Wall Street’s Rate-Cut Dreams Have to Wait as Fed Stays on Hold

(Bloomberg) -- Wall Street got a reality check on Wednesday as the Federal Reserve laid out projections for just one interest-rate cut in 2024 with traders hoping the central bank would be more aggressive in reducing borrowing costs.

Most Read from Bloomberg

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Fed Officials Dial Back Rate Forecasts, Signal Just One ‘24 Cut

Stock Bull Run Breaks Record on Fed Decision Day: Markets Wrap

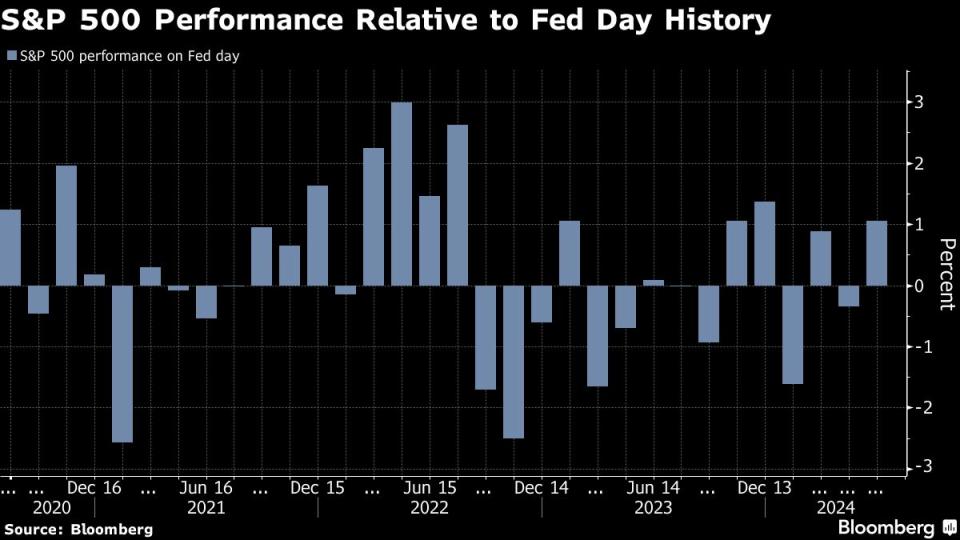

The S&P 500 Index and Nasdaq 100 Index are paring their gains after rising more than 1% earlier, but they remain near record highs, propelled by rising rate-sensitive technology shares like Apple Inc., Microsoft Corp. and Nvidia Corp. Fed swaps showed traders still favored at least two rate cuts this year despite the central bank’s guidance. As recently as this morning, swaps contracts were pricing in quarter-point rate cuts in November and December.

“There has been modest further progress toward our inflation objective,” Fed Chair Jerome Powell said at his press conference in Washington after the rate decision was announced. “We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.”

Traders had hoped that an encouraging consumer price index print Wednesday morning represented the early stages of inflation resuming a downward trend after remaining stubbornly high for most of the year. However, the numbers also gave credence to the wait-and-see approach highlighted by Powell and a chorus of Fed speakers after the latest strong jobs report fueled the debate over how restrictive monetary policy actually is.

From here, investors will continue to parse Powell’s comments, looking for signals on whether the market’s aggressive dovish bid was overdone after data released Wednesday morning showed inflation cooling for a second month in May.

Powell’s press conference and the central bank’s projections offered “something for everyone,” according to Cayla Seder, macro multi-asset strategist at State Street.

“For the doves, there are no hikes and confirmation cuts are the next move, in addition to still-strong GDP growth,” she said. “Plus Powell has highlighted that the FOMC believes the labor market is in better balance. This sets a new bar with which to measure labor data from here.”

Here’s what others on Wall Street had to say:

Scott Colyer, chief executive at Advisors Asset Management:

“The Fed adjusts their dot plots accordingly, so they change all the time and stock traders know that. It’s clear the Fed really wants to cut rates at least one time this year. And those cuts, even if just once, will still be supportive for stock prices.”

Gregory Kuhl, portfolio manager at Janus Henderson Investors:

“It seems as if the market and the Fed are consolidating around the same view that rates are appropriate where they are for now, but that the Fed remains biased towards a rate cut as its next move. Based on what we see from apartment landlords, we think the shelter component of CPI is going to continue putting downward pressure on the overall headline figure which could give the Fed the additional signals of progress its looking for as the year goes on. Importantly for listed REITs, which unlike private real estate have already been marked to market, an environment where rates stay the same or decline should be a tailwind.”

Donald Ellenberger, senior portfolio manager at Federated Hermes:

“I think the Fed’s going to want to definitely see at least three or four months of lower inflation. They want to make sure it’s on track to get to 2%, because the worst case scenario for the Fed would be if they cut rates and then inflation kind of goes back up again and then they are forced to kind of reverse cuts and start hiking rates again.”

Dave Lutz, head of ETFs at JonesTrading:

“Dots being more hawkish than anticipated has taken some of the fluff off the move today, but we need to see how the rest of the presser is digested,” said Dave Lutz, head of ETFs at JonesTrading. “Feels like with only the BOJ remaining this week, we could see the VIX fade, and stocks close near highs.”

Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors:

“Investors need to come to terms with the fact that the Fed is not in the driver’s seat. They are simply responding to inflation, which is responding to growth. Until growth breaks meaningfully to the upside or downside, inflation is likely to stay stubbornly above the Fed’s target and you’re unlikely to see any aggressive moves from the Fed.”

Marvin Loh, senior macro strategist at State Street Global Markets:

“The Fed seems increasingly divided on how the economy will evolve this year, which is shown in the nearly equally divided view on where funds will wind up this year. Looking into 2025 and 2026 however, the dots suggest that once they begin, they are increasingly comfortable that they can move towards normalization more quickly. This is neutral to dovish despite the reduction to only 1-cut this year.”

Jay Hatfield, chief executive officer at Infrastructure Capital Advisors:

“We do need to at least get the first cut behind us, and then we think we’ll be off to the races in a broader rally. It’s going to come from weakening economic growth and weakening labor market. That’s what’s going to induce them to make the first cut. Because any reasonable forecast would show that — I think the Fed’s too conservative at 2.8% — but that we’re going to stall out.”

Mohamed El-Erian, the president of Queens’ College, Cambridge and a Bloomberg Opinion columnist:

“The one question I would have for Chairman Powell is, ‘Do those numbers and the expectations that four people had for no rate cuts reflect this morning’s inflation data or not?’”

Kevin Caron, senior portfolio manager at Washington Crossing Advisors

“Even though the dots plot says one cut this year, I don’t think we should be surprised at that, given the fact that the Fed’s message has not changed when it comes to inflation: they want convincing evidence that we’re on a sustainable path to 2%. That is going to take several months.

Alex Cohen, FX strategist, Bank of America Corp.

“The dots read hawkish — or maybe cautious is the better word — on the margin, with just one cut for 2024. I think that explains why the USD has pared back a bit of the more notable depreciation from CPI. Unclear though if members would have changed their dot on back of CPI or not, so maybe that’s something that comes up in the presser.”

John Velis, a foreign exchange and macro strategist at BNY Mellon:

“So on balance, and given the fact that the CPI print this morning is not likely not reflected in the dots, it isn’t as hawkish as first seems...The higher “longer run” on neutral rate was raised from 2.6 to 2.8. Before March, it had been 2.5% for what seemed like forever. That supports the higher equilibrium neutral rate argument.”

--With assistance from Natalia Kniazhevich, Nazmul Ahasan, Carter Johnson, Matthew Griffin and Norah Mulinda.

(Updates stock moves and adds quotes)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance