Vertex (VRTX) Q4 Earnings Beat on Solid CF Product Sales

Vertex Pharmaceuticals Inc. VRTX reported fourth-quarter 2019 earnings per share of $1.70, beating the Zacks Consensus Estimate of $1.21. Moreover, the bottom line surged 31% year over year. Strong cystic fibrosis (CF) product revenues led to higher earnings in the reported quarter.

Vertex’s revenues were $1.4 billion in the fourth quarter, also surpassing the Zacks Consensus Estimate of $1 billion. Total revenues included $155.8 million of sales from Orkambi distributed through the early access program in France during the fourth quarter. Excluding this impact, the company’s sales surged 45% year over year to $1.26 billion, driven by the early launch of Trikafta triple combination regimen in the United States and the global uptake of Symdeko/Symkevi.

Full-Year Results

For 2019, Vertex generated revenues of $4.2 billion, reflecting 37% growth year over year.

For the same period, the company reported earnings of $5.33 per share, up 31% year over year.

Quarter in Detail

Vertex’s fourth-quarter sales comprised only CF product revenues of $1.4 billion. The company markets four CF medicines, namely Kalydeco (ivacaftor), Orkambi (lumacaftor-ivacaftor), Symdeko (a combination of tezacaftor and ivacaftor) and Trikafta (elexacaftor/tezacaftor/ivacaftor and ivacaftor). The company did not record any collaborative and royalty revenues during the reported quarter.

Newly launched Trikafta generated sales of $420 million in the period under review.

A regulatory application in the EU seeking approval of elexacaftor/tezacaftor/ivacaftor combination regimen was validated by the European Medicines Agency (EMA) on Oct 31, 2019. The company expects to gain approval of this triple combination in Europe this year.

Symdeko/ Symkevi registered sales of $322 million in the fourth quarter, reflecting a rise of 12.9% year over year.

Meanwhile, Kalydeco, Vertex’s first CF medicine, recorded sales of $236 million in the quarter under consideration, reflecting an 8.8% decrease year over year.

Vertex’s second CF medicine Orkambi generated sales of $270 million in the reported quarter, accounting for a 14.3% decline year over year.

Notably, a strong adoption of Trikafta might have resulted in sales erosion of the existing combinations. On fourth-quarter earnings call, management stated that it expects Trikafta to be the main revenue driver for Vertex in 2020.

Adjusted research and development (R&D) expenses rose 22.5% to $337 million in the fourth quarter.

Adjusted selling, general and administrative (SG&A) expenses increased 27.2% to $159 million in the reported quarter.

2020 Revenue Guidance

Vertex’s current-year outlook for sales from CF products was better than management expectations.

The company expects total revenues for CF products in the range of $5.1-$5.3 billion, significantly above the Zacks Consensus Estimate of $4.86 billion.

Shares of Vertex were up 5.9%% in after-hours trading following a favorable outlook for 2020. In fact, the stock has rallied 20.2% in the past year against the industry’s decrease of 5.9%.

During fourth-quarter conference call, management stated that a strong uptake of Trikafta and the recent reimbursement approvals in key countries like England and France for Vertex’s CF drugs led to the bullish view for 2020.

Moreover, combined adjusted research and development (R&D) plus selling, general and administrative (SG&A) expenses for 2020 are anticipated in the band of $1.95-$2 billion.

Other Pipeline Updates

Vertex’s non-CF pipeline, though in early stage, looks interesting with treatments being developed for beta thalassemia, sickle cell disease, alpha-1 antitrypsin deficiency (AAT), APOL1-mediated kidney diseases and pain.

In November 2019, Vertex and partner CRISPR Therapeutics CRSP announced positive preliminary safety and efficacy data from the ongoing phase I/II studies evaluating their CRISPR/Cas9 gene-editing therapy, CTX001, for two severe blood disorders, namely sickle cell disease (SCD) and adult transfusion-dependent b-thalassemia (TDT).

Vertex is enrolling patients in the ongoing phase II proof-of-concept study on its first oral small molecule corrector VX-814 for the treatment of alpha-1 antitrypsin (AAT) deficiency. The company plans to announce data from the same in 2020. It also has a second AAT corrector, VX-864, currently in phase I development to address AAT deficiency.

In the fourth quarter, Vertex completed the phase I study on its investigational candidate VX-147 in healthy volunteers for the treatment of APOL1-mediated focal segmental glomerulosclerosis (FSGS) and other serious kidney diseases. The company intends to initiate a phase II proof-of-concept study on the same in 2020.

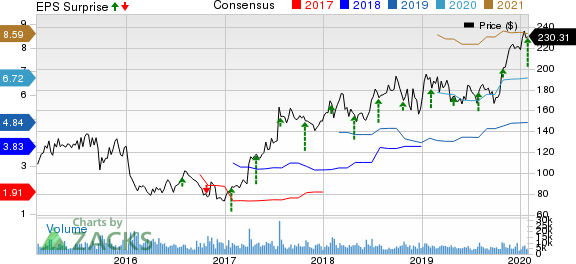

Vertex Pharmaceuticals Incorporated Price, Consensus and EPS Surprise

Vertex Pharmaceuticals Incorporated price-consensus-eps-surprise-chart | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank & Stocks to Consider

Vertex currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include Alexion Pharmaceuticals, Inc. ALXN and Denali Therapeutics Inc. DNLI. While Alexion carries a Zacks Rank #2 (Buy), Denali sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion’s earnings estimates have been revised 1.8% upward for 2020 over the past 60 days.

Denali’s loss per share estimates have narrowed 0.4% for 2020 over the past 60 days. The stock has risen 22.2% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Denali Therapeutics Inc. (DNLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance