US plans curbs on foreign investment in tech firms as trade tensions rise

The US is set to block some foreign companies from investing in American technology firms in a bid to protect intellectual property, according to reports citing sources at the US Treasury.

The draft proposals could prevent companies with 25pc or more foreign ownership from investing in US companies with “industrially significant technology”, by using anti-terror legislation.

The level of foreign ownership of a firm allowed to invest in US technology firms, and other key details on the restrictions could be altered before the release of a report by Treasury Secretary Steven Mnuchin, due to be finalised on Friday.

Initial reports claimed that the move would specifically target Chinese investment in US companies.

Previously, under legislation known as Section 301, an investigation into alleged Chinese theft of US firm’s intellectual property was used to justify the introduction of tariffs on imports.

The investigation found that “practices of the Chinese government related to technology transfer, intellectual property, and innovation are unreasonable or discriminatory and burden or restrict US commerce”.

However, Steve Mnuchin, Treasury secretary, denied that the move was set to target China specifically and called these reports “fake news”.

Mr Mnuchin said that the use of anti-terror legislation to protect “industrially significant technology” in US companies could be applied to any foreign investor.

He said: “[The] Statement [that] will be out [will] not specific to China, but to all countries that are trying to steal our technology.”

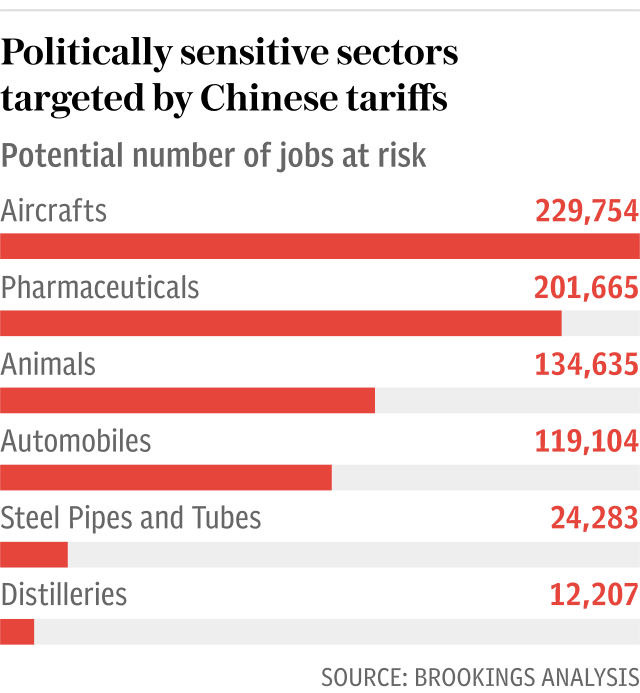

The step could be aimed at areas such as aerospace, robotics and pharmaceuticals. These industries are among those most prized by the Chinese regime’s long term economy policy to modernise its manufacturing: Made in China 2025.

The sale of microchip firms is already source of major tension between the US and China.

President Donald Trump is set to use legislation first created in 1977, the International Emergency Economic Powers Act (IEEPA), to prevent these acquisitions.

The United States is insisting that all countries that have placed artificial Trade Barriers and Tariffs on goods going into their country, remove those Barriers & Tariffs or be met with more than Reciprocity by the U.S.A. Trade must be fair and no longer a one way street!

— Donald J. Trump (@realDonaldTrump) June 24, 2018

The last time IEEPA was used at scale was in response to the terrorist attacks on the World Trade Centre on September 11, 2001.

A separate investigation in March under Section 232 also used national security as grounds for protectionist measures. It was used to justify putting tariffs on imports of 25pc on steel and 10pc on aluminium, from a range of countries including some of the US's closest allies.

The EU and Canada have hit out at suggestions that national security is under threat on this basis. They have complained that it is an attempt to side step the World Trade Organisation (WTO), the global arbiter of trade disputes.

The EU said: "The US measure cannot be justified using the WTO exception for issues of national security".

This latest step on technology investment is likely to trigger further tit-for-tat measures on trade between the US and China, the EU and others. These rising tensions now risk becoming a full-blown trade war between the world’s largest economies.

In his latest social media post about trade, Mr Trump said: “The United States is insisting that all countries that have placed artificial Trade Barriers and Tariffs on goods going into their country, remove those Barriers & Tariffs or be met with more than Reciprocity by the U.S.A. Trade must be fair and no longer a one way street!”

The US Treasury announcement hit Hong Kong stocks, including the Hang Seng index which lost 1.3pc. The six month low was led by a drop shares in technology companies.

Yahoo Finance

Yahoo Finance