Coronavirus: US government to borrow record $3tn in three months to tackle crisis

The US government expects to borrow a record $3tn (£2.4tn) in just three months in a bid to shore up the economy against the coronavirus crisis.

The US Treasury department confirmed the borrowing plans for the second quarter between April and June late on Monday. The figures are more than five times higher than the previous record, according to Reuters.

It far exceeds the near $1.8tn borrowed in a whole year during the global financial crisis in 2009, but officials believe there is enough market demand for the debt issuance. More details will be announced on Wednesday.

The federal department said the new debt “is primarily driven by the impact of the COVID-19 outbreak.” It highlighted new crisis spending measures to help businesses and citizens, and the hit to tax receipts from letting both defer their tax payments for the second quarter until July.

READ MORE: UK could face tax hikes amid fears of ‘biggest deficit in history’

Analysts at ING said it was “no huge surprise” that borrowing was set to soar, given surging federal spending to tackle the crisis and the likely budget deficit. More than 1.18 million people have been infected with the virus in the US, and more than 68,000 have died.

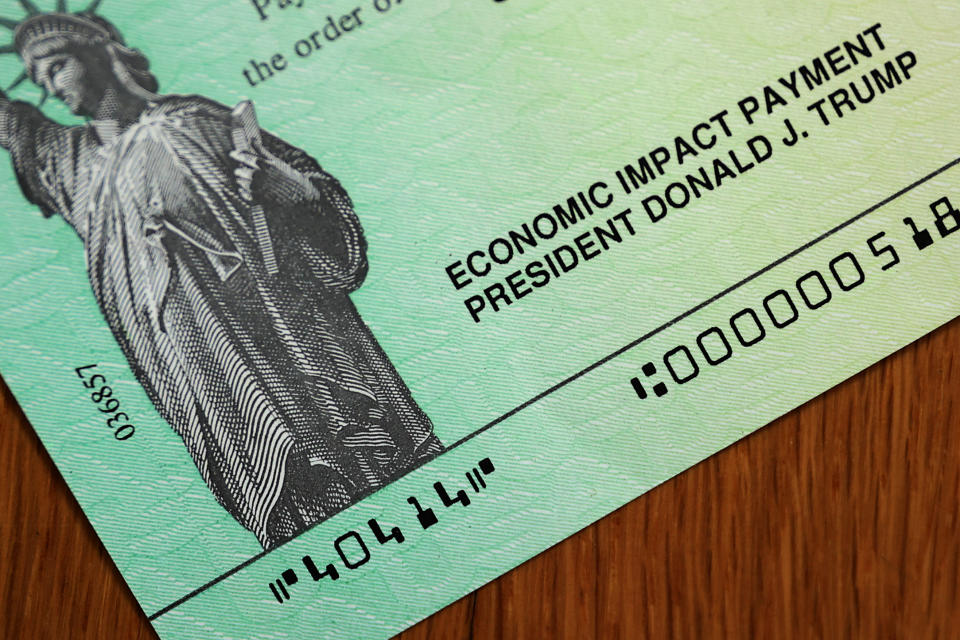

Almost $3tn has been approved by Congress in stimulus and support for firms, households, healthcare, and state and local authorities since the crisis began. US president Donald Trump’s administration’s measures include a $660bn support programme of loans for small firms hit by the pandemic and lockdowns.

The government’s deficit will almost quadruple in size to a record $3.7tn this tax year, according to the Congressional Budget Office. It also predicts GDP will drop by 40% in the second quarter.

The Treasury’s borrowing plans are largely a “one-shot-one-quarter solution,” ING analysts noted. Borrowing is expected to drop to $677bn in the third quarter.

Watch the latest videos from Yahoo UK

Yahoo Finance

Yahoo Finance