The USD Index Cycle and the USDCNH

The Elliott Wave Perspective

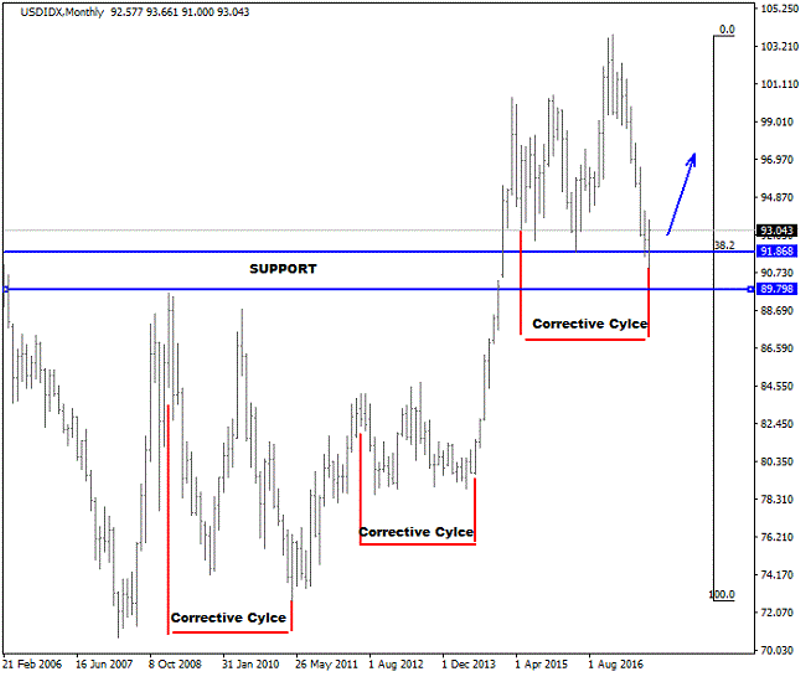

If you are a subscriber of ForexAnalytix you already know that we are still expecting another leg up on USD Index to complete bullish cycle from 2011. We think that the USD index is now at some very interesting levels near 90.00, a strong support from where uptrend may resume. Well, some USD-based currency pairs will form tops or bottoms earlier than others, and become signals for upcoming turning points. We consider USDCNH to be one of them; it’s pair that has been in a nice uptrend since 2013; clearly defined in five waves followed by a three waves set-back to the area of a former wave four. We have seen a nice bounce from that region in the last three weeks which can prove to be important evidence for more upside. If that’s the case then USD Index may also experience equivalent bullish price action by the end of the year, especially if we also consider that the “corrective cycle” since 2015 may be nearly complete based on past two cycles that ended in 2011 and 2014.

This article was written by one or more of the following contributors: Blake Morrow, Nicola Duke, Grega Horvat, Steve Voulgaridis and Stelios Kontogoulas. They are all analysts at ForexAnalytix which provides macro & technical analysis for various financial instruments. Forex Analytix primary goal is to educate traders of all experience levels and to provide a wide range of tools which can help with their trading decisions.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance