VeriSign (VRSN) Q1 Earnings Up Y/Y, '24 Revenue View Tweaked

VeriSign VRSN reported first-quarter 2024 adjusted earnings per share (EPS) of $1.92. The company had reported EPS of $1.70 in the prior-year quarter.

Revenues jumped 5.5% year over year to $384 million.

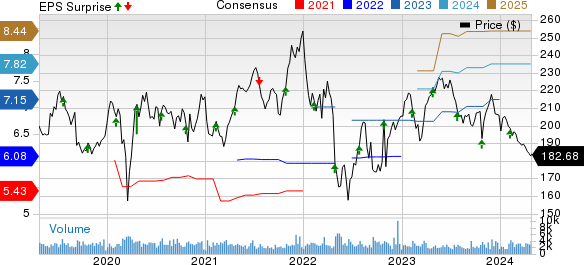

VeriSign, Inc. Price, Consensus and EPS Surprise

VeriSign, Inc. price-consensus-eps-surprise-chart | VeriSign, Inc. Quote

Quarter in Details

VRSN ended the reported quarter with 172.5 million .com and .net domain name registrations, down 1.3% year over year.

The company processed 9.5 million new domain name registrations for .com and .net compared with 10.3 million in the year-ago quarter.

The final .com and .net renewal rates for fourth-quarter 2023 were 73.2% compared with 73.3% in the year-ago quarter. Renewal rates are not fully measurable until 45 days after the end of the quarter.

Management expects the renewal rate for first-quarter 2024 to be around 74% compared with 75.5% in the year-ago quarter.

VeriSign’s research and development expenses increased 2.5% from the year-ago quarter to $24.8 million.

Selling, general and administrative (SG&A) expenses increased 5.1% year over year to $51.5 million.

Operating income was $259 million, up 7.3% year over year. Operating margin expanded 120 bps to 67.4%.

Balance Sheet & Cash Flow

As of Mar 31, 2024, VRSN’s cash and cash equivalents (including marketable securities) were $731.8 million compared with $926.4 million as of Dec 31, 2023.

Cash flow from operating activities was $257.3 million in the first quarter compared with $259 million in the year-ago quarter. Free cash flow was $254 million in the reported quarter.

In the first quarter, Verisign repurchased 1.3 million shares for $260 million. The available amount under Verisign's share repurchase program is $860 million.

2024 Guidance

Management now expects 2024 revenues between $1.555 billion and $1.570 billion compared with the previous guidance of $1.560 billion-$1.580 billion. VRSN’s domain name base’s growth is now expected to decline 1.75% to rise 0.25% compared with the previous guidance of a fall of 1% to a rise of 1%.

GAAP operating income is now expected to be between $1.047 billion and $1.062 billion. Capital expenditures are anticipated to be in the range of $30-$40 million.

Performance of Other Companies

A few other stocks from the broader technology space are Badger Meter BMI, Pinterest PINS and Arista Networks ANET. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS has increased 9.9% in the past 60 days to $3.89. BMI’s long-term earnings growth rate is 12.3%.

Badger Meter’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 12.7%. BMI shares have risen 35.8% in the past year.

The Zacks Consensus Estimate for PINS’s 2024 EPS has increased 0.7% in the past 60 days to $1.34. PINS’s long-term earnings growth rate is 20.1%.

Pinterest’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, delivering an average earnings surprise of 37.4%. Shares of PINS have gained 13% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.4% in the past 60 days to $7.49. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 62.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance