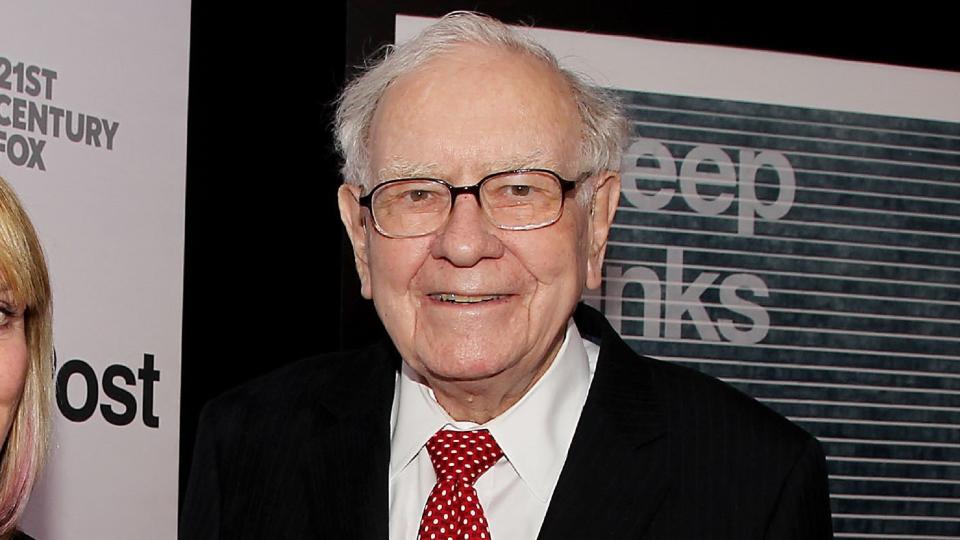

Warren Buffett’s First Earnings Letter After Charlie Munger’s Passing: 4 Future Investing Plans

Warren Buffett released his much-anticipated annual letter to shareholders on Feb. 24. This was the first such letter following Charlie Munger’s death — Munger having been his right-hand man — on Nov. 28, at the age of 99. His letter paid homage to Munger, whom Buffett called “the architect of Berkshire.”

Check Out: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Read Next: 6 Genius Things All Wealthy People Do With Their Money

“In the physical world, great buildings are linked to their architect while those who had poured the concrete or installed the windows are soon forgotten. Berkshire has become a great company. Though I have long been in charge of the construction crew; Charlie should forever be credited with being the architect,” Buffett wrote in the letter.

Buffett summarized Berkshire’s goal, which he deemed “simple”:

“We want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring. Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. It’s harder than you would think to predict which will be the winners and losers. And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen,” he wrote.

Berkshire Hathaway’s earnings reported $37.4 billion full-year operating profit, and the conglomerate is now sitting on an all-time high of $167.6 billion in cash and equivalents.

Learn More: I’m a Financial Advisor — I’d Invest My First $5,000 in These 6 Stocks

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Buffett Adopted a More Somber Tone

Buffett’s first letter since Munger’s death had a more serious and somber tone than previous letters, some experts noted. Said experts noted that earlier letters had humor throughout.

David Kass — clinical professor of finance at University of Maryland’s Robert H. Smith School of Business — also noted that this letter was unusually critical of the regulatory environment faced by Berkshire Hathaway Energy.

“He also seemed less optimistic about Berkshire’s future, but did acknowledge that it was built to last a long time,” he said.

Kass added that Buffett also indicated the personality of the upcoming annual meeting on May 4 will change: The on-stage abruptness and humor of Charlie Munger will be replaced by the serious and businesslike Greg Abel. Abel is CEO of Berkshire Hathaway Energy and is widely viewed as Buffett’s successor. He will be joined by Ajit Jain, vice chairman for non-insurance operations.

“Since Munger was the ‘architect’ and Buffett was the ‘general contractor,’ I do not anticipate Buffett’s strategy changing from what it otherwise would have been with Charlie,” said Kass. “However, I do expect dramatic changes when Buffett is no longer there.”

Capital Deployment Prospects

With Berkshire sitting on $167 billion in cash, many people have been pondering where Buffett would next deploy its capital.

Yet, as Buffett wrote in the letter: “There remain only a handful of companies in this country capable of truly moving the needle at Berkshire. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.”

Indeed, Buffett acknowledged in the letter that “size did us in.”

As Peter Earle — senior economist with the American Institute for Economic Research — noted, the conglomerate has become so large that it is facing difficulties finding acquisitions which will materially impact its bottom-line performance.

“It’s a hugely diversified, highly profitable company, but since it dwarfs just about any firm that it might come across, opportunities for explosive returns from a single or even a handful of purchased firms have dissipated,” added Earle.

While some might believe this sounds a dour note for Berkshire’s future, Robert R. Johnson — PhD, CFA, CAIA and professor of finance at the Heider College of Business, Creighton University — himself a longtime Berkshire shareholder, does not.

“What it likely means,” he added, “is that the degree of outperformance of Berkshire versus the S&P 500 will narrow going forward, just because of the sheer size of the conglomerate.”

An Unabashedly Bullish Buffett (and What He Won’t Sell)

And on his vision for America, stocks and the economy, Buffett is an unabashed bull — largely because he takes a long-term perspective, added Johnson.

“One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been — and will be — rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes,” Buffett wrote.

Following Coke and Amex in 2023, this year, Buffett said there are certain investments he will hold.

First, Occidental Petroleum, in which Berkshire now has a 27.8% stake in. The other investments feature five Japanese companies: Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo. Berkshire now owns 9% of each company, according to Buffett.

“When you find a truly wonderful business, stick with it. Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable,” he wrote.

Ignore the Pundits

One piece of advice Buffett gave in his letter is to forget the noise and ignore the pundits, citing his sister Bertie — who has a large portion of her savings invested in Berkshire — as an example.

According to him, you don’t need to be an “economic expert,” but you should keep on top of business news, be “very sensible” and “ignore the pundits.”

“After all, if she could reliably predict tomorrow’s winners, would she freely share her valuable insights and thereby increase competitive buying? That would be like finding gold and then handing a map to the neighbors showing its location. Bertie understands the power — for good or bad — of incentives, the weaknesses of humans, the ‘tells’ that can be recognized when observing human behavior. She knows who is ‘selling’ and who can be trusted. In short, she is nobody’s fool,” he wrote.

The message investors should take from Buffett is “Don’t focus on short-term noise,” said Johnson, stressing that Buffett doesn’t believe you can accurately forecast what will happen in the stock market over short periods of time.

“My favorite Buffett quote is ‘We have long felt that the only value of stock forecasters is to make fortune tellers look good,'” he added.

More From GOBankingRates

I'm a Costco Superfan: These Are the 5 Highest-Quality Kirkland Food Items

7 Things the Wealthy Elite Do With Their Money (That You Should Be Doing, Too)

The Biggest Mistake People Make With Their Tax Refund -- And How to Avoid It

This article originally appeared on GOBankingRates.com: Warren Buffett’s First Earnings Letter After Charlie Munger’s Passing: 4 Future Investing Plans

Yahoo Finance

Yahoo Finance