Vauxhall to 'terminate' entire dealership network as sales plunge

Vauxhall is terminating the contracts of all its 326 dealerships in Britain as the company battles to deal with plunging sales and a changing market.

The marque is ending all dealer contracts in the UK - a move also happening with sister brand Opel across Europe - as the entire sales network is reorganised.

Some 1600 dealers across the pan-European network will be given two years’ notice from April 30 that the manufacturer is ending its relationship with them, and proposing a new contract with about two thirds of them.

About 12,000 staff are employed in franchisees' UK dealerships but Stephen Norman, Vauxhall's UK boss, insisted that staff would not lose their jobs as a "direct result" of Vauxhall's decision to refranchise the network.

"Based on 42 years experience in the industry, and having been through four of these network refranchisings, I do not expect jobs to be threatened," he said. "I'm don't want to 'de-dramatise it, but refranchising is not something that doesn't happen at regular intervals in the motor industry.

"Nobody is being sacked. The vast majority of franchises will continue as before," Mr Norman said.

"We do not expect a reduction in the number of retail dealer outlets as a result of this action. People will find work in other franchises," he added, insisting that "simple" facts about demand for cars in the UK indicated they would be able to find employment "perhaps with other dealers".

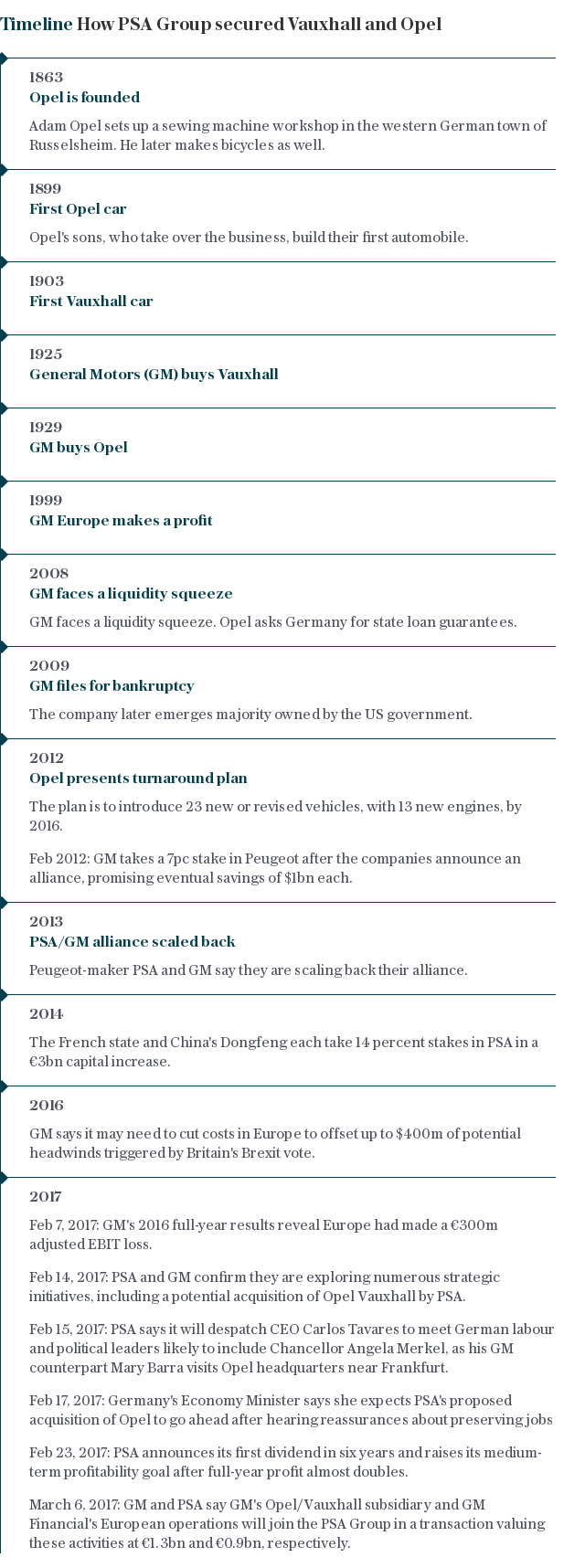

Mr Norman said that Vauxhall - which was bought along with Opel last year for £1.9bn by France’s PSA Group from GM - would still be Britain's second-largest dealer network after the restructuring but would be "go from being the second largest after Ford to closer to the third largest". This suggests about about 200 or so dealerships will remain.

Sales of Vauxhall cars have been falling for some time but the decline accelerated last year, dropping 22pc - more than three times the 5.7pc fall seen across the wider UK market. Last year Vauxhall sold 195,000 cars in the UK.

Mr Norman said that the network was profitable last year in the first quarter of this year and all of last year, but at an "insufficient" level, and the refranchising is aimed at "addressing this and protecting it" for the future.

The move is not related to the UK's decision to quit the EU, the car boss said, adding it was "something that would happen with or without Brexit".

"Conditions in the motor industry are changing," Mr Norman added. "Competition is much more fierce than it was five years ago, their are different methods of consumption [such as buyers looking online]. It is not any one single reason."

The "Pace" efficiency plan being inplemented by PSA - which also owns Citroen and Peugeot - across the group also contributed to the decision.

Vauxhall has to treat every dealer the same - hence the network termination - but a motor industry source said that the company is currently in consultations about dividing dealerships into those it wants to keep on and those that will be closed.

The decisions are understood to being made based on factors including sales performance, customer satisfaction and geographical location.

One source with knowledge of the plans said: “The market is just too small to support such a big dealer network. Put it this way, Volkswagen sold the same amount of cars last year out of 200 dealerships.”

Earlier this month Vauxhall was given a boost in the UK when its parent agreed a £100m-plus investment in its Luton plant which produces vans, securing production there for at least the next decade.

However, doubts hang over the future of the Vauxhall plant at Ellesmere Port, which builds the Vauxhall Astra car. There have been two rounds of jobs cuts there with the loss of 650 positions since PSA took over as it seeks efficiencies in the face of falling demand for the Astra.

There are fears that Brexit could mean that the plant is uncompetitive and may not get future investment required for the tooling to build a new model there, meaning it could be shut.

However, PSA has refused to comment directly on Ellesmere Port’s future, saying only that costs there were “significantly higher” than other plants in the group, but that PSA's management was “confident in the ability of the workforce to deliver the necessary improvements in financial performance”.

Yahoo Finance

Yahoo Finance