Visa (V) Q1 Earnings Meet Estimates, Revenues Increase Y/Y

Visa Inc. V reported first-quarter fiscal 2020 earnings of $1.46 per share, which matched the Zacks Consensus Estimate and were up 7.7% year over year.

The results were driven by growth in payments volume, cross-border volume and processed transactions.

Net operating revenues of $6.1 billion missed the Zacks Consensus Estimate by 0.16% but were up 10% year over year. This upside was primarily driven by an increase in all the components of net revenues such as service, data processing, international transaction revenues and others.

However, increase in client incentives, which constitute a contra revenue item, acted as a partial dampener to revenue growth.

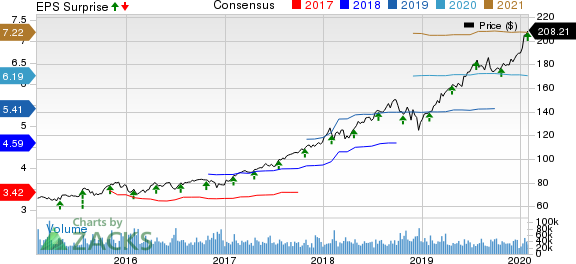

Visa Inc. Price, Consensus and EPS Surprise

Visa Inc. price-consensus-eps-surprise-chart | Visa Inc. Quote

Strong Financial Performance

On a constant-dollar basis, payments volume growth in the quarter was 8% year over year. Cross-border volume growth, on a constant-dollar basis, was 9%. Visa's processed transactions increased 11% from the prior-year quarter to 37.8 billion.

Service revenues increased 9% year over year to $2.6 billion on higher nominal payments volume. On a year-over-year basis, data processing revenues rose 16% to $2.9 billion and international transaction revenues grew 9% to $2 billion. Other revenues increased 35% year over year to $365 million.

Client incentives of $1.7 billion increased 22.4% year over year.

Adjusted operating expenses increased 13% year over year to $2.03 billion, primarily due to higher personnel, network and processing, professional fees, depreciation and amortization, and general and administrative costs. Interest expense declined 23.4% year over year to $111 million.

Solid Balance Sheet

Cash and cash equivalents, and available-for-sale investment securities were $8.8 billion as of Dec 31, 2019, up 12.8% year over year.

Total assets were $74.8 billion as of Dec 31, 2019, up 3% year over year.

Share Buyback

During the quarter, the company made share repurchases to the tune of $2.3 billion.

On Jan 28, 2020, the company declared a quarterly cash dividend of 30 cents per share, payable on Mar 3, 2020, to all holders of record as of Feb 14, 2020.

Developments During the Quarter

On Oct 22, 2019, Visa announced that it completed the acquisition of the token services and ticketing businesses of Rambus. These businesses will enable Visa to extend the security and convenience of tokenization to all types of transactions, including the ability to support domestic card networks and account-based and real-time payments systems

On Dec 13, 2019, the district court granted final approval of the 2018 settlement agreement, which provides monetary relief for Visa and Mastercard merchants of approximately $5.5 billion. The case is, however, not yet fully resolved as several objectors have filed notices to appeal to the district court’s decision.

On Jan 13, 2020, Visa announced that it has signed a definitive agreement to acquire Plaid, a network that makes it easy for people to securely connect their financial accounts to the apps they use to manage their financial lives. Visa will pay $4.9 billion cash consideration and $0.4 billion of retention equity and deferred equity consideration.

2020 Guidance

For fiscal 2020, Visa expects annual net revenues to grow in low double digits on a nominal basis, with approximately 1% of negative foreign currency impact and nearly 0.5% of positive impact from acquisitions. Client incentives, as a percentage of gross revenues, are projected to be in the high-end range of 22.5% to 23.5%.

Annual adjusted operating expense is expected to increase by mid- to high-single digit with approximately 1% of negative foreign currency impact and nearly 3-4% of positive impact from acquisitions.

The effective tax rate is estimated between 19% and 19.5%.

The company expects annual earnings per share growth in mid-teens.

Our Take

Visa remains well positioned for future growth on the back of its solid market position, increase in payments volume, accretive acquisitions and significant opportunities owing to its secular shift toward electronic payments. Its strong balance sheet position and vast payment network offer significant long-term growth potential.

Zacks Rank & Stocks to Consider

Visa currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Some better-ranked stocks in the same space are Envestnet, Inc. ENV, Global Payments Inc. GPN and Fidelity National Information Services, Inc. FIS. Each of the stocks carries a Zacks Rank #2 (Buy).

Envestnet, Global Payments and Fidelity National Information surpassed earnings estimates in the four trailing quarters with positive surprise of 3.51%, 2.42% and 2.92%, on average, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance