Verisk Analytics Inc (VRSK) Q1 2024 Earnings: Solid Performance with Revenue and EPS Growth

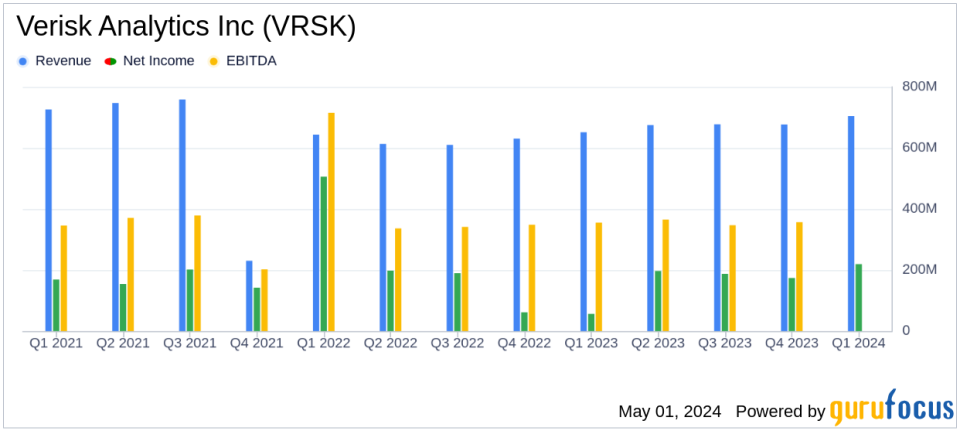

Revenue: Reported at $704 million, marking an 8.0% increase year-over-year, surpassing the estimated $699.06 million.

Net Income: Achieved $219 million from continuing operations, up 12.9% year-over-year, slightly below the estimated $220.21 million.

Earnings Per Share (EPS): Diluted EPS from continuing operations reached $1.52, up 19.7% year-over-year, just below the estimated $1.53.

Adjusted Earnings Per Share (EPS): Diluted adjusted EPS was $1.63, reflecting a 26.4% increase and surpassing the estimated $1.53.

Free Cash Flow: Increased by 4.2% to $317 million, indicating solid cash generation capabilities.

Dividends: Continued shareholder returns with a declared quarterly dividend of 39 cents per share.

Share Repurchases: Completed a $200 million Accelerated Share Repurchase program, underscoring ongoing commitment to returning value to shareholders.

On May 1, 2024, Verisk Analytics Inc (NASDAQ:VRSK) released its 8-K filing, announcing the financial results for the first quarter ended March 31, 2024. The company reported a revenue of $704 million, surpassing the analyst's expectation of $699.06 million, marking an 8.0% increase from the previous year. The diluted earnings per share (EPS) for the quarter stood at $1.52, closely aligning with the estimated EPS of $1.53. Additionally, the net income from continuing operations increased by 12.9% to $219 million.

Company Overview

Verisk Analytics is a leading provider of statistical, actuarial, and underwriting data for the U.S. property and casualty insurance industry. The company leverages extensive databases and proprietary data to develop analytical tools that help insurers assess risk, optimize claim settlement, and detect fraud. With a growing presence in life insurance and international markets, Verisk continues to expand its influence and operational scope.

Operational Highlights

The Insurance segment, which includes underwriting and claims, showed robust growth. Underwriting revenues rose by 8.2% to $498 million, while claims revenues increased by 7.6% to $206 million. The overall performance in this segment was driven by strong growth in underwriting and modest growth in claims, contributing to an 8.0% increase in total insurance revenues.

Financial Performance Analysis

Verisk's adjusted EBITDA for the quarter was $380 million, up 11.8% from the previous year, reflecting strong revenue growth coupled with disciplined cost management. The adjusted EBITDA margin also improved, indicating efficient operations and profitability. The company's focus on high-return investments and capital allocation has been effective, as evidenced by the solid margin expansion and double-digit EPS growth.

Strategic Initiatives and Future Outlook

Verisk's management highlighted ongoing strategic initiatives aimed at enhancing data analytics capabilities and expanding market reach. The company has reaffirmed its financial guidance for 2024, projecting revenues between $2,840 million and $2,900 million, with an adjusted EBITDA margin of 54.0% to 55.0%. These projections reflect confidence in the company's growth strategy and operational execution.

Shareholder Returns and Capital Allocation

Verisk remains committed to returning value to shareholders through dividends and share repurchases. The company declared a quarterly dividend of 39 cents per share and reported the completion of a $200 million Accelerated Share Repurchase program. These actions underscore Verisk's strong cash flow generation and shareholder-friendly capital allocation policies.

Conclusion

Verisk Analytics Inc (NASDAQ:VRSK) has demonstrated a strong start to 2024, with financial results that showcase robust revenue growth, margin expansion, and strategic capital management. The company's focus on enhancing its analytical offerings and expanding its market presence positions it well for sustained growth. Investors and stakeholders can look forward to continued operational excellence and strategic initiatives that drive value creation across the insurance industry and beyond.

For detailed insights and further information, please refer to the official 8-K filing.

Explore the complete 8-K earnings release (here) from Verisk Analytics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance