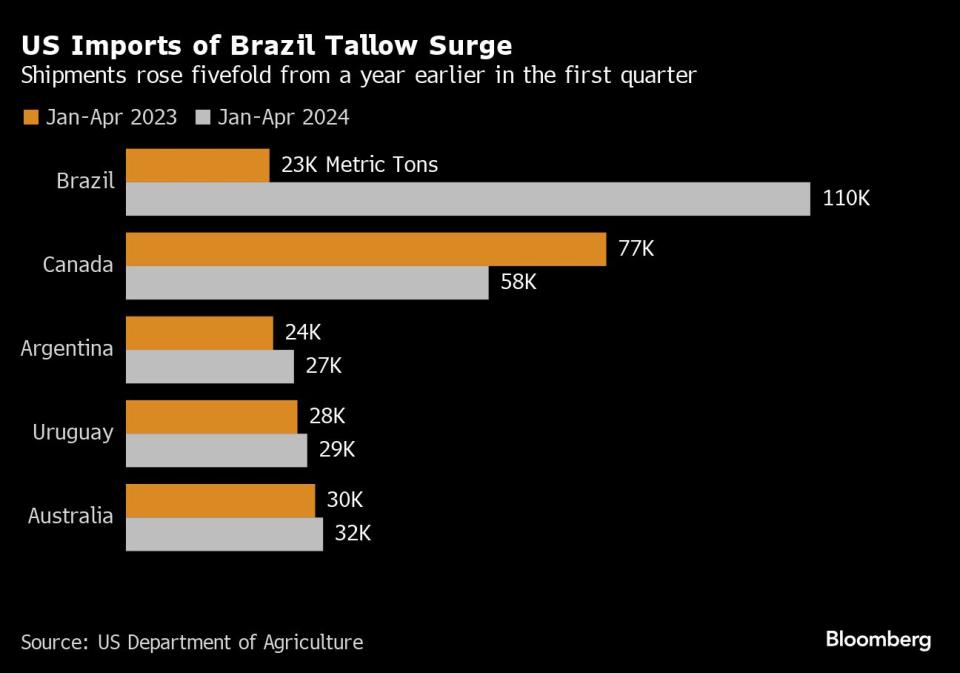

American purchases of Brazilian cattle tallow, a form of waste fat, climbed 377% in the first four months of 2024 from a year earlier. Brazil has accounted for nearly all the 40% increase in overall tallow shipments into the US in the period.

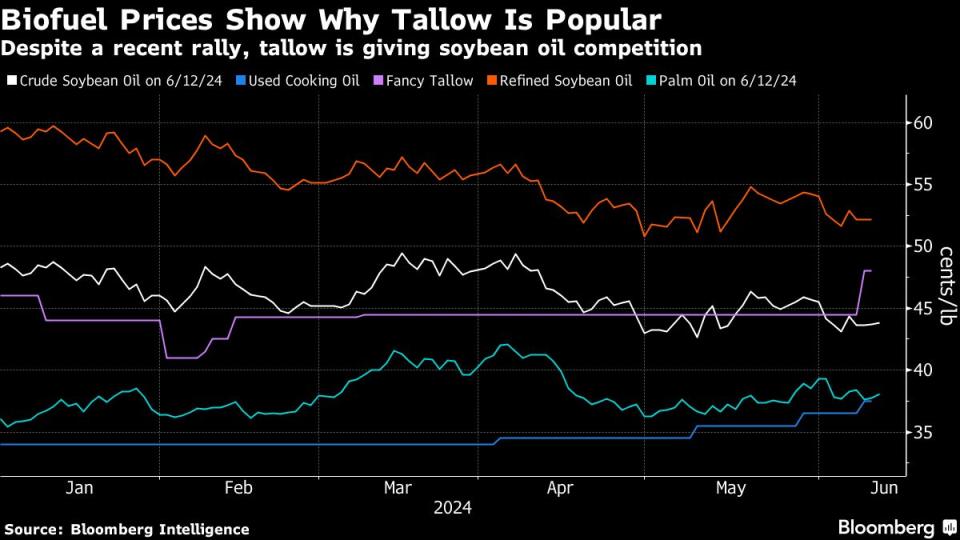

US fuelmakers, including Diamond Green Diesel LLC and Marathon Petroleum Corp., are turning overseas for cheaper raw materials that will help boost their margins. Renewable diesel made from waste fat or used cooking oil has a lower carbon score than soy oil and therefore gets higher tax credits in California, where a large part of US green diesel currently is consumed.

“As long as the rules are the way they are these biofuel companies are going to use whatever is cheapest,” said John Baize, an independent analyst who also advises the US Soybean Export Council.

A new federal tax credit will also start next year, with tallow and used cooking oil generally more lucrative as feedstocks compared to vegetable oil made with US soy. Brazil is capitalizing on the rules to emerge as the largest US supplier of tallow today from almost zero exports a few years ago.

The booming imports exacerbate a challenging situation for farmers and agriculture companies. Bunge Global SA, Archer-Daniels-Midland Co. and others have been counting on soaring demand for crop-based green diesel feedstocks but competition from foreign imports is eating into profits and jeopardizing expansion plans.

Tallow, used in a variety of products from pet food to soap, is abundant in Brazil, which slaughters more cows than any other country except China. Brazil rarely exported tallow until 2022, when Irving, Texas-based Darling Ingredients Inc. agreed to buy FASA Group, Brazil’s largest independent rendering company. FASA has since become a supplier of waste fat to Diamond Green Diesel, a biofuel venture between Darling and Valero Energy Corp.

“Brazilian tallow has been folded into the US biofuel feedstock mix, in part due to Darling Ingredients’ integration of FASA,” Bloomberg Intelligence analyst Brett Gibbs said.

Total US tallow imports rose fourfold since 2019 to a record 779,300 metric tons in 2023, according to US government trade data. Brazil, which made up for roughly 23% of shipments last year, saw its share jump to 40% in the first four months of the year.

The US market for biofuel material also has been flooded with record shipments of waste cooking oil, mostly from China, prompting a group of soybean crushers to push for a hike in import tariffs.

(Corrects fifth paragraph of story published June 13 to remove description of the federal tax credit being bigger next year.)

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance