The only region in the world where billionaire population is growing

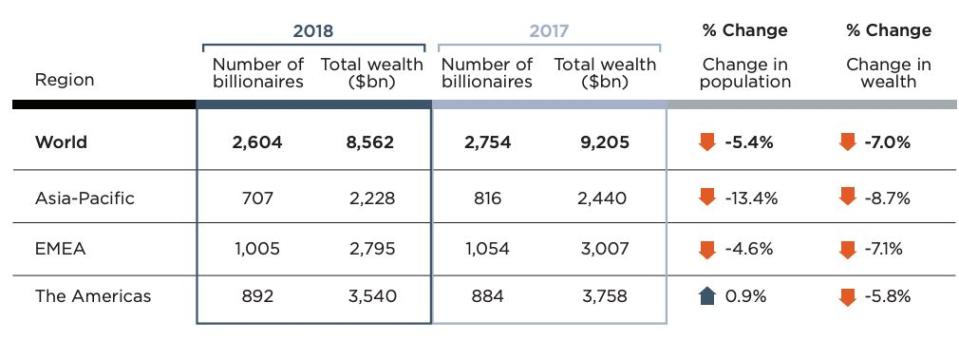

The US was the only region in the world where the number of billionaires grew in 2018, according to wealth data and research house Wealth-X.

In the group’s annual Billionaire Census report, it said that North America was the only region to record an increase in billionaire population with a 3% rise.

Whereas Asia-Pacific, posted the largest decline in 2018 (13.4%). In 2017, Asia-Pacific led the charge for billionaire population growth. In the Europe, Middle East, and Africa region, the number of billionaires dropped by 5%.There was a modest expansion of the billionaire class in the Americas (+1%), in which Wealth-X says was driven by an increase in North America.

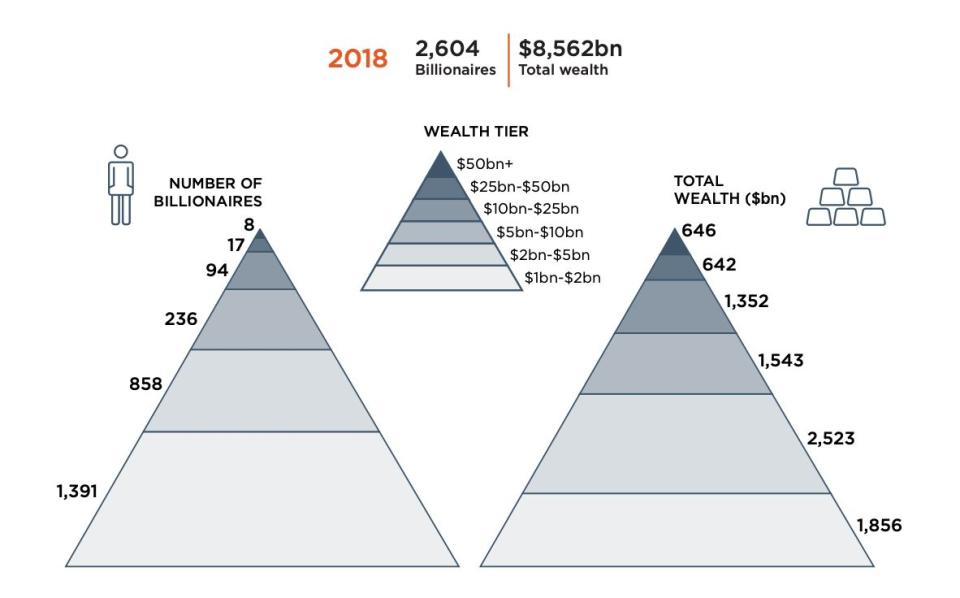

Globally, there was a 5.4% decline in the number of billionaires with 2,604 individuals. This is only the second time this population has dropped since the global recession a decade ago. Meanwhile, the collective wealth of global billionaires fell by 7% in the last year after reaching record levels the previous year.

“Many global factors contributed to this fall in global wealth, including a slowdown in global growth, persistent trade tensions and a late-year slump in equity markets,” said Wealth-X. “A related strengthening of the US dollar encouraged capital outflows from emerging markets, triggering currency volatility and risk aversion.”

Yahoo Finance

Yahoo Finance