Volatility 101: Should Buzzi Unicem (BIT:BZU) Shares Have Dropped 32%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Buzzi Unicem S.p.A. (BIT:BZU) shareholders have had that experience, with the share price dropping 32% in three years, versus a market decline of about 17%. Shareholders have had an even rougher run lately, with the share price down 32% in the last 90 days. But this could be related to the weak market, which is down 30% in the same period.

See our latest analysis for Buzzi Unicem

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Buzzi Unicem actually saw its earnings per share (EPS) improve by 38% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 1.0% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 5.3% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Buzzi Unicem further; while we may be missing something on this analysis, there might also be an opportunity.

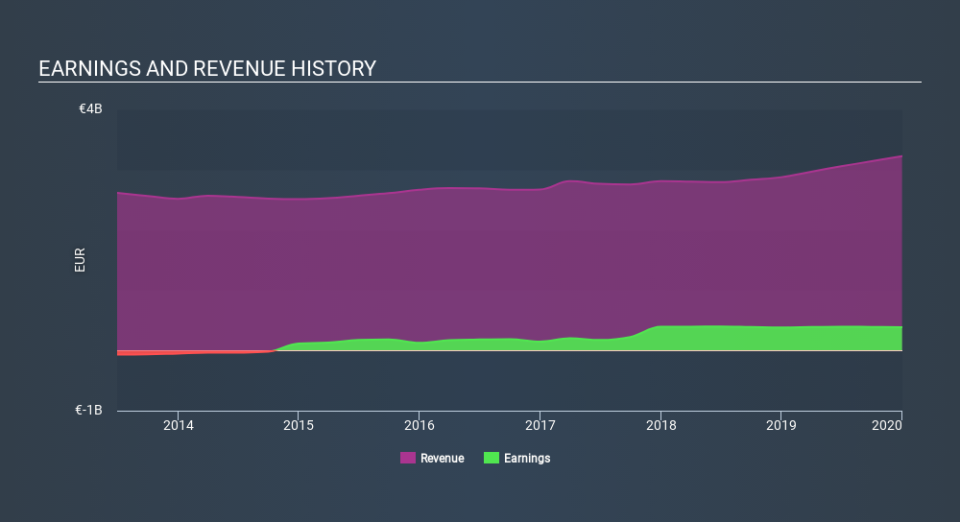

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Buzzi Unicem has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Buzzi Unicem stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Buzzi Unicem's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Buzzi Unicem shareholders, and that cash payout explains why its total shareholder loss of 31%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Buzzi Unicem shareholders are down 18% over twelve months (even including dividends) , which isn't far from the market return of -18%. Longer term investors wouldn't be so upset, since they would have made 1.9%, each year, over five years. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Buzzi Unicem (1 can't be ignored) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance