‘I didn’t bring my gun today’: Credit Suisse executives face shareholder anger at chaotic investor meeting

Credit Suisse executives were told they would have been crucified in medieval times for overseeing the bank’s ignominious rescue deal during a chaotic final shareholder meeting on Tuesday.

In a 15,000-capacity ice hockey stadium in northern Zurich, angry investors spent hours tearing into Credit Suisse’s management who oversaw the downfall of the 167-year-old lender.

The bank was taken over by arch rival UBS last month in a government-engineered deal to stave off a broader financial crisis.

Credit Suisse chairman Axel Lehmann apologised to the bank’s exasperated shareholders who face large losses on their investments.

He said: “It is a sad day. For all of you, and for us… The bitterness, anger, and shock of all those who are disappointed, overwhelmed and affected by the developments of the past few weeks is palpable.”

Mr Lehmann said he and his colleagues had “fought tirelessly” to try and save Credit Suisse but admitted that the bank would have collapsed without the shotgun marriage with UBS.

He said: “The bank could not have been saved. There were only two options: deal or bankruptcy. The merger had to go through. The terms had to be accepted.”

Mr Lehmann, who only assumed the role of chairman last year, took responsibility for Credit Suisse’s fate. He said: “Those who are at the helm at the end, are responsible, too. Hence, including me.

“That week in March was like being wiped away by an avalanche, there was really not much more we could do.”

Ulrich Körner, the bank’s chief executive, said the end of Credit Suisse’s independence filled him with “sorrow”.

He said: “I understand that you feel disappointed, shocked, or angry. I share the disappointment of you, our shareholders, but I also share the disappointment of all of our employees, our clients, and, ultimately, the general public.

“After 167 years Credit Suisse is giving up its independence. A proud and, at times, turbulent company history is drawing to an end and something new is being created.”

The apologetic tone adopted failed to quell a wave of investor anger, with a long queue of upset Swiss lining up to air their grievances at the meeting.

The first shareholder to speak set the tone. Guido Röthlisberger told Credit Suisse’s board: “I didn’t bring my gun along today, don’t worry. I am wearing my red tie today to represent that I and many other shareholders are seeing red.

“I rather feel that I’ve been cheated by these institutions.”

Another investor said: “I can only remind you of what would have happened to you in medieval times: you would have been crucified.”

One investor offered the board a bag of empty walnut shells, saying they were worth as much as a share in Credit Suisse.

Mr Lehmann said he would accept the gift, but quipped that he had his own packet of nuts to keep him going through the meeting.

As one of Switzerland’s biggest and most historic banks, Credit Suisse shares were held by many small-time investors.

Mr Lehmann acknowledged that: “For many former and current employees, for clients, for our fellow citizens, this bank forms part of our Swiss identity.”

Vincent Kaufman, chief executive of the Ethos Foundation, which represents Swiss pension funds, told executives that “numerous scandals in Credit Suisse in the last few years have completely ruined the bank”.

Despite the chaos, Mr Lehmann was reelected as chairman and will remain in post until the takeover deal is complete. However, he suffered a significant rebellion with 43pc of investors voting to oust him.

Seven other directors also had their mandates renewed but suffered similar revolts. Christian Gellerstad, who has been on the board for four years, suffered the largest rebellion, receiving just 50.05pc support.

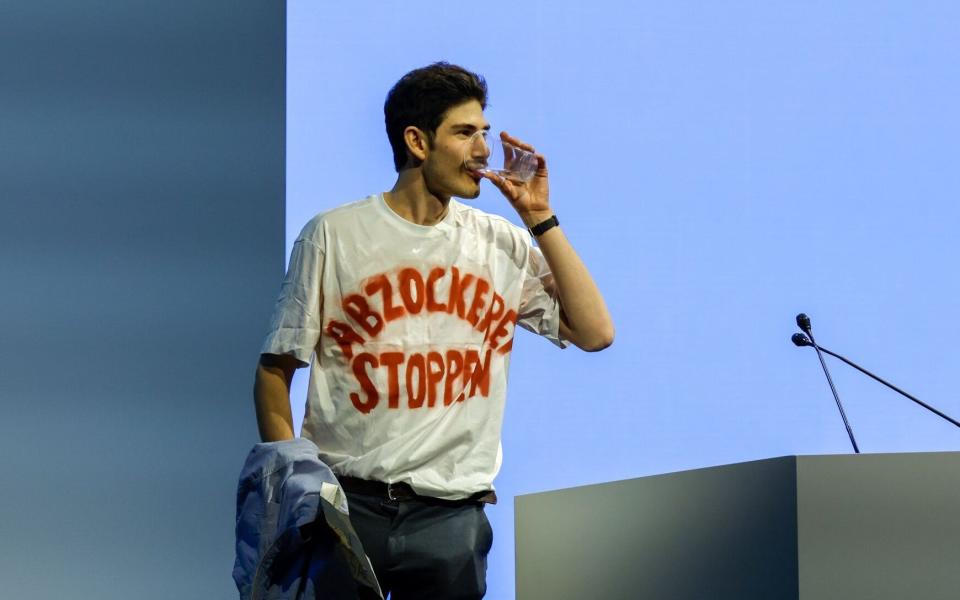

Angry investors took to the stage wearing shirts declaring “stop the rip off” as a final pay deal for the bank’s bosses was approved by the narrowest of margins.

The 18-member executive team was paid 32.2 million Swiss franc (£28.4m) in fixed pay last year, with no bonuses.

Just 50.06pc of shareholders approved the annual compensation report at the failed lender’s final annual general meeting. Some 49.38pc rejected the report and 0.56pc abstained.

In the past dozen years, Credit Suisse has put 35bn francs (£30.7bn) into its annual bonus pools, according to Bloomberg calculations. The total profits it generated in that period were just 35m francs.

Mr Lehmann thanks UBS for ultimately rescuing Credit Suisse.

He said: “I know that they will tackle the upcoming integration and the challenges ahead with great discipline, fairness, and prudence, and in a sustainable manner.”

UBS will hold its annual meeting on Wednesday. Last week, the bank drafted in its former chief executive to steer the bank through the takeover of Credit Suisse.

Sergio Ermotti, who led UBS for nine years until 2020, has agreed to replace Ralph Hamers.

Mr Ermotti, who currently serves as the chairman of insurer Swiss Re, is expected to slash jobs at the bank once the merger is complete, with reports suggesting up to 30pc of bankers will lose their jobs.

Credit Suisse was left vulnerable after a series of missteps and crises at its investment bank, which led to an exodus of clients and a crisis of confidence.

Before the rescue, Credit Suisse was embarking on a radical three-year turnaround plan, which included cutting around 9,000 jobs.

08:07 PM

Signing off

Okay that's all from me. We'll be back tomorrow morning with the latest news.

08:02 PM

London’s junior stock exchange adds new member

One of the world’s leading producers of animal feed additives has joined London’s junior exchange Aim.

Aim, the London Stock Exchange's market for small and medium size growth companies, welcomed Ocean Harvest Technology on Tuesday.

Ocean Harvest issued 37.5m new shares, raising £6m.

The funds raised will enable Ocean Harvest to continue investing in research and development, expand its global sales teams and build out its supply chain, chief executive Mark Williams said.

The Berkshire-based company, founded in 2005, is seeking to become the largest supplier of seaweed-blended additives to the global animal feed industry.

“We are confident in our ability to deliver on the opportunities ahead and I look forward to providing updates on our progress as our business develops,” Mr Williams said.

07:08 PM

Aviva bulk buys Deutsche Bank's pension liabilities for £400m

Aviva has agreed to insure the majority of UK pension payments made by Deutsche Bank under a £400m deal.

Aviva will now be responsible for the defined pension liabilities that Deutsche Bank owes 1,300 members of its UK scheme.

Defined pension liabilities refer to the funds that schemes have to set aside in order to meet future payment obligations to employees.

The amount of pension payments that members receive will not change following the deal.

The agreement - called a bulk annuity deal - allows Deutsche to protect pension holders against investment, inflation, interest rate and longevity risks.

According to Jeremy Sowden, Deutsche’s UK head of pensions and benefits, the bank is working closely with the scheme’s trustee board to “to evaluate future de-risking opportunities”.

06:34 PM

UK broadcaster Richard Bacon receives backing of Murdoch-founded media group

The media group co-founded by Elisabeth Murdoch has invested in an entertainment start-up launched by UK broadcaster Richard Bacon.

Sister - which was also co-founded by Jane Featherstone TV producer and former 20th Century Fox chief executive Stacey Snider - has taken a “significant stake” in Yes Yes Media, the company announced on Tuesday.

The deal grants Yes Yes access to Sister’s network of creative companies and investments across television, film, podcasting, publishing and live events.

Yes Yes is currently created new unscripted entertainment formats - such as talent and game shows - which it plans to stream directly to viewers.

“We’re now truly in the TikTok era, but traditional television entertainment hasn’t fully tapped into that in a way that feels native,” said Mr Bacon.

“I see all screens as television now. At Yes Yes we’re developing content that naturally and authentically meets audiences on any of their devices.”

06:14 PM

Rupert Murdoch calls off engagement to Ann Lesley Smith

Just in: Rupert Murdoch has called off his engagement to his prospective fifth wife Ann Lesley Smith, just months before they were due to get married.

The 92-year-old Fox Corporation chairman announced his engagement only last month, when he said that the 66-year-old radio host would be his “last” wife.

05:59 PM

Australia bans TikTok from government devices

Australia has become the latest country to ban TikTok government-owned devices over security concerns.

It follows concerns that China could use the Beijing-based company to harvest users' data, advancing its political agenda and undermining Western security interests.

However, restricting the Chinese app risks renewing diplomatic tension between Australia and its largest trading partner.

Australian finance minister Katy Gallagher's said.

“Look, this has been informed by security agencies’ advice on work that’s been done and provided to government so that’s the decision we’ve taken is around government-issued devices."

TikTok said it was extremely disappointed by Australia's decision, calling it "driven by politics, not by fact."

It means that all members of the so-called Five Eyes intelligence-sharing network have banned the app from government devices.

The network consists of Australia, Canada, the United States, Britain and New Zealand.

05:43 PM

Second UK airport scraps 100ml liquid limit

London City Airport has become the second in the UK to abandon the 100ml liquid limit rule for passengers.

New technology will allow travellers to now carry up to two litres of liquid past security at City airport.

It means passengers will also not have to put toiletries in a separate bag and can leave laptops and other electronics in their hand luggage.

The C3 scanners, which takes high resolution 3D images of luggage, processes 30pc more passengers per hour, the airport said.

Aviation minister Baroness Vere said:

We’re making sure that all major airports across the UK introduce a new generation of sophisticated security technology, and it’s great to see this being harnessed at London City Airport already.

This will reduce queueing times, improve the passenger experience, and most importantly detect potential threats. Passengers travelling from other airports should continue to always check the necessary guidance on security procedures at those airports before travelling.

It comes after Teesside International Airport announced last month that it was using the C3 technology.

The Government previously set a June 2024 deadline for airports to install new security technology designed to to reduce hassle for passengers.

05:14 PM

Seize property to build wind and solar farms, says JP Morgan chief

The chief executive of JP Morgan has suggested that governments should seize private land to build wind and solar farms in order to meet net zero targets.

Banking correspondent Simon Foy has the story:

Jamie Dimon, the longstanding boss of the Wall Street titan who donates to the Democratic Party, said green energy projects must be fast-tracked as the window for averting the most costly impacts of global climate change is closing.

In his annual shareholder letter, Mr Dimon said: “Permitting reforms are desperately needed to allow investment to be done in any kind of timely way.

“We may even need to evoke eminent domain – we simply are not getting the adequate investments fast enough for grid, solar, wind and pipeline initiatives.”

Eminent domain is when a government or state agency carries out a compulsory purchase of private property for public use and compensates the asset holder.

04:42 PM

Pound reaches 10 month high

The pound has reached above $1.25 for the first time since June 2022.

The pound has today surged 0.9pc to $1.253, its highest level in 10 months against a weakening US dollar.

04:29 PM

Wood Group share price sinks following Apollo's slightly improved offer

The share price of Wood Group has sharply declined following Apollo's announcement that it has made its final bid for the Scottish engineering firm.

Its share price is down 2.30pc on the day.

04:04 PM

Apollo makes final takeover bid for Scottish engineering firm

Private equity firm Apollo Global Management has made a fifth and final £1.66bn offer for Scottish engineering firm Wood Group.

The New York private equity giant is now offering a final price of 240p per share in cash.

Apollo said the final offer provides a “compelling opportunity” for Wood’s shareholders to cashout at a “significant premium”, which eliminates the risks and uncertainty with Wood’s refreshed strategy.

It's the fifth takeover proposal that Apollo has made since the start of the year.

In February, Wood revealed it had unanimously rejected three bids from Apollo.

Last month, the Aberdeen-based consultant privately rejected Apollo's sweetened £1.6bn cash offer.

Wood’s board said the fourth offer of 237p per share continued to undervalue the group but agreed to continue to engage with Apollo on a limited basis.

03:34 PM

Handing over

That's all from me. I will leave you in Adam Mawardi's capable hands for the rest of the day.

I leave you with what has happened to US two-year Treasuries after the latest jobs data across the Pond, which showed vacancies falling to their lowest level since May 2021.

The two-year yield has dropped 12 basis points to 3.84pc.

2-year yields sliding again after the JOLTS data pic.twitter.com/Qwqh6AexL1

— Joe Weisenthal (@TheStalwart) April 4, 2023

03:14 PM

US job vacancies at lowest level in nearly two years

The number of US job openings slipped in February to its lowest level since May 2021 in a sign that the labour market may be starting to cool.

Vacancies were down to 9.9m from 10.6m in January according to the Labor Department in what will be welcome news for policymakers at the Federal Reserve.

The American job market has proven resilient in the face of sharply higher interest rates, stifling efforts to reduce inflation.

Over the past year, the Fed has raised its benchmark rate nine times in a drive to slow inflation that last year hit a four-decade high in the US and the UK.

US job openings fell below 10 million in February, the first time since May 2021.

The #FederalReserve has been hiking since March 2022.

Financial tightening takes time, especially after massive fiscal and monetary #stimulus, but it will ultimately hurt. pic.twitter.com/E2Iw2tmFn4— jeroen blokland (@jsblokland) April 4, 2023

02:52 PM

Credit Suisse pay approved by narrowest of margins

Much of the ire directed at Credit Suisse executives in Zurich has been over the bank’s pay and compensation practices over the years as it booked losses.

Nevertheless, shareholders approved the annual compensation report again, but by the thinnest of margins. Just 50.06pc of holders pressed the green button on the voting machines in the conference hall. Some 49.38pc rejected the report, and 0.56pc abstained.

Credit Suisse's directors faced shouts and jibes from angry investors in their final shareholder meeting in Zurich, which stretched on for several hours.

One shareholder asked the board how they could sleep at night. Another offered a bag of walnuts they said was worth the same as a Credit Suisse share. A third unveiled a spray-painted T-shirt reading "Stop the rip off".

Shareholders also point to the discrepancy between bonuses and profits. In the past dozen years, Credit Suisse put 35bn francs (£30.7bn) into its annual bonus pools, according to Bloomberg calculations.

The total profits it generated in that period were 35 million francs.

Chairman Axel Lehmann said: "If you take a look at the profits we generated over the past 10 to 15 years and the amount we paid out to shareholders - if you compare that to the bonuses that were paid out, then there is very probably a certain imbalance there, objectively."

02:36 PM

Wall Street flat at the open

It has been a tepid start to the day for US markets.

The Dow Jones Industrial Average and the broad-based S&P 500 both inched down barely 0.1pc to 33,565.09 and 4,128.54 respectively.

The tech-heavy Nasdaq Composite was flat at 12,194.47.

02:16 PM

Bankers joked about Epstein’s relationship with young girls, court filings claim

Senior JP Morgan bankers joked about Jeffrey Epstein's interest in young girls when the late paedophile financier was a client of the bank, court filings have claimed.

Banking & financial services correspondent Simon Foy has the latest:

The US Virgin Islands (USVI), which is bringing a lawsuit against the Wall Street giant in New York, has alleged that Mr Epstein's behaviour "was so widely known at JPMorgan that senior executives joked about Epstein's interest in young girls".

In an amended filing, USVI, which has accused JP Morgan of benefitting from Mr Epstein's sex trafficking while he was a client of the bank until 2013, made the allegation by citing a 2008 email to Mary Erdoes, who runs the bank's asset and wealth management arm.

The content of the email was redacted and JP Morgan last month said that Ms Erdoes "always acted with the highest levels of integrity and professionalism" and had "informed this client 10 years ago that his relationship with our firm was being terminated".

The territory also pointed to internal emails at JP Morgan about Epstein being under investigation or sued for sexual abuse and communication from a senior compliance official in 2010.

Read what lawyers for the territory allege.

02:00 PM

CBI cancels all outside events amid misconduct allegations

The Confederation of British Industry (CBI), one of the UK's biggest business groups, has cancelled all external events after fresh allegations over sexual misconduct.

The group will postpone events including its annual dinner, which is regularly attended by the Chancellor and was due to host Bank of England governor Andrew Bailey this year.

It had been due to take place on May 11.

It comes a day after the CBI said it is investigating "all recent allegations" after the Guardian said it had been approached by more than a dozen women who said they had been victims of sexual misconduct by senior figures at the lobbying group.

Separately, CBI boss Tony Danker stepped aside from his role a month ago after it was reported the group was looking into his conduct.

It is understood the latest allegations are not related to Mr Danker. A CBI spokesman said:

In light of the very serious allegations that are currently subject to independent investigation, the CBI has decided to temporarily pause its external programme of events, including the annual dinner on 11 May.

After Easter, the board hopes to have preliminary findings and actions from the first phase of the investigation and, among other steps, will review this pause in event activity at that point.

01:48 PM

Google workers strike over job cuts

Hundreds of Google employees staged a walkout at the company’s London offices on Tuesday, following a dispute over layoffs.

In January, Google's parent company Alphabet announced it was laying off 12,000 employees worldwide, equivalent to 6pc of its global workforce.

The move came amid a wave of job cuts across corporate America, particularly in the tech sector, which has so far seen companies shed more than 290,000 workers since the start of the year, according to tracking site Layoffs.fyi.

Trade union Unite, which counts hundreds of Google's UK employees among its members, said the company had ignored concerns put forward by employees.

Unite regional officer Matt Whaley said:

Our members are clear: Google needs to listen to its own advice of not being evil.

They and Unite will not back down until Google allows workers full union representation, engages properly with the consultation process and treats its staff with the respect and dignity they deserve.

A Google employee attending the protest, who asked not to be named for fear of retaliation, said that talks between employees and management had been "extremely frustrating".

01:24 PM

Oil continues gains after Opec+ production cut

Oil has continued its rise after its largest intraday gain in more than a year caused by the Opec+ cartel's decision to cut production.

Brent crude, the international benchmark, has risen by 0.7pc to more than $85.50 a barrel, following its near 8pc surge on Monday.

US-produced West Texas Intermediate has risen by 0.8pc to more than $81 a barrel.

It comes as Iraq's federal government and the Kurdistan Regional Government (KRG) signed a deal to restart northern oil exports through Turkey today, according to Reuters.

A formal request has been sent to Turkey to restart oil exports through an Iraq-Turkey pipeline and "in the next few hours pumping will resume," a Baghdad government official said.

01:01 PM

Norton account raises concerns about Twitter blue tick verification

TV presenter Graham Norton has expressed his "worry" after his Twitter account appeared to be hacked amid continued verification concerns on the social media platform.

The 60-year-old TV presenter deleted his Twitter account, @grahnort, last year but posted on Instagram on Monday evening that the old Twitter page had been reactivated.

Posting to over 600,000 followers, Mr Norton urged people to "spread the word" that the account has not been reactivated by him, despite it still having a blue verified tick.

The Eurovision host said:

I've just been told someone has reactivated my Twitter account. I'm now locked out of it.

My worry is that whoever has access may try sending DMs asking for money or donations.

Please spread the word that it is not me even though it still has a blue tick.

Mr Norton's statement comes after Twitter failed to take legacy blue checkmarks off the social media platform, having committed to remove them on April 1 amid confusion over changes made by Twitter owner Elon Musk.

12:51 PM

Virgin Media broadband outage fixed

Virgin Media tweeted that it has fixed the issues that caused a massive outage on its broadband network today:

We’ve restored broadband services for customers but are closely monitoring the situation as our engineers continue to investigate. We apologise for any inconvenience caused.

— Virgin Media (@virginmedia) April 4, 2023

12:38 PM

Wall Street on track to open higher

US stock markets are expected to rise after the opening bell amid gains in technology and growth stocks.

Tesla rose 1pc in premarket trading as sales of its China-made electric vehicles rose in March. Its shares were set to bounce back from 6pc declines on Monday following data on March-quarter deliveries.

Other major growth names Microsoft and Meta climbed 0.7pc and 0.6pc, respectively, helping futures tracking the tech-heavy Nasdaq to outperform peers.

Meanwhile, rising oil prices due to output cuts by Opec+ have renewed fears about inflation, denting hopes of an end to aggressive interest rate hikes despite recent signs of cooling prices and turbulence in the banking sector.

Energy majors Chevron, Exxon Mobil and Occidental Petroleum inched higher before the bell, rising between 0.2pc and 0.9pc.

The Dow Jones Industrial Average was up 0.2pc in pre-marketing trading, while the S&P 500 had gained 0.3pc. Nasdaq 100 futures were up or 0.4pc.

12:12 PM

TikTok 'considering next steps' after £12.7m fine

After TikTok's £12.7m fine for breaching data protection law - including by using the personal data of children aged under 13 without parental consent - a spokesman said the company disagreed with the ICO's decision.

However, the company was pleased the penalty had been reduced from the possible £27m set out last year.

The spokesman said:

We invest heavily to help keep under 13s off the platform and our 40,000 strong safety team works around the clock to help keep the platform safe for our community.

We will continue to review the decision and are considering next steps.

12:02 PM

Elon Musk replaces Twitter icon with a dog

Elon Musk has changed Twitter's blue bird logo to the icon for the parody cryptocurrency Dogecoin in an apparent late April Fool's joke.

Technology editor James Titcomb has the latest:

The Twitter logo on the social network's mobile and desktop homepages was replaced with a picture of a Shiba Inu dog on Monday night. The dog also featured on the website's loading screen.

The picture used is the symbol for Dogecoin and the change sent the price of the joke cryptocurrency soaring by 25pc.

Mr Musk has been a repeated advocate of Dogecoin, tweeting about it and allowing owners to use it to pay for Tesla merchandise.

The digital currency was set up in 2013 as a parody of cryptocurrencies such as Bitcoin. Dogecoin was based on a then-popular doge meme, which featured a Shiba Inu dog surrounded by colourful comic text.

11:42 AM

TikTok used children's data 'potentially delivering harmful, inappropriate content'

TikTok had faced a fine from the Information Commissioner's Office of £27m, but the final total has been reduced to £12.7m.

Information commissioner John Edwards said:

There are laws in place to make sure our children are as safe in the digital world as they are in the physical world. TikTok did not abide by those laws.

As a consequence, an estimated one million under 13s were inappropriately granted access to the platform, with TikTok collecting and using their personal data.

That means that their data may have been used to track them and profile them, potentially delivering harmful, inappropriate content at their very next scroll.

TikTok should have known better. TikTok should have done better. Our £12.7m fine reflects the serious impact their failures may have had.

11:19 AM

TikTok fined after allowing children to use platform

TikTok has been fined £12.7m for a number of data protection law breaches, including failing to use children's personal data lawfully, the Information Commissioner's Office (ICO) said.

The regulator estimated more than one million UK children under 13 were on TikTok in 2020, contrary to its terms of service.

It also said their personal data was used without parental consent.

The ICO said TikTok "did not do enough" to check who was using their platform and take sufficient action to remove the underage children that were using the social network.

11:09 AM

Virgin Media tells customers its broadband is still down

Virgin Media is still telling customers that its broadband services are down.

Its Twitter account continues to respond saying it is "aware of an issue that is affecting broadband services".

Its teams "are currently working to identify and fix the problem as quickly as possible".

We’re aware of an issue that is affecting broadband services for Virgin Media customers as well as our contact centres. Our teams are currently working to identify and fix the problem as quickly as possible and we apologise to those customers affected.

— Virgin Media (@virginmedia) April 4, 2023

10:59 AM

People across eurozone expect inflation to fall

Consumers in the eurozone have lowered their expectations for inflation for a second month — supporting recent remarks by European Central Bank officials that interest-rate increases may be nearing their end.

Expectations for the next 12 months dropped to 4.6pc in February from 4.9pc in January, the ECB said in its monthly survey. For three years ahead, they declined to 2.4pc from 2.5pc.

The numbers add to an ever-more uncertain economic backdrop as the ECB analyses its next steps.

Banking turbulence and the surprise decision by the Opec+ cartel to cut oil output has further complicated matters.

Officials have raised borrowing costs by 350 basis points since last July.

Interesting to see that the largest decline in inflation expectations was recorded in Germany, while they ticked higher in France (think food prices in particular). pic.twitter.com/DiYL8voWqi

— Frederik Ducrozet (@fwred) April 4, 2023

10:42 AM

Interest rates face 'earlier and faster reversal,' says Bank chief

Interest rates will need an "earlier and faster reversal" to avoid inflation falling well below its 2pc target, a Bank of England policymaker has said.

Monetary Policy Committee member Silvana Tenreyro suggested the Bank has pushed rates too high to 4.25pc.

Ms Tenreyro, who has consistently voted against interest rate rises, told the SES Annual Conference in Glasgow:

Given that outlook, I have voted for no change in Bank Rate in recent months, rather than further tightening.

With Bank Rate moving further into restrictive territory, I think a looser stance is needed to meet the inflation target in the medium term.

In general, a looser stance can be achieved either through lower Bank Rate today, or through lower Bank Rate in future, which leads to a lower market curve. A lower market curve would then lower lending rates and loosen financial conditions today.

At the same time, with Bank Rate moving further into restrictive territory, there are limits to the amount of loosening that can be provided through this mechanism.

So I expect that the high current level of Bank Rate will require an earlier and faster reversal, to avoid a significant inflation undershoot.

10:19 AM

Shareholder anger at 'greed and incompetence' of Credit Suisse managers

There is huge anger among shareholders at the way Credit Suisse was forcibly taken over by UBS as Switzerland's government sought to avoid triggering a global banking crisis.

The meeting in Zurich today is the first time that chairman Axel Lehmann and chief executive Ulrich Koerner have publicly addressed investors since the takeover.

Shareholder advisory firm Ethos decried the "greed and incompetence of its managers" as well as pay that reached "unimaginable heights", as it prepared to challenge top executives at the shareholder meeting.

"Shareholders have lost considerable amounts of money and thousands of jobs are on the line," it said.

Dominik Gross of the Swiss Alliance of Development Organisations said: "The government's use of emergency powers to push this deal through goes beyond legal and democratic norms.

"Swiss taxpayers too are on the hook for billions of francs of junk investments and yet the government, (regulator) FINMA and the central bank have given little explanation about the state's 9 billion (franc) loss guarantee to UBS."

One of the world's biggest investors, Norway's sovereign wealth fund said it would vote against the re-election of Mr Lehmann and six other directors, in a public show of protest.

US proxy adviser Institutional Shareholder Services (ISS) had earlier rebuked the bank's management for a "lack of oversight and poor stewardship".

10:05 AM

Credit Suisse chairman says bank 'could not be saved'

Credit Suisse chairman Axel Lehmann has apologised to shareholders for failing to stem a loss of trust in the bank that he said had built up well before he took over.

He told investors at the bank's annual shareholder meeting in Zurich that he was "truly sorry" that its leadership had "failed to stem the impact of legacy scandals, and counter negative headlines with positive facts", meaning in the end "the bank could not be saved".

The public mea culpa comes as shareholders confront the bank's leadership over its historic takeover by larger rival UBS, ending Credit Suisse's independent existence after 167 years.

The 3 billion-franc (£2.7bn) deal was sealed last month without shareholder approval, putting an end to a crisis of confidence after years or scandals, losses and failures in risk management.

Mr Lehmann added:

We wanted to put all our energy and our efforts into turning the situation around and putting the bank back on track.

It pains me that we didn't have the time to do so, and that in that fateful week in March our plans were disrupted. For that I am truly sorry.

09:47 AM

Pound at highest level since June

The pound has climbed to its highest value against the dollar since June as the outlook improves for the UK economy and the US was hit by weak manufacturing data.

Sterling has risen 0.4pc today and is heading in the direction of $1.25.

Bank of England chief economist Huw Pill and Monetary Policy Committee member Silvana Tenreyro will give speeches today which could indicate the future direction of interest rate rises.

The Opec+ cartel's decision to cut oil production has raised fresh concerns about inflation, heaping pressure on policymakers to keep raising interest rates.

Meanwhile, US manufacturing activity slumped in March slumped to a near three-year low as new orders plunged, according to the Institute for Supply Management.

Analysts suggested tighter credit conditions could choke off more activity.

09:28 AM

Markets rise as miners and financial stocks gain

The commodity-heavy FTSE 100 has risen for a seventh straight session, underpinned by gains in materials and financials stocks.

However it has already pulled back from its strong open, with the blue-chip index up 0.2pc. The mid-cap FTSE 250 has risen 0.4pc.

Industrial metals miners across the FTSE 350 have climbed 0.6pc, providing the biggest boost to the FTSE 100, although they are down from a 1.4pc gain to start the day. Banks have risen 0.5pc.

Rathbones Group advanced 2.3pc as the wealth manager said it had agreed to buy the UK wealth business of Investec in an all-share deal valued at £839m. Shares of Investec climbed 2.4pc.

Meanwhile, OKYO Pharma has tumbled following its plan to delist from UK markets.

OKYO Pharma fell nearly 17.6pc after the bio-pharmaceutical company said it plans to delist from the London Stock Exchange next month, citing tepid volumes of trading and low valuations.

09:21 AM

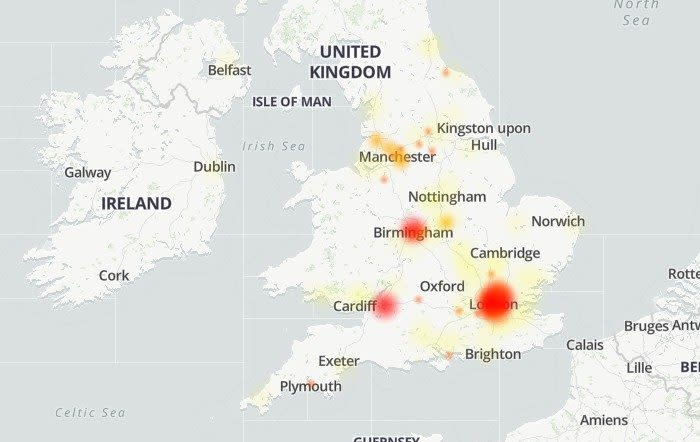

Virgin Media outages mapped

As you might expect, London is the hotspot for the reports of Virgin Media broadband outages on tracking website Downdetector.

However, Birmingham and Cardiff also have high levels of complaints.

09:15 AM

Virgin Media customers angered at 'eight hours to become aware' of outage

Customers have voiced their frustration at the apparent delay in Virgin Media addressing the problem, with thousands of complaints reported on Downdetector by 2am.

Frustrating that a simple @pingdom check that pings my phone knew you had an outage 7 hours earlier and kept track of all the UPs and DOWNs throughout the night -- 50 messages in total.

Do you or your engineers or your customer service have no such notifications?…— Jason Kneen (@jasonkneen) April 4, 2023

Ah someone has finally logged in to the Virgin Media twitter account. The fact it took you 8 hours to become ‘aware’ of the issue fills me with confidence that you’ll fix it quickly…

— Andrew Mackenzie (@awmackenzie) April 4, 2023

Disgraceful, you should have had a team on this overnight. Your crisis management and customer focus are obviously lacking and if you had a team/s on this I would call into question your capability to understand key flows and dependencies.

— StudioAlien (@StudioAlien1) April 4, 2023

08:39 AM

Virgin Media hit by broadband outages

Thousands of Virgin Media customers have reported outages with their broadband as the company races to fix the problem.

Outages began emerging before 2am according to the tracking website Downdetector, with more than 14,000 customers reporting issues.

The problems appeared to wane before another surge just before 8am, reaching a peak of nearly 29,000 complaints.

Virgin has confirmed it is working on the issue:

We’re aware of an issue that is affecting broadband services for Virgin Media customers as well as our contact centres. Our teams are currently working to identify and fix the problem as quickly as possible and we apologise to those customers affected.

— Virgin Media (@virginmedia) April 4, 2023

08:29 AM

Saga losses increase tenfold

Saga suffered a tenfold increase in pre-tax losses as its insurance business was hit by a "very competitive motor market" and regulatory changes.

The over-50s holiday and financial services company said it took a £269m hit on its insurance arm, which meant it slumped to a pre-tax loss of £254.2m.

Its share price slumped 2.9pc in early trading following what it described as "impairment of insurance goodwill".

However, the company returned to an underlying profit of £21.5m, with its travel bookings ahead of last year and the division expected to return to profit following the pandemic. Chief executive Euan Sutherland said:

Our insurance underwriting business took pricing action to reflect the rise in claims inflation, while our insurance broking business navigated a challenging landscape, adjusting to significant regulatory changes and increased competitive pressure.

We also took a number of key steps to reposition the business, consistent with the strategy we set out 12 months ago to create 'The Superbrand' for older people.

Our top priorities for the next 12 months are to strengthen our financial position and continue to build Saga into the largest and fastest-growing business for older people in the UK, delivering long-term, sustainable growth for our stakeholders.

08:03 AM

FTSE 100 rises at the open

The energy heavy FTSE 100 has enjoyed a strong start to the day after the unexpected cut in oil production announced by Opec+ this week, which has sent oil prices surging.

The blue chip index has begun the day 0.6pc higher at 7,719.95 while the domestically-focused FTSE 250 rose 0.3pc to 18,936.96 after the open.

08:00 AM

Investec and Rathbones create £100bn wealth manager

Asset managers Investec and Rathbones have agreed a deal that will create a British wealth manager with combined funds of £100bn.

The companies have agreed to an all-share combination of the UK unit of Investec Wealth & Investment and Rathbones.

The enlarged Rathbones Group will remain an independent company operating under the Rathbones brand with Investec as a long-term, strategic shareholder.

After the deal closes, Investec Group will own 41.25pc of the economic interest in Rathbones' share capital, but with voting rights limited to 29.9pc.

The terms of the combination imply an equity value of about £839m for Investec W&I UK.

The new entity will operate out of Investec's London office and both firms will enter into a relationship agreement, which includes two Investec representatives joining the board of the new group. Investec Group chief executive Fani Titi said:

The combination of Investec W&I UK and Rathbones brings together two businesses which have a long-standing heritage in UK wealth management and closely aligned cultures.

The transaction represents a real step-change and long-term opportunity for our UK wealth strategy, underscores our commitment to the UK wealth management market and enhances our UK business as a whole.

07:51 AM

L’Oreal to buy Natura's Aesop in $2.5bn cosmetics deal

L'Oréal has agreed to acquire high-end cosmetics brand Aesop from Natura for $2.5bn (£2bn).

Natura had been mulling a partial or total sale of Aesop as part of a broader overhaul being conducted by Fabio Barbosa, who took over as chief executive officer last year.

Mr Barbosa has sought to simplify the company's structure and cut costs.

The transaction will help the Brazilian beauty giant reduce its debt burden and focus on turning around other businesses.

Aesop was increasingly seen by investors as the crown jewel of the group, which saw other businesses including Avon and Body Shop grow at a slower pace.

The unit reported revenue of 880m reais (£139.8m) for the fourth quarter, accounting for about 8pc of Natura's total net revenue, and was the group’s most profitable business, according to Lucror Analytics.

L'Oréal's chief executive Nicolas Hieronimus said: "Aesop taps into all of today's ascending currents and L'Oréal will contribute to unleash its massive growth potential, notably in China and travel retail."

07:40 AM

Virgin Orbit 'will have wide appeal to buyers,' insists boss

As the company filed for Chapter 11 bankruptcy, Virgin Orbit chief executive Dan Hart said:

The team at Virgin Orbit has developed and brought into operation a new and innovative method of launching satellites into orbit, introducing new technology and managing great challenges and great risks along the way as we proved the system and performed several successful space flights – including successfully launching 33 satellites into their precise orbit.

While we have taken great efforts to address our financial position and secure additional financing, we ultimately must do what is best for the business.

We believe that the cutting-edge launch technology that this team has created will have wide appeal to buyers as we continue in the process to sell the Company.

At this stage, we believe that the Chapter 11 process represents the best path forward to identify and finalize an efficient and value-maximising sale.

I'm incredibly grateful and proud of every one of our teammates, both for the pioneering spirit of innovation they've embodied and for their patience and professionalism as we've managed through this difficult time.

Today my thoughts and concerns are with the many talented teammates and friends now finding their way forward who have been committed to the mission and promise of all that Virgin Orbit represents.

I am confident of what we have built and hopeful to achieve a ransaction that positions our company and our technology for future opportunities and missions.

07:32 AM

Branson pumps another $31.6m into Virgin Orbit to secure sale

Sir Richard Branson has injected a further $31.6m (£25.4m) into Virgin Orbit to help fund a sale through the bankruptcy procedure.

This is on top of the $10.9m provided last week through his Virgin Investments vehicle to cover severance payments after laying off 85pc of Virgin Orbit's 750 staff.

Virgin Group has released a statement following the bankruptcy filing:

In just a few short years, Virgin Orbit has achieved much of what it set out to do having successfully led multiple missions to space launching 33 satellites into their desired orbit. The team has created a light, fast, flexible, and affordable satellite launch system and we are proud of all the team has strived for.

Richard Branson and the Virgin Group have supported Virgin Orbit over the long term, investing more than $1bn in the company, including $60m since November 2022. However, this significant funding was not enough to counter the strong headwinds and liquidity challenges Virgin Orbit continues to face.

The Virgin Group has committed to providing $31.6m in debtor-in-possession financing to help fund Virgin Orbit's restructuring process announced as part of the Chapter 11 process. This financing will enable Virgin Orbit to continue paying remaining employees and funding operations while the Company executes its sale process. It has also paid $10.9m to fund severance and benefits for departing employees, announced last week.

Whilst Virgin Orbit will not have made this decision lightly, we believe this definitive action puts Virgin Orbit in the best possible place to maximize value and positions the company and technology for future opportunities and missions.

07:21 AM

Virgin Orbit received $50m in five months

Virgin Orbit went public in 2021 through a blank-check deal, raising $255m less than expected.

Spun off from Sir Richard Branson's space tourism firm Virgin Galactic in 2017, Virgin Orbit air-launches rockets from beneath a modified Boeing 747 plane to send satellites into orbit.

The company's sixth mission in January with its LauncherOne rocket, the first rocket launch from Britain, failed to reach orbit and sent its payload of US and UK intelligence satellites plunging into the ocean.

Between November and March, Branson's Virgin Group provided $50m to the satellite launch company via debt secured against its equipment and other assets in the event of a bankruptcy.

The company is roughly 75pc-owned by Virgin Group and scrambled to find new funding after the January rocket failure, halting operations and furloughing nearly all its employees on March 15 to conserve cash.

07:14 AM

Virgin boss says bankruptcy 'best path forward'

Virgin Orbit has filed for Chapter 11 bankruptcy in the US Bankruptcy Court for the District of Delaware seeking a sale of its assets.

Chief executive Dan Hart had been understood to be in last ditch talks to sell the business after the company announced it was sacking 85pc of its staff last week - but the process appears to have failed

Mr Hart said: "At this stage, we believe that the Chapter 11 process represents the best path forward to identify and finalise an efficient and value-maximizing sale."

The company listed assets of about $243m and its total debt at $153.5m as of September 30 in the filing.

06:52 AM

Good morning

Virgin Orbit has filed for bankruptcy after a collapse in its share price following a failed rocket launch in January.

The California-based business failed to secure the long-term funding needed to help it recover from the unsuccessful mission from Cornwall earlier this year.

5 things to start your day

1) Brussels rift over border app threatens to inflict misery on holidaymakers | Disagreement over who develops software risks causing lengthy delays for passengers

2) Putin pushes Russian oil exports to record high | It comes after surprise production cuts led by Saudi Arabia risks causing pain for motorists at the pumps and stoking inflation

3) Glencore launches $22bn copper raid as battle for battery resources explodes | Proposed merger would make the combined business the world's third largest copper producer

4) 'Completely unsellable': how HS2 is causing property market chaos | Repeated delays to the project's timeline cause added uncertainty for homeowners

5) No, our inflation problem is not due to Brexit | Inflation is still set to fall sharply this year – regardless of Brexit scaremongering

What happened overnight

Shares were mixed in Asia as investors watched for the latest moves by central banks.

Meanwhile oil prices steadied after shooting higher the day before following an announcement that major exporters plan to cut production.

Benchmarks rose in Tokyo, Shanghai and Seoul but fell in Hong Kong and Sydney.

Australia's central bank kept its key interest rate unchanged at 3.6pc.

Wall Street's main equity indexes mostly advanced on Monday, as energy stocks surged amid rising oil prices following surprise production cuts led by Saudi Arabia.

The Dow Jones Industrial Average rose 1pc to close at to 33,601.15, while the broad-based S&P 500 index closed 0.4pc higher at 4,124.51. The tech rich Nasdaq composite fell 0.3pc to 12,189.45.

Yields on US government bonds retreated following reports that manufacturing activity shrank more sharply than expected in March, suggesting lowered odds for more Federal Reserve interest rate increases.

The benchmark 10-year yield declined five basis points to 3.42pc.

Yahoo Finance

Yahoo Finance