Warner Bros. Discovery’s ‘Big Loss’ of the NBA Would Weaken its Venu Sports Contribution

Warner Bros. Discovery’s NBA rights are hanging in the balance as the league continues negotiations for media deals collectively worth more than $76 billion.

If the David Zaslav-led media giant loses the NBA, the company’s ad revenue could plummet about $270 million a year, and its TNT subsidiary could see a 45% decline in affiliate fees, Citigroup analyst Jason Bazinet estimated.

But Venu Sports — the company’s new joint streaming venture with Disney and Fox — likely would suffer less, since the platform could fill programming gaps with other sports.

Three insiders close to the venture said the outcome of NBA negotiations would not impact the offering’s launch, which is on track for the fall, subject to regulatory approval and final agreements with the parties. Under terms that run through the 2024-2025 season, ESPN pays the NBA about $1.4 billion annually while WBD pays about $1.2 billion.

Venu is already limited because it will be missing sports available on NBC and CBS, and a growing number of games are moving to platforms like Amazon’s Prime Video and Netflix.

“The more major sports that are missing, the less compelling the bundle is because avid fans would need to add other standalone platforms,” Hub Entertainment Research founder Jonathan Giegengack told TheWrap.

As Venu will still offer NBA games through ESPN and ABC, losing the league would weaken WBD’s contributions to the service.

“WBD already has a weaker sports portfolio than Disney or Fox,” said Insider Intelligence analyst Ross Benes. “Without the NBA, it will be a weak third leg on the Venu tricycle.”

Representatives for the NBA did not return TheWrap’s request for comment. NBCUniversal, Amazon, Disney, Venu Sports and Warner Bros. Discovery declined to comment.

Minimal impact for Venu Sports

Disney accounted for 31% of all time spent watching sports on traditional television last year, followed by Fox, which accounted for 24%, analysts with MoffettNathanson estimated. By comparison, WBD accounted for only 7%, placing it behind both NBCUniversal and Paramount — with 3.4% of that total linear sports viewership time attributable to the NBA.

Despite the lower viewership share, the research firm pointed out that WBD’s viewing time percentage includes other rights that are “highly valued by a large segment of any sports-streaming product’s target audience” — such as the NCAA basketball championships and the NHL. Those rights helped the company deliver an estimated 18% share of viewership in the second quarter of 2023, partly balancing the gap in Fox’s schedule, whose viewership share for the same quarter stood at 12%.

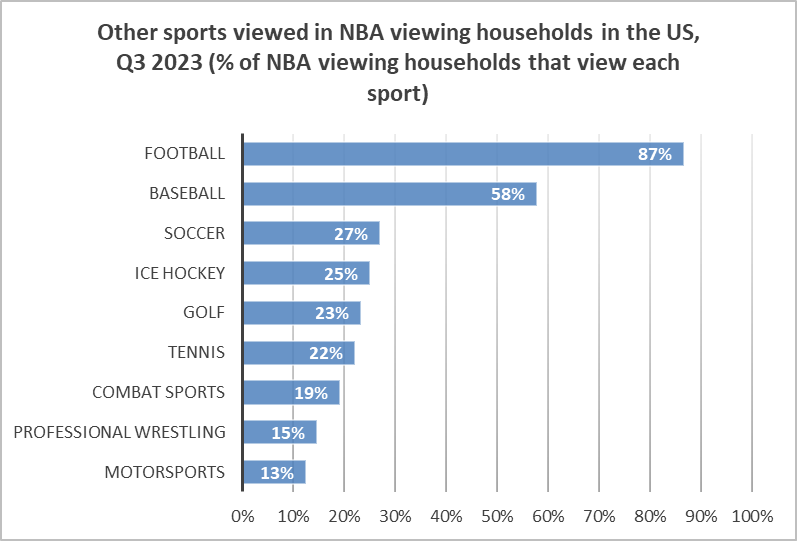

“A small slice of potential Venu subscribers focused primarily on NBA coverage could be unimpressed in 2026 (after the new deals take effect) if WBD isn’t contributing additional NBA games,” S&P Global analyst Seth Shafer told TheWrap. But, he added, “our consumer surveys show that NBA fans tend to watch a wide range of other sports so the NBA diehards probably aren’t a large pool.”

Another key factor will be the offering’s pricing, which analysts predict could run between $35 to $50 per month. Fox CEO Lachlan Murdoch has said that pricing would be in “the higher ranges of what people are talking about.” One insider close to the venture previously told TheWrap that the offering would be priced lower than YouTube TV’s $72.99 per month base plan.

“If Venu is priced on the high end, any gap in sports programming could be an issue,” Shafer added. “And the converse is true as well, as aggressive pricing on the lower end could paper over any programming gaps and minimize the impact.”

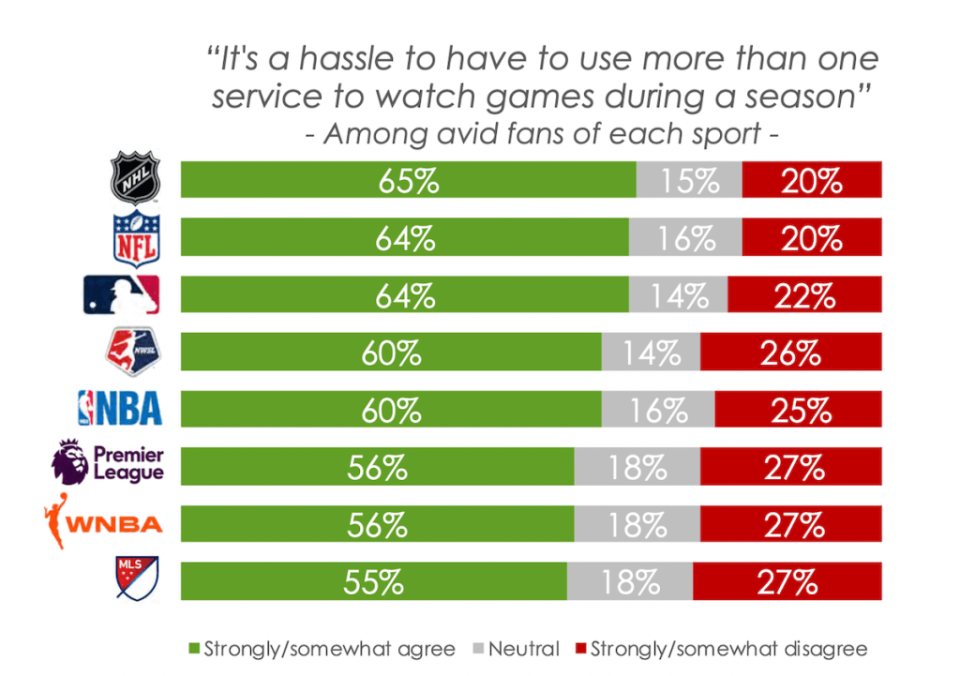

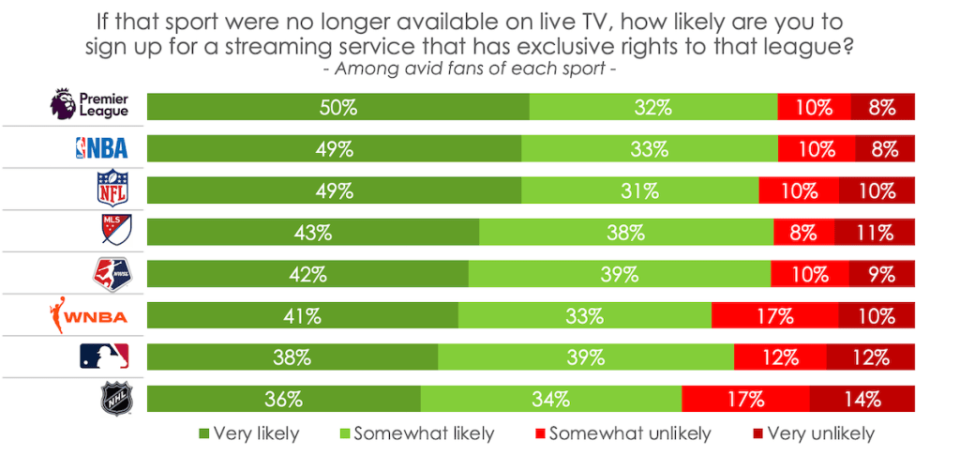

A Hub Research survey of more than 3,000 consumers aged 13 to 74 found that NBA fans are among the most likely to sign up for a new streaming platform that had exclusive rights to the sport. It also found that 60% of avid NBA fans find using multiple services over the course of a season to watch sports to be a hassle. NBA fans are less likely to be cord cutters than sports fans in general, suggesting they might be less-desirable targets for Venu.

Under terms of the Venu agreement, Fox, Disney and WBD will each own a one-third stake, have equal board representation and will license their sports content to the joint venture on a non-exclusive basis.

The service will combine content from linear networks that include ESPN, ESPN+, ESPN2, FOX, TNT, TBS and ABC network. More than a dozen sports will be represented, including the NFL, NBA, WNBA, MLB, NHL, NASCAR, College Sports, UFC, PGA TOUR Golf, Grand Slam Tennis and the FIFA World Cup. Subscribers can also bundle the product.

Rather than split revenue equally from the partnership, the companies are expected to earn a similar carriage fee rate as they do through other distribution channels where their networks are available. Venu’s members will be responsible for selling their own advertising and will retain all the advertising revenue from their content, one individual close to the venture previously confirmed to TheWrap.

The NBA’s new suitors

The NBA could score about $76 billion in revenue over 11 years from media deals with NBC, Amazon and Disney, The Wall Street Journal reported. The deals, which would also include rights to WNBA telecasts, could translate to a 2.5 times increase in annual fees for the NBA to an average of nearly $7 billion, according to the Journal.

NBCUniversal is expected to pay the NBA an average of $2.5 billion a year to show around 100 games per season — half of which would air exclusively on Peacock, an individual familiar with the terms told TheWrap. The games would run on NBC on Tuesdays and select Sundays to avoid conflicting with the network’s “Sunday Night Football.”

Amazon would pay $1.8 billion for regular season and playoff games, the new NBA in-season tournament and “play-in” games where teams compete for the final payoff spots. The tech giant would also be given a share of the conference finals, which the media partners would split in a rotation, people familiar told the Journal.

Disney would pay about $2.6 billion per year to continue to air the NBA Finals, up from its current $1.5 billion. The company would get fewer games than its current deal and ESPN would air games on its upcoming direct-to-consumer service slated to launch in 2025, the Journal said.

Warner’s NBA options

Warner Bros. Discovery has had some discussions with the NBA about potentially securing a fourth package of games, an individual familiar with negotiations told TheWrap.

If those talks are unsuccessful, WBD could also try to enforce its matching rights, which it would have five days to do from when the league presents the formalized agreements. But if it tries to match and the NBA rejects them, that could potentially lead to a lawsuit.

“It’s not an easy decision to make,” Patrick Crakes, a former Fox Sports executive turned media consultant, told TheWrap. “You either add a fourth partner, which means maybe some of the new partners don’t get all the content they wanted, or you’re going to end up in some kind of nasty litigation.”

During a Thursday presser at the first NBA Finals game, NBA Commissioner Adam Silver declined to comment on WBD’s matching rights, calling it a “complex legal issue.” But he emphasized that traditional cable is in decline while streaming is seeing “accelerated growth, particularly around premium live sports” and gives fans “enormous additional choice.”

“We’re trying to put foot, hand, finger in sort of every one of those buckets,” he added.

Warner without the NBA

Zaslav — who infamously said in 2022 that “we don’t have to have the NBA” — could decide to walk away and invest some of WBD’s $3.4 billion of cash into cheaper alternatives. The company is facing an estimated $42.6 billion in gross debt.

Without the NBA, WBD could look to sublicense more sports, similar to the recent agreement TNT struck with ESPN for College Football Playoff games. Or it could bid for other sports rights that come up for renewal, such as the UFC, whose deal with Disney expires next year.

In addition to the NBA, Warner currently has rights to NASCAR, the National Hockey League, Major League Baseball and the March Madness college basketball tournament. Warner also recently acquired the U.S. rights to the French Open, which will begin in 2025. And it currently is in an exclusive negotiating window to potentially reach a deal with All Elite Wrestling.

“We feel very comfortable, and we’ve been very strategically focused on making sure that we have a robust offering of sports for each of our sports channels in the U.S. and around the world,” Zaslav said at a business conference last month.

As for Venu, Shafer said the service could consider adding additional partners in the future to bring more sports rights in to make up for any gaps in programming.

“Things move quickly in the media world — especially with sports distribution — and it wouldn’t be a complete shock to see an additional partner join the Venu joint venture,” Shafer said.

The post Warner Bros. Discovery’s ‘Big Loss’ of the NBA Would Weaken its Venu Sports Contribution appeared first on TheWrap.

Yahoo Finance

Yahoo Finance