Is Vertu Motors (LON:VTU) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Vertu Motors plc (LON:VTU) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Vertu Motors

What Is Vertu Motors's Net Debt?

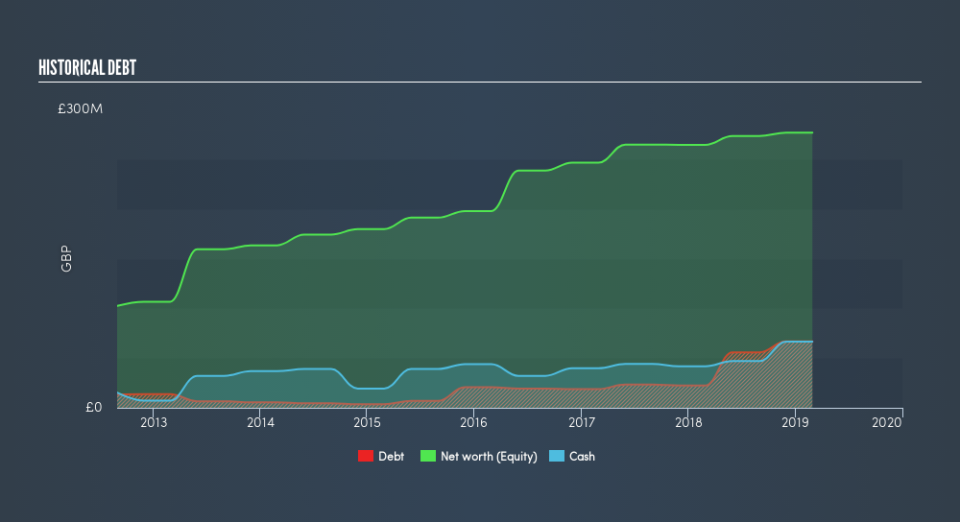

The image below, which you can click on for greater detail, shows that at February 2019 Vertu Motors had debt of UK£66.8m, up from UK£22.5m in one year. However, because it has a cash reserve of UK£66.5m, its net debt is less, at about UK£316.0k.

How Healthy Is Vertu Motors's Balance Sheet?

We can see from the most recent balance sheet that Vertu Motors had liabilities of UK£755.2m falling due within a year, and liabilities of UK£63.7m due beyond that. On the other hand, it had cash of UK£66.5m and UK£54.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£698.0m.

This deficit casts a shadow over the UK£127.6m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt At the end of the day, Vertu Motors would probably need a major re-capitalization if its creditors were to demand repayment. Vertu Motors may have virtually no net debt, but it does have a lot of liabilities.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Vertu Motors's debt of just 0.0079 times EBITDA is really very modest. And EBIT easily covered the interest expense 7.6 times over, lending force to that view. On the other hand, Vertu Motors's EBIT dived 11%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Vertu Motors can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Vertu Motors's free cash flow amounted to 33% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say Vertu Motors's level of total liabilities was disappointing. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Overall, it seems to us that Vertu Motors's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance