Walgreens in, GE out — What you need to know in markets on Wednesday

Tuesday was a day of trade worries for investors.

Late Monday, President Donald Trump directed his administration to find an additional $200 billion worth of Chinese imports on which to impose tariffs, ratcheting up trade tensions yet another time and sending markets in Asia lower overnight.

Investors were greeted by a sea of red early Tuesday, though pared some of these losses during the trading day. The Dow ultimately closed with the steepest losses, dropping 287 points, or 1.1% with industrial giants Boeing (BA) and Caterpillar (CAT) each dropping more than 3%.

The benchmark S&P 500 and the tech-heavy Nasdaq saw smaller declines, losing just 0.4% and 0.3%, respectively, as the small-cap Russell 2000 eked out gains.

On Wednesday, investors will again remain attuned to any news on the trade front out of the White House as the relatively slow week of scheduled economic and corporate news continues.

The day’s biggest markets story, however, is likely to come from the Dow, as S&P Dow Jones Indices announced late Tuesday that Walgreens Boots Alliance (WBA) would replace General Electric (GE) in the Dow Jones Industrial Average, effective prior to the open of trading on June 26.

This move will bring to an end 111 years of continuous Dow membership for GE, which was an original member of the blue chip index at its founding in 1896.

“Since [GE first joined the Dow] the U.S. economy has changed: consumer, finance, health care and technology companies are more prominent today and the relative importance of industrial companies is less,” said David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices.

“Walgreens is a national retail drug store chain offering prescription and non-prescription drugs, related health services and general goods. With its addition, the DJIA will be more representative of the consumer and health care sectors of the U.S. economy. Today’s change to the DJIA will make the index a better measure of the economy and the stock market.”

Following this announcement, shares of Walgreens were up 2.6% in after hours trading while GE shares were down 1.7%.

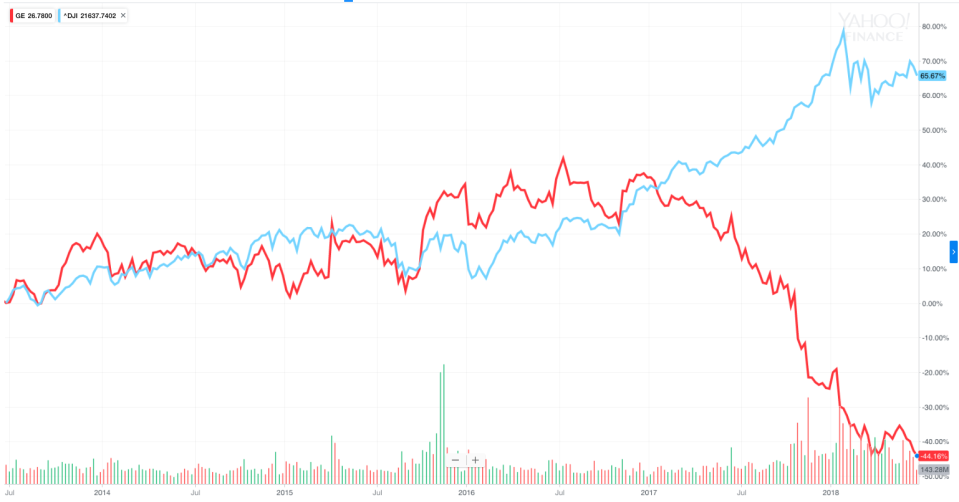

In 2017, Yahoo Finance readers voted GE the year’s worst company, as shares fell over 40% and its CEO Jeff Immelt stepped down in June 2017. At least one analyst called his tenure at the company an “unmitigated disaster for shareholders.” Shares of GE have lost another 28% so far this year and were trading at around $12.73 in after hours action on Tuesday.

The last company to join the Dow was Apple (AAPL), which replaced AT&T (T) back in March 2015. In the year that followed Apple’s inclusion in the blue chip index the stock lose about 14%; shares of the world’s largest company by market cap have risen by about 50% since the company joined the Dow. After leaving the Dow, AT&T stock rose about 15%.

And while many investors have their complaints about the Dow — it’s only 30 stocks, it’s a price-weighted index which makes certain companies’ daily moves too important — GE in many respects was the Dow, and the company getting booted from the index is truly the end of an era.

The economics calendar will bring investors the May report on existing home sales as the highlight, with economists forecasting sales rose 1.1% to an annualized pace of 5.52 million homes. This data will be closely watched by housing market observers as the lower-end of the single-family home market continues to come under pressure due to a lack of supply.

Earnings expected out on Wednesday should come from just one member of the S&P 500 — Micron Technology (MU). Other notable companies set to report results also include gunmaker American Outdoor Brands (AOBC) and Winnebago Industries (WGO).

Other stocks investors will be tracking on Wednesday should include Starbucks (SBUX), shares of which were down about 2% in after hours trading after the company lowered its sales outlook for the third quarter.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance