Victoria (LON:VCP) Shareholders Have Enjoyed A Whopping 447% Share Price Gain

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the Victoria plc (LON:VCP) share price rocketed moonwards 447% in just one year. On top of that, the share price is up 46% in about a quarter. However, the stock hasn't done so well in the longer term, with the stock only up 25% in three years.

See our latest analysis for Victoria

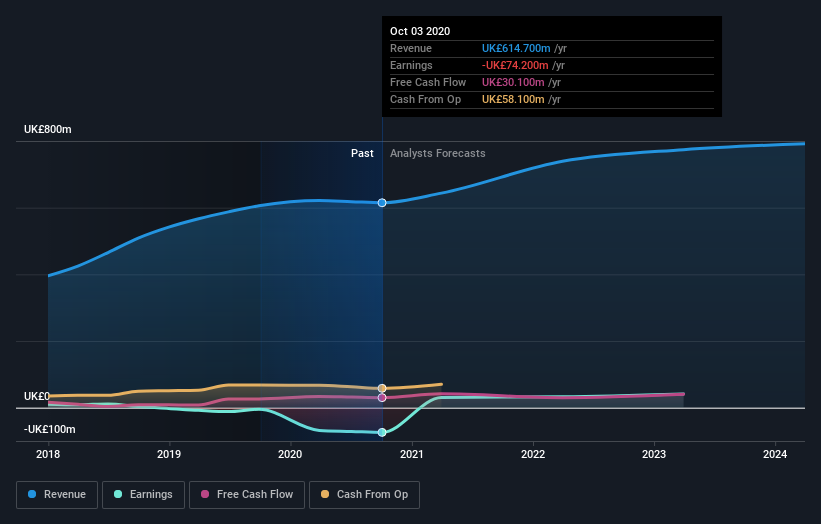

Because Victoria made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Victoria grew its revenue by 1.4% last year. That's not a very high growth rate considering it doesn't make profits. So it's truly surprising that the share price rocketed 447% in a single year. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Victoria's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Victoria shareholders have received a total shareholder return of 447% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 31% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Victoria that you should be aware of.

We will like Victoria better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance