US Housing Looks Good Despite October's New Home Sales Dip

October sales pace for newly constructed homes looks strong despite recording a marginal decline from the prior month. Moreover, the reading surpassed market expectation by 3.8%, signaling sturdy housing demand on the back of lower home prices and borrowing costs.

A few homebuilding companies like Hovnanian Enterprises, Inc. HOV, Taylor Morrison Home Corporation TMHC, Century Communities, Inc. CCS and TRI Pointe Group, Inc. TPH gained 3.3%, 2.7%, 2.7% and 1.8%, respectively, on Nov 26. All the four stocks carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SPDR S&P Homebuilders ETF XHB, iShares U.S. Home Construction ETF ITB and Invesco Dynamic Building & Construction ETF PKB also gained 1.5%, 1.4% and 1.1%, respectively, post the release of October sales.

Let’s see how the current sales picture will frame the industry’s future.

No Reason to Worry

Sales of newly constructed single-family homes — accounting for roughly 10% of U.S. home sales — dipped slightly in October from the prior month to a seasonally adjusted annual rate of 733,000 units, per data released by the Commerce Department. Nonetheless, the sales were 31.6% higher than October 2018.

Importantly, September’s reading was upwardly revised from 701,000 to 738,000. October and September sales figures mark the two strongest readings since July 2007.

Regionally, new home sales in the South — accounting for bulk of transactions — dropped 3.3% in October. Although sales in the Northeast declined 18.2%, sales increased 4.2% and 7.1% in the Midwest and West, respectively.

Meanwhile, median sales prices in October were $316,700, which grew 2.1% month over month but fell 3.5% from the year-ago level. Average prices also rose 4.5% to $383,300 from the September level but declined 2.9% from October 2018.

The supply of new homes inched up 0.3% from September to 322,000 in October. However, housing inventory decreased 3.3% from the year-ago period. It would take just 5.3 months to deplete the current supply of homes, up from 5.2 months in September.

The U.S. housing industry’s prospects for the upcoming quarters appear bright, given extremely low mortgage rates, the Fed’s dovish stance, steady economic growth and favorable demographics. Importantly, residential investment rebounded in the third quarter, after contracting for six straight quarters.

In the words of Greg Ugalde, chairman of the National Association of Home Builders, and a home builder and developer from Torrington, CT, “Forty-five percent of homes sold in October were priced below $300,000, which is an indication that more millennial buyers are taking advantage of low mortgage rates and entering into the marketplace.”

Per the recent The Mortgage Bankers Association’s Builder Application Survey, mortgage applications for new home purchases increased 31.5% in October from a year ago and 9% from September.

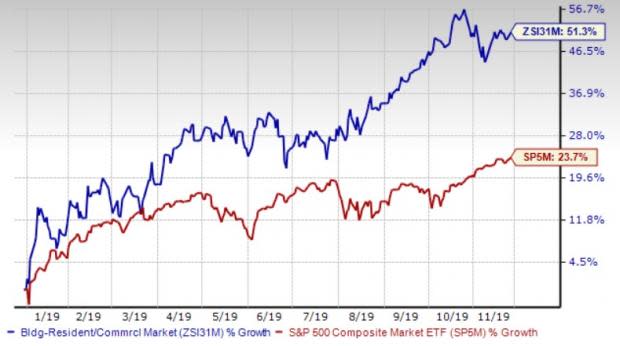

So far this year, the Zacks Homebuilding Industry has rallied 51.3%, comparing favorably with 23.7% rally of the S&P 500 composite. Moreover, a good industry rank (top 10% of more than 250 industries) supports its growth potential.

Also, homebuilder sentiment — which marked the second highest reading in November since June 2018 — and October housing starts and permits — which recorded strong growth in more than the past 12 years — are promising signs for the housing market.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

TRI Pointe Group, Inc. (TPH) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

Hovnanian Enterprises Inc (HOV) : Free Stock Analysis Report

iShares U.S. Home Construction ETF (ITB): ETF Research Reports

Invesco Dynamic Building & Construction ETF (PKB): ETF Research Reports

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance