Wabash National Corp (WNC) Q1 Earnings: Misses Revenue and EPS Estimates Amid Slow Customer Pickups

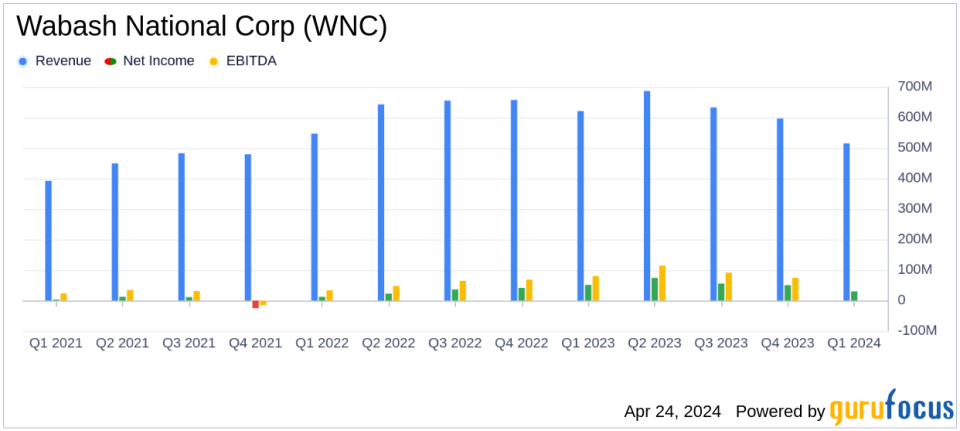

Revenue: Reported $515 million, a decrease of 17% year-over-year, falling slightly short of estimates of $516.85 million.

Net Income: Achieved $18.17 million, significantly below the estimated $22.67 million.

Earnings Per Share (EPS): Recorded at $0.39, below the estimated $0.45.

Operating Income: Totaled $29.6 million with an operating margin of 5.7%.

Backlog: Stood at approximately $1.8 billion, down 5% from the previous quarter.

2024 Full-Year Outlook: Revenue forecast maintained between $2.2 billion and $2.4 billion, with EPS guidance of $2.00 to $2.50.

Strategic Developments: Continues investment in digital solutions and dealer network to strengthen market position despite industry slowdown.

On April 24, 2024, Wabash National Corp (NYSE:WNC), a leader in connected solutions for the transportation, logistics, and distribution industries, disclosed its financial results for the first quarter ended March 31, 2024. The company reported quarterly revenue of $515 million, falling short of the analyst's expectation of $516.85 million, primarily due to slower customer pickups. This represents a significant decline from the previous year's revenue of $620.95 million.

Operating income for the quarter was $30 million with an operating margin of 5.7%, and diluted earnings per share (EPS) stood at $0.39, both of which also missed the estimated EPS of $0.45. The company's performance reflects a downturn from the same period last year, where it achieved a higher operating margin and EPS. Despite these challenges, Wabash maintains its EPS outlook for 2024, projecting between $2.00 and $2.50.

Wabash National Corp, headquartered in Lafayette, Indiana, continues to drive innovation within the industry, focusing on the production and service of a diverse range of products including dry freight and refrigerated trailers, truck bodies, and specialized equipment for the food service industry.

The company's total backlog as of March 31, 2024, stood at approximately $1.8 billion, a slight decrease from the previous quarter. This backlog is expected to convert to revenue over the next 12 months, amounting to approximately $1.5 billion.

President and CEO Brent Yeagy commented on the quarter's outcomes, stating,

During the first quarter, customer pickups of equipment lagged somewhat behind the pace of our production. It's typical for customer pickup rates to vary between quarters, especially in slower years for the industry. We anticipate that the delays experienced in the first quarter will be recovered in subsequent quarters, particularly the second quarter."

Yeagy also highlighted the strategic advancements for 2024, emphasizing the ongoing development of the Wabash Marketplace digital platform, which aims to streamline the supply chain experience and improve access to parts, services, and trailers.

In terms of segment performance, the Transportation Solutions segment saw a decrease in net sales by 18.6% compared to the previous year, while the Parts & Services segment reported a 4.4% increase in net sales, reflecting strategic growth in this area.

The financial statements revealed a net income of $18.2 million for the quarter, significantly lower than the previous year's $51.2 million. The company also reported a decrease in cash and cash equivalents, highlighting a challenging quarter in terms of cash flow and operational efficiency.

Wabash's first quarter results reflect the cyclical and challenging nature of the transportation and logistics industry, compounded by slower customer pickups. As the company continues to navigate these challenges, its focus on digital transformation and strategic investments in its service offerings remain crucial for long-term growth.

To access the detailed financial results, please visit Wabash National Corp's 8-K filing.

For further insights and detailed financial analysis, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Wabash National Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance