Wall Street’s Hedging Trades in Danger in an Event-Filled Week

(Bloomberg) -- Bears have sounded like a broken record for months now: The 60/40 investment industry remains at the mercy of monetary angst and fiscal largesse.

Most Read from Bloomberg

Homebuyers Are Starting to Revolt Over Steep Prices Across US

Key Engines of US Consumer Spending Are Losing Steam All at Once

Saudi Arabia Puts Wall Street on Notice to Set Up Shop in Riyadh

Modi Set for Landslide Election Win in India, Exit Polls Show

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

After lackluster Treasury auctions sent major assets in a tizzy with bond yields whipsawing, the naysayers looked less contrarian this week. Stocks and bonds posted fresh in-tandem gyrations, causing headaches for balanced 60/40 portfolios and hedging strategies on Wall Street.

With the Federal Reserve in no hurry to cut interest rates, the S&P 500 snapped a five-week advance, while Treasuries and investment-grade obligations were all down even as a benign inflation reading on Friday buoyed bonds.

It was an event-packed week with everything from the historic shift in US equity settlement, a glitch in live pricing for the S&P 500 index and a guilty verdict for former President Donald Trump — adding a volatility-inducing wildcard heading into the November election. But beyond the noise, one thing is clear: Balanced-investment strategies betting on the safety of fixed income aren’t out of danger. No wonder there is so much talk of diversifying alternatives including the private-market boom.

“Higher stock-bond correlation has made it tougher for asset allocators to find that sort of diversification,” said Josh Kutin, head of asset allocation, North America at Columbia Threadneedle Investments, who now touts so-called absolute-return trades to help clients spread out their market bets. “The playbook hasn’t been working to the same degree” since 2022, he said.

With the S&P 500 up 11% year-to-date, the idea of hedging via bonds may sound like an afterthought, while market co-movements pale into comparison to the inflation-driven dark days of 2022. Yet money managers are still contending with challenging trends in fixed income.

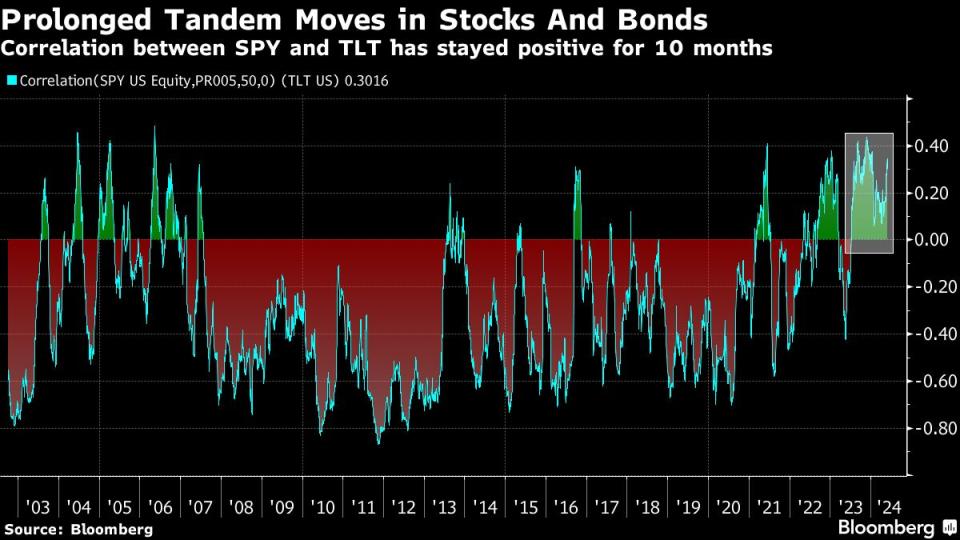

For one, the 50-day correlation between the iShares 20+ Year Treasury Bond ETF (ticker TLT) and SPDR S&P 500 ETF Trust (ticker SPY) has stayed positive for 10 months now in the longest stretch on record. It’s creating a headwind for a popular quant strategy that seeks to diversify risk across assets. The RPAR Risk Parity ETF (ticker RPAR), which invests in stocks, bonds and commodities, slipped for a second week. Ditto a Bloomberg gauge of the popular 60/40 model, which allocates 60% to equities and 40% to fixed income.

Rather than offsetting each other and smoothing out price swings, lockstep moves among varied assets are, in fact, making RPAR more volatile, or riskier, than simply holding stocks.

While inflation and central bank policy have underpinned harmonized asset moves, earlier this week saw an added catalyst as weaker demand for Treasury auctions pushed up yields across the curve. That in turn dragged down stocks in a month of otherwise outsized gains in risky assets.

Over at Gavekal Capital, founder Charles Gave argues that potentially stubborn inflation trends mean investors should focus on preserving their capital and shift more money into cash and gold.

“Maintaining a classical balanced portfolio is a road to ruin, if we are duly moving back into an inflationary period,” Gave wrote in a recent note. “In the 1970s, investors who kept 50-50 allocations between bonds and equities lost more than 50% in real terms in the following decade,” he added. “There is no reason to think that the same might not occur again.”

Yet for many on Wall Street, there are plenty of good reasons to be bullish on 60/40 trades at least in the short-term, citing juicy yields on offer in bonds that would soften any blow from equities trading at elevated valuations. But it’s looking choppy out there. With the Fed not expected to cut rates until potentially later this year, Treasuries are at risk of posting a loss in the “year of the bond” that wasn’t.

The massive stimulus during the pandemic “destroyed this relationship between Treasuries and stocks,” said Bryce Doty, senior portfolio manager at Sit Investment Associates. “It’s going to be like a year or two before these things will normalize. So in the next year or two, you just are left without the same kind of options to diversify as it used to have.”

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

US Malls Avoid Death Spiral With Help of Japanese Video Arcades

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance