Walgreens Boots (WBA) Q3 Earnings Top Estimates, Revenues Miss

Walgreens Boots Alliance, Inc. WBA reported adjusted earnings per share (EPS) from continuing operations of 96 cents in third-quarter fiscal 2022, down 36.4% year over year (down 28.9% at constant exchange rate or CER). The figure topped the Zacks Consensus Estimate by 1.1%.

GAAP EPS from continuing operations for third-quarter fiscal 2022 was 33 cents compared with the year-ago quarter’s $1.27. The metric plunged 74% year over year.

Total Sales

Walgreens Boots recorded total sales of $32.59 billion for the fiscal third quarter, down 4.2% year over year and 2.8% at CER. The top line also missed the Zacks Consensus Estimate by 0.4%.

Quarterly Details

During its Q1 fiscal 2022 earnings call, Walgreens Boots’ announced the formation of a new operating segment, Walgreens Health, in line with the introduction of its new consumer-centric healthcare strategy. Given the announcement, the company divided its business into three reportable segments—the United States, International and Walgreens Health—at the start of the fiscal year.

United States

The segment’s sales totaled $26.69 billion for the fiscal third quarter, representing a decline of 7.1% year over year.

Comparable sales increased 1.8% from the year-ago quarter, reflecting a 2% increase in comparable pharmacy sales and a 1.4% rise in comparable retail sales.

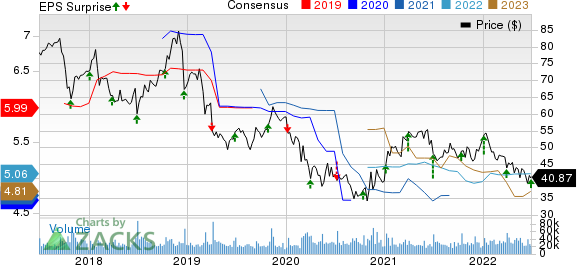

Walgreens Boots Alliance, Inc. Price, Consensus and EPS Surprise

Walgreens Boots Alliance, Inc. price-consensus-eps-surprise-chart | Walgreens Boots Alliance, Inc. Quote

In comparable stores, total prescriptions filled decreased 2.5% from the year-ago quarter, including immunizations adjusted to 30-day equivalents.

Pharmacy sales were down 9.7% from the year-ago quarter, negatively impacted by an 11-basis points (bps) headwind from the AllianceRx Walgreens business.

Retail sales increased 1% and comparable retail sales grew 1.4% year over year. Comparable retail sales (excluding tobacco and e-cigarettes) also increased 2.4% from the prior-year quarter.

Health and wellness sales increased 7.9%, backed by at-home COVID-19 tests and cough cold flu.

Personal care increased 2.6%, partially offset by beauty and consumables and general merchandise, which fell 0.4% and 1.9%, respectively.

International

Revenues at the International division rose 0.3% on a year-over-year basis and 9.3% at CER to $5.31 billion for the fiscal third quarter.

Boots UK sales rose 13.5% year over year. The Germany wholesale business sales increased 6.8% in the fiscal third quarter.

Boots UK’s comparable retail sales increased 24%, driven by market share gains across all categories, led by beauty.

However, Boots UK comparable pharmacy sales declined 0.4% year over year, as growth in comparable National Health Service (NHS) volumes was more than offset by favorable timing on NHS reimbursement in the year-ago quarter.

Walgreens Health

The Walgreens Health segment reported fiscal third-quarter revenues of $596 million.

Within the segment, the Shields business rose 47% on a pro forma basis versus their standalone results in the year-ago quarter. The upside was driven by key contract wins, continued partnership growth and a strong focus on execution. Meanwhile, VillageMD increased 69% owing to existing clinic growth and footprint expansion.

Margins

Gross profit for the reported quarter fell 8.1% year over year to $6.57 billion. Gross margin contracted 86 bps to 20.2%.

Selling, general and administrative expenses were up 14.8% year over year to $7.02 billion.

The company reported an adjusted operating loss of $447 million in the quarter under review.

Financial Condition

Walgreens Boots exited the third quarter of fiscal 2022 with cash and cash equivalents of $2.29 billion compared with $1.89 billion recorded at the fiscal second-quarter end. Total debt was $13.46 billion at the fiscal third-quarter end, up from $13.31 billion at the second-quarter fiscal 2022 end.

Net cash provided by operating activities at the end of third-quarter fiscal 2022 was $3.81 billion, down from the year-ago period’s $4.31 billion.

The company has a 5-year annualized dividend growth rate of 4.7%.

Fiscal 2022 Guidance

The company has maintained the full-year adjusted EPS guidance to low-single-digit growth. The Zacks Consensus Estimate for the same is pegged at $5.06.

Our Take

Walgreens Boots exited third-quarter fiscal 2022 with better-than-expected earnings. The Boots business continued its rally in the fiscal third quarter, with robust sales growth across the Boots UK and Boots.com. The company witnessed increased online growth momentum, with digital sales up 25% in the United States. Further, sales contributions from the newly-formed Walgreens Health segment instill investors’ optimism.

Walgreens Boots also played a significant role in COVID-19 vaccinations and testing, administering 4.7 million vaccinations and 3.9 million tests in the reported quarter and more than 16 million boosters to date. The rollout of VillageMD continued to progress well in the fiscal third quarter. VillageMD had 315 total clinics open by quarter-end, indicating an increase of 97 clinics from the year-ago period.

Walgreens Boots’ fiscal third-quarter revenues fell shy of estimates and declined year over year. The top-line performance was affected by a sales decline at AllianceRx Walgreens. Contraction of gross margin does not bode well. The company also reported an operating loss in the quarter, raising apprehension.

Zacks Rank and Key Picks

Walgreens Boots currently carries a Zacks Rank #3 (Hold).

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Quidel Corp. QDEL currently has an Earnings ESP of +9.17%. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Quidel’s earnings yield of 15.44% compares favorably with the industry’s (-2.57%).

Quest Diagnostics Inc. DGX currently has an Earnings ESP of +5.37% and sports a Zacks Rank #2 (Buy). The company is scheduled to report its second-quarter 2022 results on July 21, before market open.

Quest Diagnostics has a historical earnings growth rate of 22.4%. DGX’s earnings yield of 6.77% compares favorably with the industry’s 3.57%.

Merck & Co., Inc. MRK currently has an Earnings ESP of +19.05% and carries a Zacks Rank #2. Merck is scheduled to report its second-quarter 2022 results on July 28, before market open.

Merck’s long-term earnings growth rate is estimated at 10.1%. MRK’s earnings yield of 7.91% compares favorably with the industry’s 7.52%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance