Vertex (VRTX) Kidney Drug Gets FDA Breakthrough Designation

Vertex Pharmaceuticals Incorporated VRTX announced that the FDA has granted Breakthrough Therapy Designation (BTD) to its pipeline candidate, inaxaplin (VX-147) for treating APOL1-mediated focal segmental glomerulosclerosis or FSGS.

A Breakthrough Therapy status is granted to medicines being evaluated for serious conditions where early clinical evidence indicates the said medicines’ potential for substantial improvement over available therapies.

The European Medicines Agency (EMA) also granted Priority Medicines (PRIME) designation to inaxaplin for APOL1-mediated chronic kidney disease (AMKD). The EMA grants PRIME status to drugs that have a major therapeutic advantage over existing treatments or benefit patients without treatment options. AMKD is a form of chronic kidney disease, which is caused by mutations in the APOL1 gene.

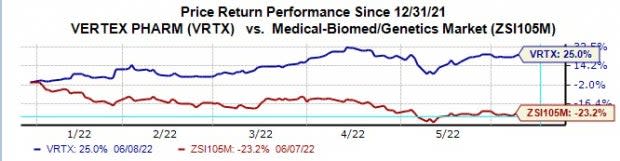

Vertex’s stock has risen 25.0% this year so far against the industry’s decline of 23.2%.

Image Source: Zacks Investment Research

Vertex initiated the pivotal development of inaxaplin in March this year in a single-phase II/III study in patients with AMKD with two APOL1 mutations and proteinuric kidney disease. In patients with APOL1-mediated FSGS, a particular kind of AMKD, treatment with inaxaplin led to a 47.6% reduction in proteinuria compared to baseline in a phase II study. The FDA’s BTD and EMA’s PRIME designation was based on data from the same phase II study.

Vertex currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked biotech stocks are Sesen Bio SESN, Alkermes ALKS and BELLUS Health BLU, all carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Sesen Bio’s2022 loss has declined from 33 cents to 32 cents per share in the past 60 days. Shares of SESN have declined 13.5% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%.

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 14 cents to 3 cents in the past 60 days. Shares of ALKS have risen 24.5% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%.

The Zacks Consensus Estimate for BELLUS Health’s 2022 loss per share has narrowed from 87 cents to 76 cents while that for 2023 has gone down from $1.11 per share to 98 cents per share in the past 60 days. Shares of BLU have risen 11.1% year to date.

BELLUS Health delivered a four-quarter average negative earnings surprise of 2.68%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

Bellus Health Inc. (BLU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance