Vista Outdoor's (VSTO) Revelyst Acquires PinSeeker, Stock Up

Vista Outdoor Inc.’s VSTO operating segment, Revelyst, which also holds a portfolio of top-tier maker brands, has completed the acquisition of PinSeeker. The acquired company is a Wasserman portfolio company, which is a virtual network for golfers.

Following the announcement, shares of VSTO increased 3.2% during the trading hours on Mar 25.

Acquisition in Details

The PinSeeker application hosts virtual tournaments, closest-to-the-pin challenges and other contests on golf simulators, thus offering golfers a common platform wherein they can compete in contests and challenges with their friends, families and fellow golfers from any part of the world. The tournament and sponsorship income of PinSeeker will authorize Revelyst to reinvest in its brands and grow the company’s gaming environment.

The app is anticipated to be integrated into Vista Outdoor’s already existing brand, Foresight Sports, under the umbrella of Revelyst. The incorporation of this app into Foresight Sports will help the latter leverage the strong market demand for competitive tournaments and experiences in off-course golf and evolve its game and content platform along the way.

Furthermore, the PinSeeker app ensures players compete in real-time, view rankings and competitors, and enjoy more access to Falcon or QuadMAX products from Foresight Sports or other simulator devices.

Capital Allocation Strategy Boosts Inorganic Moves

Vista Outdoor intently focuses on boosting its inorganic business moves alongside its organic plans through the execution of several strategic initiatives. The initiatives include a capital allocation strategy, along with a cost reduction and earnings improvement program.

The capital allocation strategy includes investment in core organic growth opportunities, opportunistic share repurchases when valuation is believed to be highly attractive and selective tuck-in acquisitions. Through this strategic move, VSTO expects to drive value and synergies through mergers & acquisitions to develop its existing brands and increase its product offerings.

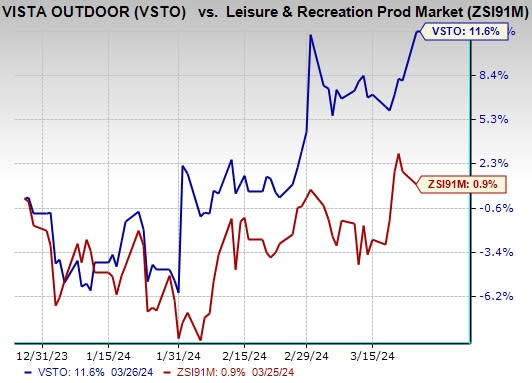

Image Source: Zacks Investment Research

This current Zacks Rank #3 (Hold) company has gained 11.6% in the past three months, outperforming the Zacks Leisure and Recreation Products industry’s 0.9% growth. It is benefiting from accretive inorganic moves as well as organic initiatives, undertaken for expanding its product offerings, market reach and operational synergies.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 17.2%, on average. The stock has gained 18.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 5% and 24.5%, respectively, from the year-ago levels.

Adtalem Global Education Inc. ATGE currently sports a Zacks Rank of 1. ATGE has a trailing four-quarter earnings surprise of 16.9%, on average. The stock has increased 36.7% in the past year.

The Zacks Consensus Estimate for ATGE’s fiscal 2024 sales and EPS implies growth of 6.4% and 10.2%, respectively, from the year-ago levels.

Ralph Lauren Corporation RL presently sports a Zacks Rank of 1. RL has a trailing four-quarter earnings surprise of 18.7%, on average. The stock has surged 62.7% in the past year.

The Zacks Consensus Estimate for RL’s fiscal 2025 sales and EPS implies growth of 4.2% and 9.5%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Vista Outdoor Inc. (VSTO) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance