Walmart is underperforming in this one key area (WMT)

BII

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Walmart is an undisputed retail titan, but it continues to struggle in one crucial area.

The company's online sales growth continued to slow in the first quarter of 2016, as Walmart continues to underperform the rest of the e-commerce industry.

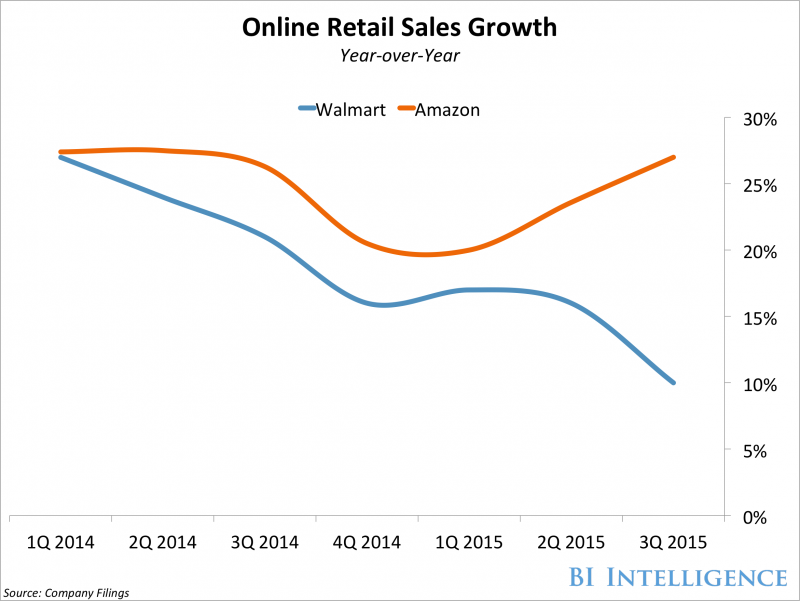

Walmart's online sales in the U.S. climbed 7% year-over-year in Q1 2016, compared to a 17% YoY growth in Q1 2015. For context, the U.S. e-commerce industry as a whole grew 15% YoY in the first quarter of this year, which indicates that Walmart is significantly underperforming compared to its competition.

The retail giant has invested heavily in its e-commerce business in the last few years, and in 2015 it announced a plan to funnel $2 billion into e-commerce fulfillment centers around the U.S.

But thus far, the evidence seems to demonstrate that these efforts have not borne fruit, as only 3% of Walmart's total retail sales currently come from online purchases.

Issues at brick-and-mortar stores are compounding this problem, as the physical locations are bringing in less sales per square foot than in previous years. If Walmart cannot find a way to grow its e-commerce sales and in-store sales continue to lag in this regard, then the company could have a serious issue on its hands.

And the potential exists, as one could argue that there's never been a better time to be a consumer. The rise of online and mobile shopping has given consumers more choice, flexibility, and often better service, and retailers are shifting their strategies to keep up.

Cooper Smith, senior research analyst at BI Intelligence, Business Insider's premium research service, has compiled a detailed report on new e-commerce strategies that looks at some of the top trends affecting retailers at each stage of the purchase funnel and how they're responding to those shifts.

Here are some of the key takeaways from the report:

Within digital, consumers are spreading out their retail purchasing across channels, forcing retailers to spread out their online marketing budgets. Paid search, affiliate marketing, and email all increased their share of e-commerce referrals last year, according to Custora.

Paid search especially stood out as a major source of spending by retailers. Search ad spending grew 18% YoY in Q4 2015, according to IgnitionOne.

Mobile continues to drive the most sales growth for retailers, but sales still aren't keeping up with retail traffic. IBM found that smartphone traffic beat both tablet and desktop, making up 53% of all online traffic. But mobile still only accounted for 29% of all online sales.

Retailers only have themselves to blame for underperformance on mobile, as many still aren't using best practices for mobile websites and apps. Only 60% of the top 100 global retailers currently have a dedicated mobile website, according to The Search Agency.

The increase in online shopping has put stress on the shipping and logistics industry. The number of UPS ground packages delivered on time during the holidays fell from 97% in 2014 to 91% in 2015, according to ShipMatrix.

Retailers are beginning to explore alternative shipping options. Earlier this year Gilt Groupe switched its primary ground shipper from UPS to Newgistics.

Retailers that can't afford to invest in alternative shipping options are offering consumers more fulfillment options using what many of them do have — brick-and-mortar stores. Buying online and picking up in-store, also called click and collect, made up about 30% of e-commerce sales at Sam's Club in 2015.

In full, the report:

Looks at how retailers are shifting their ad spending and marketing efforts to keep up with online retail behavior

Identifies which channels are top performers for referral traffic and new opportunities for reaching consumers

Analyzes how retailers are responding to the rise of mobile purchasing and where they're falling short

Examines the evolving delivery landscape and the aggressive moves retailers are making to become their own shipping carriers

To get your copy of this invaluable guide, choose one of these options:

Subscribe to an ALL-ACCESS Membership with BI Intelligence and gain immediate access to this report AND over 100 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> START A MEMBERSHIP

Purchase the report and download it immediately from our research store. >> BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of new e-commerce strategies.

See Also:

Yahoo Finance

Yahoo Finance