Utilities to Report Q4 Earnings on Feb 2: CMS, WEC & BIP

The Zacks Utilities sector’s fourth-quarter earnings are expected to have benefited from a revival of demand in the commercial and industrial groups of customers.

Per the latest Earnings Preview, the Zacks Utilities sector’s fourth-quarter 2022 earnings are expected to improve 2.8% while revenues are estimated to decline 2.9%. The capital-intensive utility stocks were impacted by the ongoing increase in interest rates and rising operating costs, while new rates implemented in their service territories boosted profits.

Factors to Consider

Domestic-focused companies operating in the sector are focused on cost management and implementation of energy-efficiency programs. New rates and customer additions are creating fresh demand as well as assisting the utilities. Investment in strengthening the infrastructure is allowing the utilities to provide services even during extreme conditions, leading to stable earnings. Domestic-focused operations also insulate utilities from the adverse impact of currency fluctuation.

A clear transition is evident in the Utilities space, with the players gradually moving toward clean sources of fuel to produce electricity and lower emission. The stringent regulation of emissions, the high cost of conventional fuel and government incentives on the usage of clean fuel are also urging the utilities to focus more on clean energy sources. Many utilities have already pledged to provide 100% electricity from clean sources in the next few decades.

The passage of Inflation Reduction Act (IRA) will support and accelerate the utilities transition toward clean energy sources. IRA has removed the uncertainties relating to federal incentives provided for renewable sources usage. The Act entails opportunity for a wide range of low-cost clean energy solutions, in a much predictable way for a long time and will create earnings visibility.

Utilities need massive funds to upgrade, maintain and expand their infrastructure and operations, and are capital-intensive in nature. The performance of the utilities is likely to have been adversely impacted by the increase in interest rates from near-zero levels. The increase in borrowing costs in 2022 is likely to have pushed up capital servicing expenses and adversely impacted earnings.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CMS Energy Corporation’s CMS fourth-quarter earnings are likely to have been impacted by planned increase in operating and maintenance expense. However, rate relief received from the company’s constructive gas rate case settlement, implemented from October 2022, is also expected to have boosted CMS Energy’s Q4 bottom line. (Read more: What's in the Offing for CMS Energy in Q4 Earnings?)

Our proven model does not predict a likely earnings beat for CMS Energy this time around. CMS has an Earnings ESP of 0.00% and a Zacks Rank of 4 (Sell).

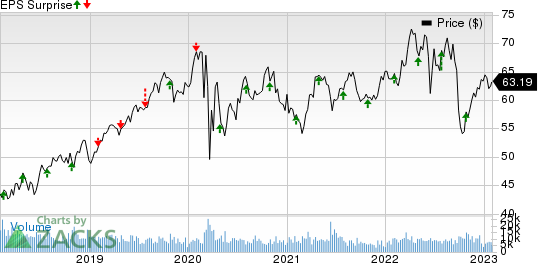

CMS Energy Corporation Price and EPS Surprise

CMS Energy Corporation price-eps-surprise | CMS Energy Corporation Quote

WEC Energy’s WEC fourth-quarter earnings are likely to have benefited from economic development in its services territories creating fresh demand for its services. Proper management of expenses is likely to boost its fourth-quarter earnings.

Our proven model does not conclusively predict an earnings beat for WEC Energy this time around. WEC has an Earnings ESP of +0.54% and a Zacks Rank of 4.

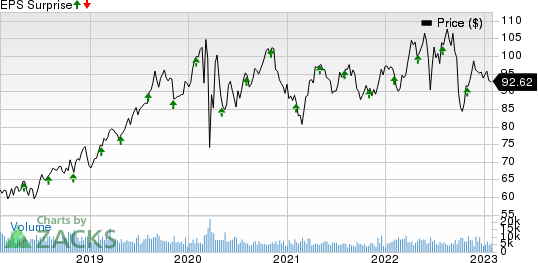

WEC Energy Group, Inc. Price and EPS Surprise

WEC Energy Group, Inc. price-eps-surprise | WEC Energy Group, Inc. Quote

Brookfield Infrastructure’s BIP fourth-quarter earnings is likely to have been benefited from contribution from acquired and organic assets. Capital recycling through sell of mature businesses is likely to have positively impacted fourth-quarter earnings.

Our proven model does not conclusively predict an earnings beat for Brookfield Infrastructure this time around. BIP has an Earnings ESP of 0.00% and a Zacks Rank of 4.

Brookfield Infrastructure Partners LP Price and EPS Surprise

Brookfield Infrastructure Partners LP price-eps-surprise | Brookfield Infrastructure Partners LP Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brookfield Infrastructure Partners LP (BIP) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance