US Inflation Eases Slightly; Gold’s Gains Resume

After mildly lower inflation and weaker advance GDP for the first quarter in the USA, there are some signs that the economy is cooling off. The dollar has taken a hit from recent releases in most of its pairs while gold has returned close to all-time highs. This article summarises recent news, data and expectations for the next meeting of the Federal Reserve (‘the Fed’) then looks briefly at the charts of XAUUSD and EURUSD.

Although headline inflation in the USA had been higher than the consensus for many months, that scenario seemed less likely for April’s release due to the unexpectedly lower result from the NFP. April’s NFP missed the consensus by about 70,000, which is significant in itself but also important because it breaks the long trend of positive surprises. As a result, inflation declined negligibly:

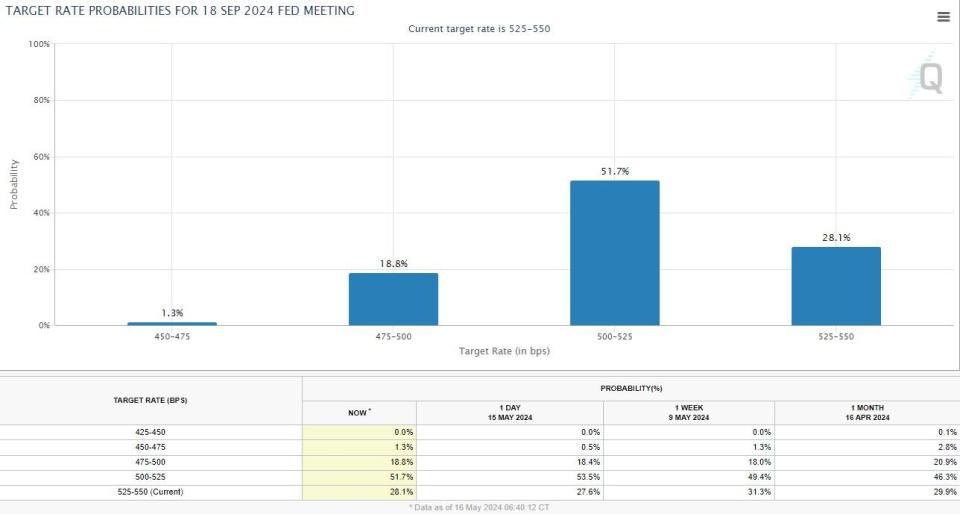

Inflation remains sticky and significantly above the usual target of 2%, so the Fed’s understandably not in a rush to start cutting rates. Although the American economy is certainly showing signs of slowing down based on recent GDP and job data, as yet there’s no clear indication of the recession which had been expected for so long. The first meeting of the Fed where a majority expects a cut to the funds rate is September:

The total probability of at least one cut by September is around 72%, more-or-less unchanged from a month ago. The Fed’s likely to be looking for a sustained decline in inflation primarily but also secondarily a reasonable amount of evidence of a slowdown in the job market before starting to cut. If this chart is correct and the first cut is indeed in September, it’s questionable whether the Fed will cut three meetings in a row before the end of the year.

The narrative of recession or ‘necessary economic slowdown’ has moved out of focus for most of 2024 so far, with traders now concentrating on what the Fed might do to avoid a repeat of the mistake in the 1970s when rates were cut too quickly and inflation surged back. That might be nothing: Jerome Powell ruled out further hikes at the Fed’s last meeting on 1 May, but policy has now been restrictive for some time, so maybe it’s just a case of waiting for inflation to decline.

Next week’s minutes might give some clues on how the Fed sees the situation developing, but 7 June’s NFP is also crucial. If there’s another decline in new jobs, a cut in September might become more likely or expectations could even shift forward to July.

Gold, Daily

Gold’s recent bounce seems to be mainly a reaction to weaker than expected American data recently, primarily GDP and the NFP, but the reaction to inflation in line with the consensus was also positive. Major indices in the USA reached fresh record highs this week, so expectations of recession aren’t currently on traders’ radar.

12 April’s intraday high around $2,430 is a likely resistance in the short term. A breakout above there would probably open the door to more gains. The 161.8% weekly Fibonacci extension around $2,525 would be an obvious stretch target in the medium to longer term. As for supports, the 100% Fibo extension around $2,320 will probably remain in view along with the limit of April’s retracement around $2,280.

With the slow stochastic signalling overbought and ATR declining so far in May, an immediate push higher is questionable. The 20 and 50 SMAs could function as dynamic supports in the next few days, so new buyers might consider entering around those to de-risk trades somewhat compared to buying at the very top.

Euro-dollar, Daily

The euro has bounced more aggressively than gold against the dollar since the middle of last month as economic conditions and, possibly, rates in the EU and USA show more signs of converging. Eurozone-wide annual headline inflation has been 2.4% for two months running and seems likely to remain below 3% for the rest of the year barring significant surprising circumstances.

The upward movement gained significant momentum on 15 May but the price has now moved into overbought based on the slow stochastic. With a new high having been reached around $1.09, there’s the possibility that this might be a new uptrend. However, to trade on this basis would probably mean waiting for a higher low both for confirmation of the possible uptrend and to reduce the risk associated with entering around a five-week high. Buyers would also probably look for neutral signals from Bands and the stochastic and increasing volume of buying before committing themselves.

The death cross of the 50 SMA below the 200 might be ignored given the fundamental situation and recent candlesticks, but this value area could be important if there’s a retracement lower over the next few days. $1.10 is an obvious candidate for the next key resistance while a move back below $1.075 seems unlikely unless there’s a major driver from news. Final eurozone-wide inflation at 9.00 GMT on 17 May is unlikely to be surprising, so the next major release for the euro is German GDP on Friday 24 May.

This article was submitted by Michael Stark, an analyst at Exness.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance