Verisk (VRSK) Riding on Growth Strategies, Debt Woe Stays

Verisk Analytics, Inc.’s VRSK shares have gained 25% over the past six months, significantly outperforming the 14.6% growth of the industry it belongs to.

The company recently reported third-quarter 2021 results, where its adjusted earnings per share of $1.44 beat the Zacks Consensus Estimate by 5.1% and grew 9.1% on a year-over-year basis. Revenues of $759 million surpassed the consensus estimate by 0.6% and increased 8% year over year.

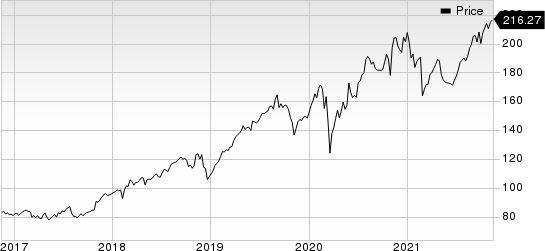

Verisk Analytics, Inc. Price

Verisk Analytics, Inc. price | Verisk Analytics, Inc. Quote

How is Verisk Doing?

Verisk remains focused on organic growth, product development and acquisitions. The company continues to invest in people, data sets, analytic solutions, technology and complementary businesses with a view to keep itself updated with changing requirements in the markets it serves. The company is maintaining its focus on increasing solution penetration with customers, developing new proprietary data base and predictive analytics, and expanding into new customer sectors. Such initiatives have helped Verisk increase its revenues at a compound annual growth rate of 10.3% over the past five years.

Verisk has developed several advantages for itself that help strengthen its client base and fend off competition. Using advanced technologies to collect and analyze data, Verisk draws on its unique data assets and deep domain expertise to provide predictive analytics and decision-support solutions that are integrated into customer workflows. Specialized and in-depth knowledge in markets such as energy, insurance, financial services and risk management adds value to its analytics. Steady stream of first-to-market innovations and its ability to deeply integrate into customer workflows have allowed the company to strengthen its client base over time. All these initiatives augur well for long-term growth and stability of the company.

Verisk’s cash and cash equivalent balance of $302.1 million at the end of third-quarter 2021 was well below its long-term debt level of $2.3 billion, underscoring that the company doesn’t have enough cash to meet this debt burden. The cash level cannot even meet the short-term debt of $766.6 million.

Zacks Rank and Stocks to Consider

Verisk currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some better-ranked stocks in the broader Business Services sector are Avis Budget CAR, sporting a Zacks Rank #1 (Strong Buy), and Automatic Data Processing ADP and AstroNova ALOT, each carrying a Zacks Rank #2 (Buy).

Avis Budget has an expected earnings growth rate of 395.7% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 618.6% so far this year. The company has a long-term earnings growth of 27.5%.

Automatic Data Processing has an expected earnings growth rate of 12.3% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 9.7%, on average.

Automatic Data Processing’s shares have surged 30.5% so far this year. The company has a long-term earnings growth of 12%.

AstroNova has an expected earnings growth rate of 566.7% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 79.2%, on average.

AstroNova’s shares have surged 87.2% so far this year. The company has a long-term earnings growth of 12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

AstroNova, Inc. (ALOT) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance