VeriSign (VRSN) Q2 Earnings Top Estimates, Revenues Up Y/Y

VeriSign VRSN reported second-quarter 2019 non-GAAP earnings of $1.33 per share that beat the Zacks Consensus Estimate by 4 cents and increased 12.7% from the year-ago quarter.

Revenues increased 1.3% year over year to $306.3 million.

Quarter Details

VeriSign ended the reported quarter with 156.1 million .com and .net domain name registrations, up 4.3% year over year. The figure reflects a net increase of 1.34 million registrations during the quarter.

The company processed 10.3 million new domain name registrations for .com and .net compared with 9.6 million in the year-ago quarter.

Notably, renewal rates are not fully measurable until 45 days after the end of the quarter. The final .com and .net renewal rate for the first quarter of 2019 was 75% compared with 75.3% for the same quarter in 2018.

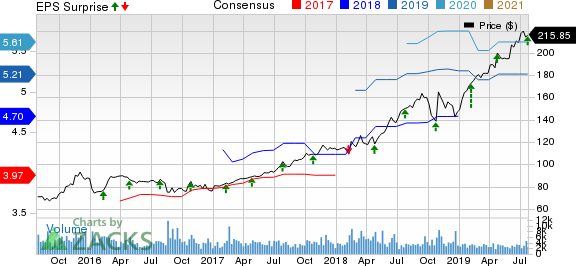

VeriSign, Inc. Price, Consensus and EPS Surprise

VeriSign, Inc. price-consensus-eps-surprise-chart | VeriSign, Inc. Quote

VeriSign’s research and development expenses (4.9% of total revenues) increased 8.6% from the year-ago quarter to $14.95 million.

General and administrative expenses (10.8% of total revenues) increased 4.5% year over year to $33.2 million.

However, sales and marketing expenses (4% of total revenues) declined 25.2% year over year to $12.4 million primarily due to a $2.1 million decrease in salary and employee benefits expenses as a result of a reduction in average headcount.

Non-GAAP operating income was $214.8 million, up 4.1% from the year-ago quarter. Non-GAAP operating margin expanded 190 basis points (bps) year over year to 70.1%.

Balance Sheet & Cash Flow

As of Jun 30, 2019, the company’s cash and cash equivalents (including marketable securities) were approximately $1.23 billion compared with $1.25 billion as of Mar 31, 2019.

Cash flow from operating activities was $165 million in the second quarter compared with $202 million at the end of the year-ago quarter.

During the three months ended Jun 30, 2019, Verisign repurchased 0.9 million shares for an aggregate cost of $175.0 million.

2019 Guidance

The company expects the domain name base growth rate to be between 2.5% and 4.25%.

Moreover, revenues are expected to be $1.225-$1.235 billion versus the earlier-guided figure of $1.22-$1.235 billion. Non-GAAP operating margin is expected to be 67.5-68.5%.

Capital expenditure is anticipated in the range of $45-$55 million.

Zacks Rank & Stocks to Consider

VeriSign currently has a Zacks Rank #3 (Hold).

Lattice Semiconductor LSCC, Alteryx AYX and Rosetta Stone RST are some better-ranked stocks in the broader computer and technology sector. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

While Lattice Semiconductor and Alteryx are set to report quarterly results on Jul 30 and 31, respectively, Rosetta Stone is scheduled to report on Aug 6.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Rosetta Stone (RST) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance